In February 2024, the Vietnamese stock market recorded a positive uptrend, following the overall trend of the Asian stock market, closing at 1,152 points. Despite having a long Lunar New Year holiday break, the stock market still saw strong capital inflows with many trading sessions having liquidity over 1 billion USD.

Entering March, Agriseco expects a favorable business result for Q1 based on a low base of 2023 as clearer recovery signals have emerged since Q4 2023. This will be the main driving force supporting the market’s upward momentum, alongside factors such as inflation remaining under control and interest rates being maintained at a low level.

However, from a general perspective, the VN-Index has risen significantly since the beginning of the year (+11% from the beginning of the year), causing the prices of many stocks to be relatively expensive. Therefore, the market’s future development is forecasted to have differentiation between industry groups and stocks within the same industry. Companies with favorable business results and their own stories are expected to have better performance compared to the overall market.

Looking at the technical perspective, the long-term upward trend of the index continues to be maintained with notable support set around the 1,180-1,200 point range. If this support zone is held, there is still a high chance of further upward momentum towards the next expected target around 1,300 points.

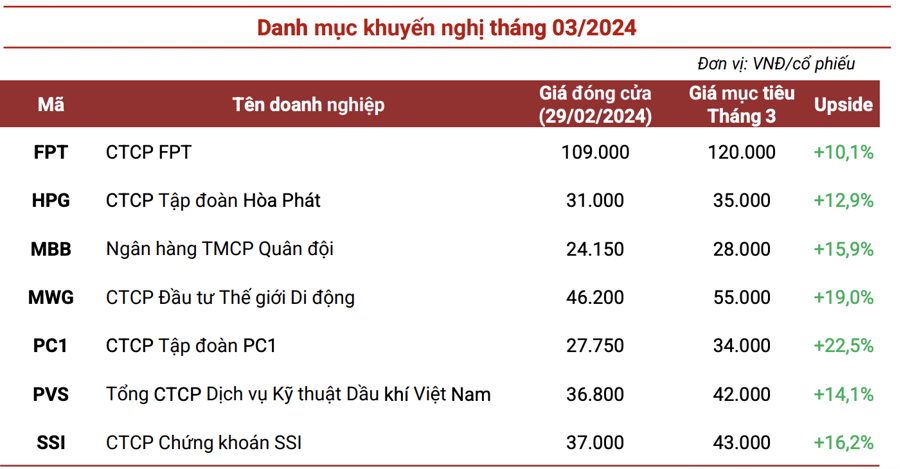

Based on the analyzed fundamental and technical factors above, Agriseco Research selects stocks for the recommended portfolio based on criteria such as leading companies in their respective industries, strong financial positions, and Q1 business results expected to show outstanding growth while being reasonably priced.

These stocks include: FPT, HPG, MBB, MWG, PC1, PVS, and SSI.

In particular, Agriseco raises the target price of FPT for the next month to 120,000 VND/share due to increased forecasts for the growth rate of the software export segment, thanks to new contracts signed with the US, Japan, and EU in the early months of 2024; the education sector is expected to have a higher number of students as FPT has started construction of additional schools in Hau Giang, Thanh Hoa, and Hue, expanding the school system to 13 schools in 11 provinces nationwide; the telecom service segment is expected to have improved profitability thanks to a new Data center project that will be operational in 2024; reducing discount rate due to a decrease in risk-free interest rates compared to the previous month.

With MBB, currently, MBB’s stock is trading at a Price-to-Book ratio of 1.35x, lower than the banking sector’s valuation of 1.66x. Meanwhile, the bank has high profitability compared to the industry average with a ROE ratio of 25% in 2023.

With SSI, the information related to the capital increase plan is expected to have positive support for the stock price: SSI is implementing a plan to issue an additional 453.3 million shares to existing shareholders (according to Resolution No. 02/2023/NQ-GMS, 100:20 ratio, expected to be completed in 2024) to increase its charter capital to nearly 19,645 billion VND. The new capital will be used to enhance activities in the margin lending and proprietary trading segments.

The Nikken and Industrial Zone segments will bring stable revenue for PC1 in 2024: It is expected that Nikken’s export volume will grow in 2024 due to the forecasted increase in global demand by 8.4% YoY in 2024 (according to ISNG – International Nikken Research Group). Meanwhile, Yen Phong II-A Industrial Zone has completed all legal procedures and is expected to basically hand over infrastructure by June 2024 with an estimated rent price ranging from 167-175 USD/m2/lease term, expected to contribute an additional 100 billion profit for PC1. In addition, revenue from selling electricity to Nomura Industrial Zone is expected to contribute 650 billion in revenue and 110-120 billion in after-tax profit annually…