Recently shared, Mr. Le Quoc Kien, a veteran real estate investor, said that in the current stage, the trend of investment prioritizes safety and optimizing cash flow from real estate will rise. Investors should choose products with fast liquidity and easy absorption. To have good liquidity, the product must have clear legal status and meet actual user needs.

Mr. Kien further analyzes: As the market becomes difficult for “fresh money”, real estate with cash flow income will be prioritized rather than real estate for speculation. Assets with rental yield (which is understood as comparing cash flow income to asset value) of less than 3% per year are low efficiency, 3-4.5% per year is average efficiency, good 4.5-5.5%, and excellent 6-8 % and above.

According to Mr. Le Quoc Kien, as the market becomes difficult as it is now, investors prioritize cash flow from rental. Illustration image.

According to Mr. Kien, from 2023, there is no longer an opportunity for the wave investment school due to the market liquidity has not recovered, and the short-term investment risk is increasing. Therefore, investing according to cash flow will surely ensure a stable level of profit. Although the profitability is not too high, investors keep their capital in the short term.

“In my opinion, this is the time to invest in real estate for serving housing needs, with the potential for good rental rates and waiting for price increases,” said Mr. Kien.

The report on real estate consumer trends and psychology (CSS) by PropertyGuru Company also pointed out that high house prices and difficult economic conditions make the trend of renting houses predicted to increase in 2024. Among them, apartments are the most interested type of property for rent (43%), followed by private houses (18%) and boarding houses (18%). Only a small part (9%) are interested in rental townhouses.

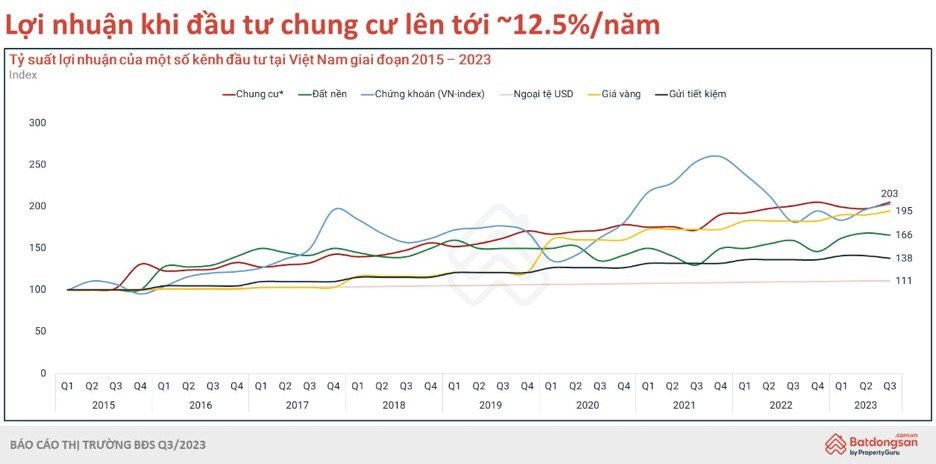

Mr. Le Bao Long, Director of PropertyGuru Vietnam, said, with long-term vision, apartments for rent are still an attractive investment channel. Due to the scarcity of supply, apartment prices are constantly increasing along with the demand for buying and renting this type of property is always high, which has led to an average return on investment in apartments of up to 12.5% / year (including the increase in price and rental income). This is evaluated as good and stable profitability compared to other forms of investment such as stocks, gold, foreign currency, land, or savings.

