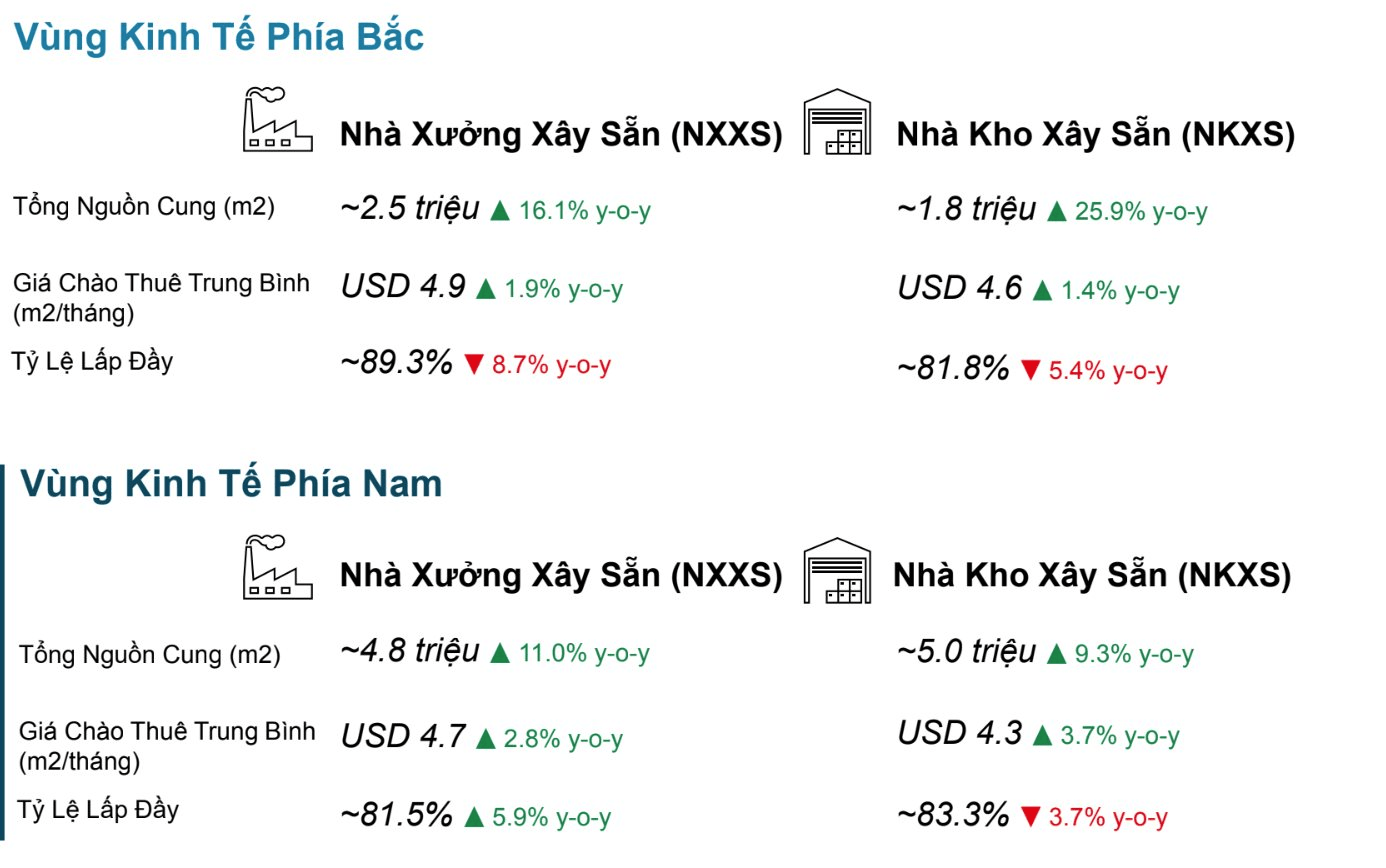

According to a recent market report shared by JLL Vietnam, the occupancy rate of industrial real estate is always at 80-90%. The increasing supply corresponds to a high absorption rate. The trend of mergers and acquisitions in the industrial and logistics sector is forecasted to continue for many years.

