You can’t judge today’s trading session based on the index because many stocks have shown strong growth despite VNI or VN30 not increasing much. Liquidity reached a very high level, with the real estate group attracting a massive inflow of capital, but pillars like VIC and VHM were weak. The average trading volume of the two exchanges in the past 11 sessions was approximately 24 trillion VND per day, almost equivalent to the peak period in September last year.

To achieve such a high level of liquidity, there must be many people selling to take profits, but buying is also very strong. Although VNI has only surpassed the September 2023 peak by a few points, many stocks have surpassed this peak. It is normal for investors to take profits.

Such a high level of liquidity in this dispute between supply and demand is difficult to sustain. In the upward trend of the current wave from December 2023 to before the Lunar New Year holiday, the average liquidity in about 48 sessions was about 15,893 billion VND per day, meaning that more than a dozen recent sessions have seen liquidity increase by more than 1.5 times. This may be the result of new money inflows into the market, including the possibility of increased buying power due to the increase in collateral value along with the stock price.

In general, as long as there is plenty of money, the ability to maintain buying power is guaranteed, especially for those who have sold early and are now feeling the psychological pressure to re-enter. It is difficult to rely on the index to decide at this time because the amplitude in individual stocks is much larger than the index. As long as the pillars remain stable, individual stocks still have room to increase due to a large amount of money. Weak signals in individual stocks will result in a high price volatility at high liquidity levels for many days. At that time, it is advisable to take profits and switch to other stocks. Only pay attention to the index if there is a simultaneous sharp decline in the pillars and VNI loses points unexpectedly, as it is very easy to have a phenomenon of mass selling due to the large accumulation of stock weightage.

The weak pillars make VN30 fluctuate uncomfortably and lack inertia, so derivative trading is not favorable. Due to differences in market capitalization, other than VNI, VN30 today only has MWG as a highlight, with CTG providing some support. MWG only started to rise sharply after 1:45 PM, while CTG, although increasing from 11 AM, had limited impact.

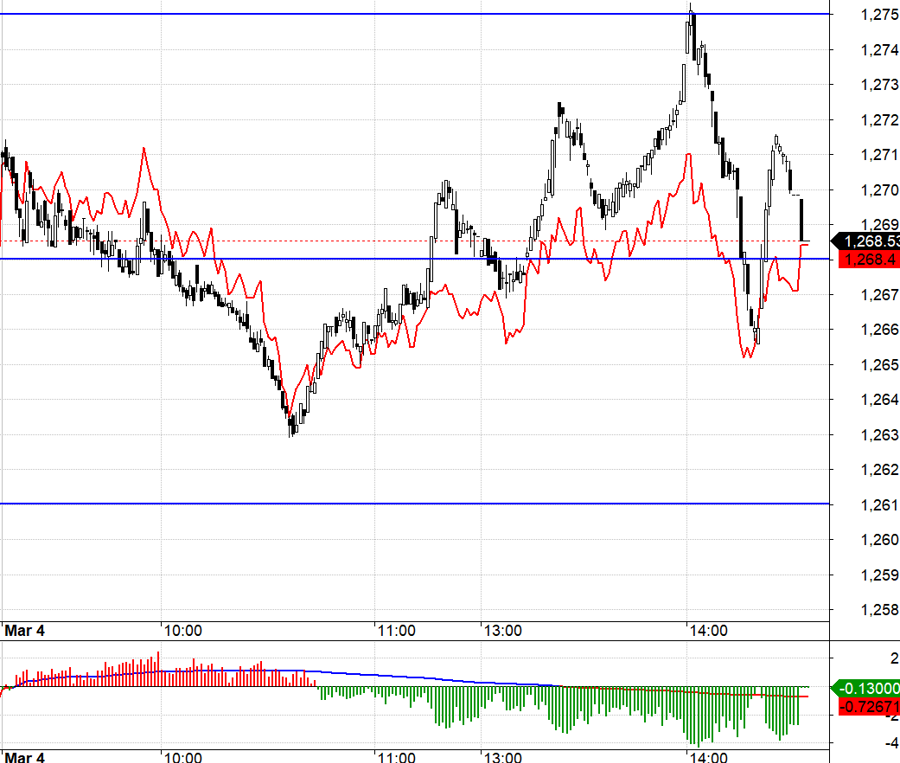

VN30 today has two expected fluctuation zones: from 1268.xx to 1275.xx and from 1268.xx down to 1261.xx. The hesitant trading in the pillars did not push the clear inertia while F1 reacted in the opposite direction, so the profit margin was very small. When VN30 broke through 1268.xx in the morning, the basis was positive and VN30 only reached 1263. When it went up in the afternoon and MWG pulled VN30 up to 1275.xx, F1 increased very little.

Without leading pillars, VN30 continues to oscillate around the September 2023 peak in the third consecutive session. Today, VN30’s basket liquidity was about 9.4 trillion VND, and nearly half of it was focused on SSI, HPG, MWG, MBB, CTG, STB, with only MWG and CTG showing clear increases, while SSI, HPG, and STB decreased. In short, the overall cash flow effect of VN30 is not clear. Although the index was pushed down from the peak by about -0.54%, the average stocks in the basket were pushed down by -1.2%, indicating selling signals at high levels. Even BCM, CTG, MWG, GVR, which closed with good increases, also had significant intraday declines. The opportunity for VN30 to break through is not high, so be flexible in Long/Short positions.

VN30 closed today at 1268.53, exactly at a significant level. The upcoming levels are 1276, 1281, 1290. Support levels are 1261, 1256, 1250, 1245, 1240, 1233.

“Stock blog” is a personal view and does not represent the opinion of VnEconomy. The opinions and assessments are those of individual investors, and VnEconomy respects the views and styles of the author. VnEconomy and the author are not responsible for any issues related to the published assessments and investment opinions.