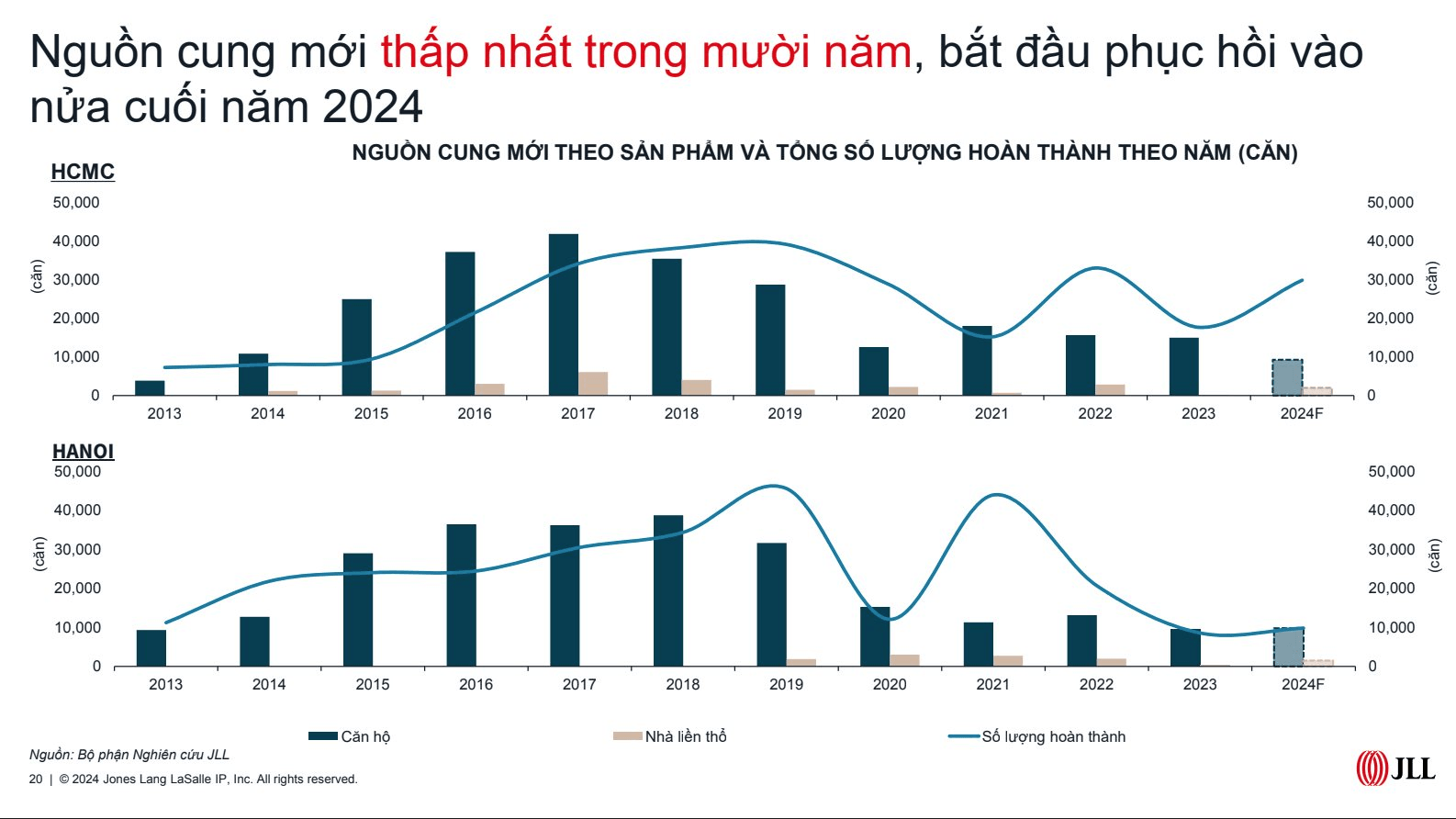

According to this unit, the occupancy rate of apartments for rent is always above 80-90%. Forecasted rental rates can increase by 5-10% in 2024 (depending on the area). There are currently 3 main reasons driving the increasing demand for buying and renting apartments in large cities, including: Limited supply of new sources; a shortage of central land funds; high actual demand.

Source: Batdongsan.com.vn

Clearly, recently both in Hanoi and Ho Chi Minh City, apartments are the least affected type of real estate because they mainly serve real needs. Among them, apartments with prices ranging from 3 – 4 billion VND are the most sought after (around 40-50 million VND/m2). Not to mention, preferential policies from developers are driving demand for this segment.

Recently, the Grand Sunlake project in Van Quan, Ha Dong (Hanoi), attracted investors’ attention when introducing The Bespoke Collection – The super collection of CASH-HOME real estate line with prices starting from 43 million VND/m2 along with many attractive incentives. Specifically, a 5% discount on the value of the apartment when the customer pays quickly 70%; A 9% discount for customers who pay quickly 95%. Customers choosing to borrow money from banks will receive support in borrowing 70% of the value of the apartment. The developer supports 0% interest and defers principal for 18 months. In addition, the developer also gives valuable gifts such as gold and furniture. In particular, the developer commits to leaseback for apartments with 2 and 3 bedrooms, respectively, at 14 million VND/month and 18 million VND/month, equivalent to 168 million VND/year for a 2-bedroom apartment and 216 million VND for a 3-bedroom apartment. It is known that this is a centrally located residential project in Ha Dong with reasonable prices, which has sold very well in previous stages.

Bordering Thu Duc City, Ho Chi Minh City, the Sky Garden project of Phu Dong Group is also implementing attractive sales policies for the last 30 units of the project. Accordingly, customers who sign a purchase contract pay 10% will receive a 10% discount, at the same time, receive 10 taels of gold and one year of management fees. This program only applies to the first 10 units. It is known that the project is about to be handed over, bordering between Di An and Thu Duc City, where there are many offices, large factories, so the demand for professionals, office workers to rent apartments is very large.

Also sharing at a recent press conference, Ms. Trang Le, Head of Research Department at JLL Vietnam emphasized: The demand for renting apartments is increasing in both Hanoi and Ho Chi Minh City. The main rental group is young families who want to experience living in a apartment environment before deciding to buy. This is an interesting growth trend of the apartment market, showing that the real needs are always present.

“Currently, the housing supply in Hanoi and Ho Chi Minh City continues to be scarce. Placed in the context of a market with more than 10 million people, while the demand for housing is still increasing, there is a large potential for development of the apartment segment. Even many people are willing to withdraw savings, idle money to find real estate,” Ms. Trang added.

The latest report from JLL shows that the housing supply remains scarce in both Hanoi and Ho Chi Minh City.