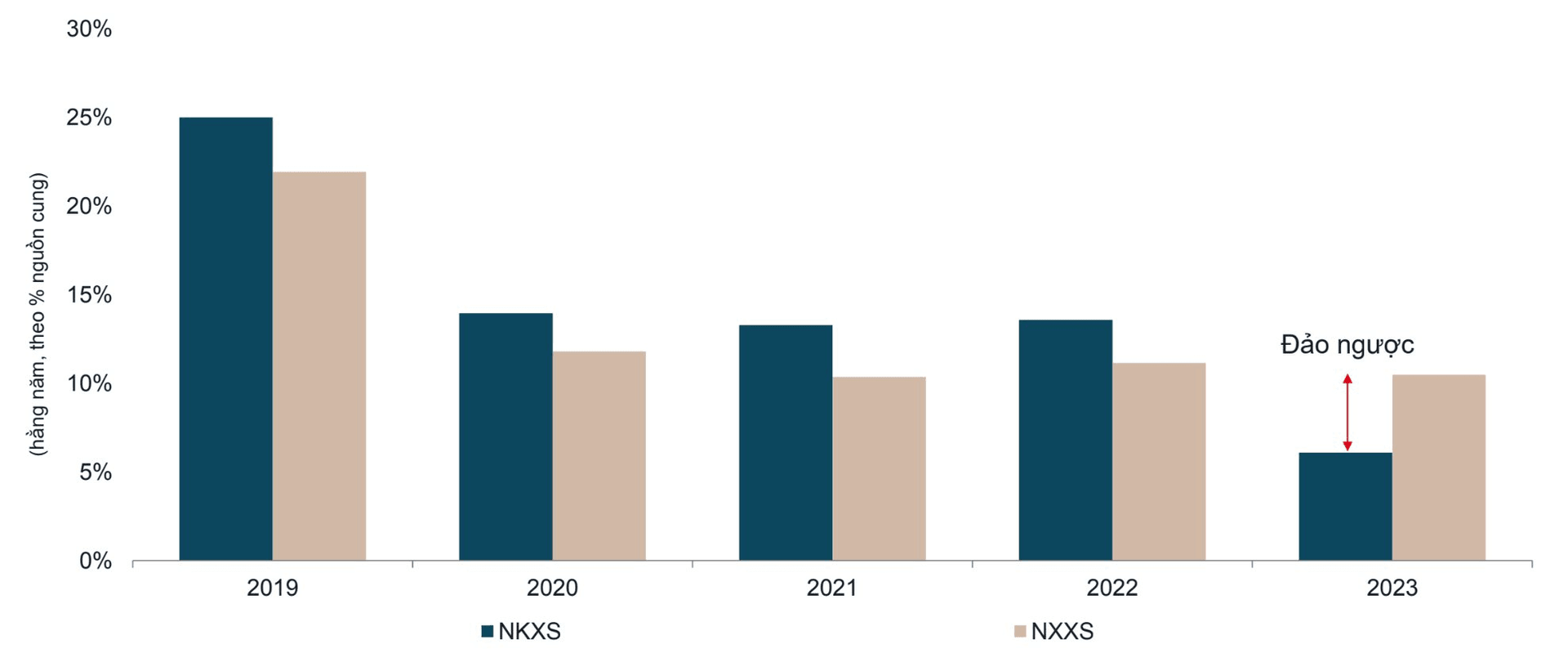

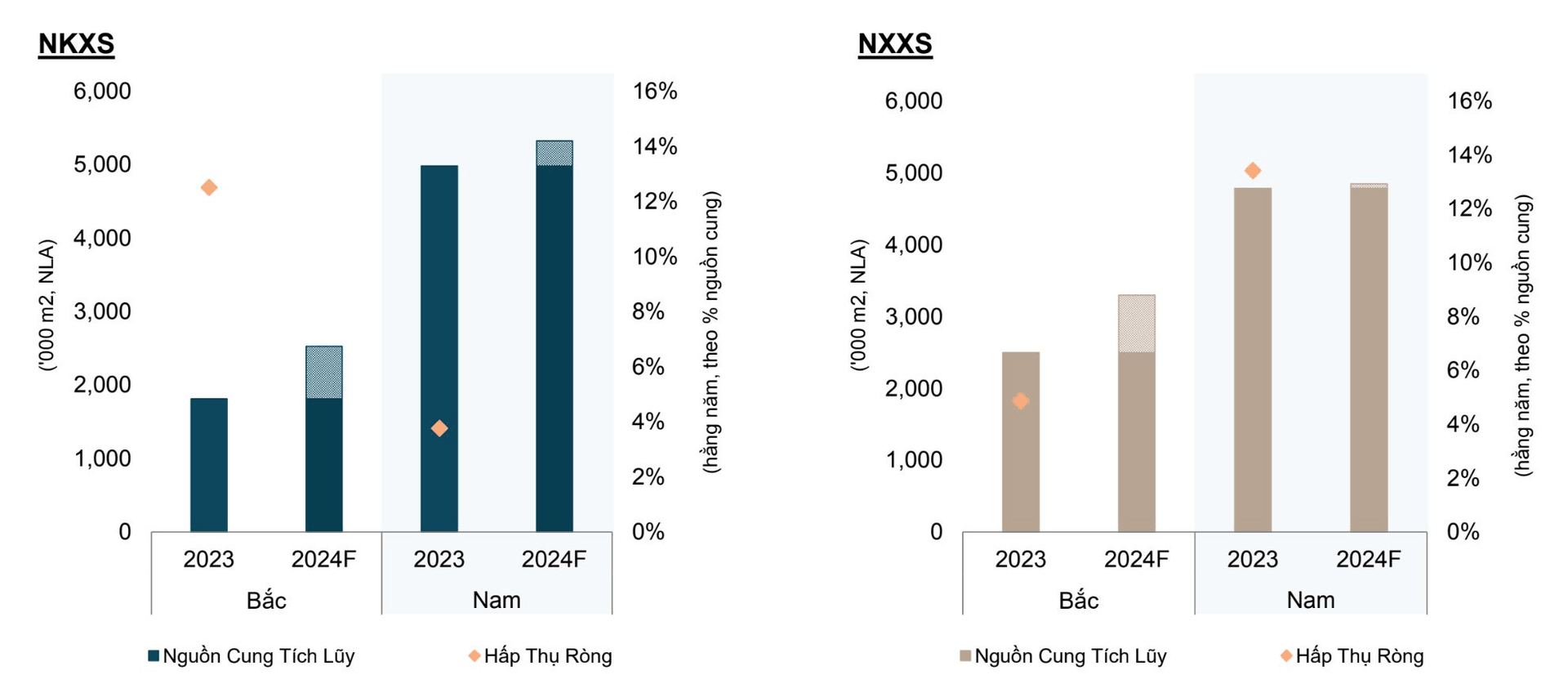

In 2023, the occupancy rate of industrial parks in Vietnam is optimistic. In the suburban areas of Hanoi and Ho Chi Minh City, the rates are currently 78% and 92% respectively. As a result, industrial land rental prices are expected to increase in the period 2022-2023, reaching 14% in the suburban areas of Hanoi and 58% in the suburban areas of Ho Chi Minh City. Along with that, the ready-built factory and warehouse segment is thriving. This sector has attracted strong foreign investment since 2018, with the number of investors increasing by 5 times. In the suburban areas of Ho Chi Minh City alone, the supply of ready-built warehouses has reached 2.1 million m2, contributing to a tenant-friendly market.

The occupancy rate of industrial real estate is high. Source: JLL

According to JLL, in just the last 3 months of the year, the southern region welcomed more than 460,000m2 of ready-built warehouses, developed by BWID, LOGOS, Emergent Capital Partners, and Cainiao, with a good absorption rate.

Ready-built warehouses always have a high absorption rate. JLL’s data is updated to Q4/2023.

Despite being considered the best-performing segment in the market with good business indicators and increasing industrial land prices, there are two main pressures weighing on the industrial real estate market.

The first pressure is the prospect of decreasing profitability. Accordingly, the asset operating capitalization rate is under pressure due to high financial costs, short land use term, and competition from other markets with significantly lower rental prices in the Asian region. According to JLL, in the next year, in the ready-built warehouse segment, landlords will have to continue to offer more flexible and attractive leasing terms to improve asset performance.

The second pressure is the price competition with neighboring countries such as Thailand. The industrial land rental prices in the suburbs of Bangkok are currently at the level of 82-164 USD/m2/lease term. This figure is much lower than the suburban areas of Hanoi (80-250 USD/m2/lease term) and the suburban areas of Ho Chi Minh City (95-280 USD/m2/lease term).

In addition, global minimum tax and high logistics fees will be barriers to attracting manufacturing investors to Vietnam. Despite signing many bilateral and multilateral FTAs, the high labor and construction costs somewhat affect Vietnam’s cost advantage.