Regular price increase of apartments

Economic development, rapid urbanization has led to a sharp increase in housing demand while land supply is gradually dwindling, housing supply is continuously decreasing due to slow implementation of projects by policies related to capital funding and decisions of agencies involved in market control of real estate (real estate). In addition, the value of urban land increases when infrastructure and public services are upgraded, pushing apartment prices to establish a new benchmark over the past few years.

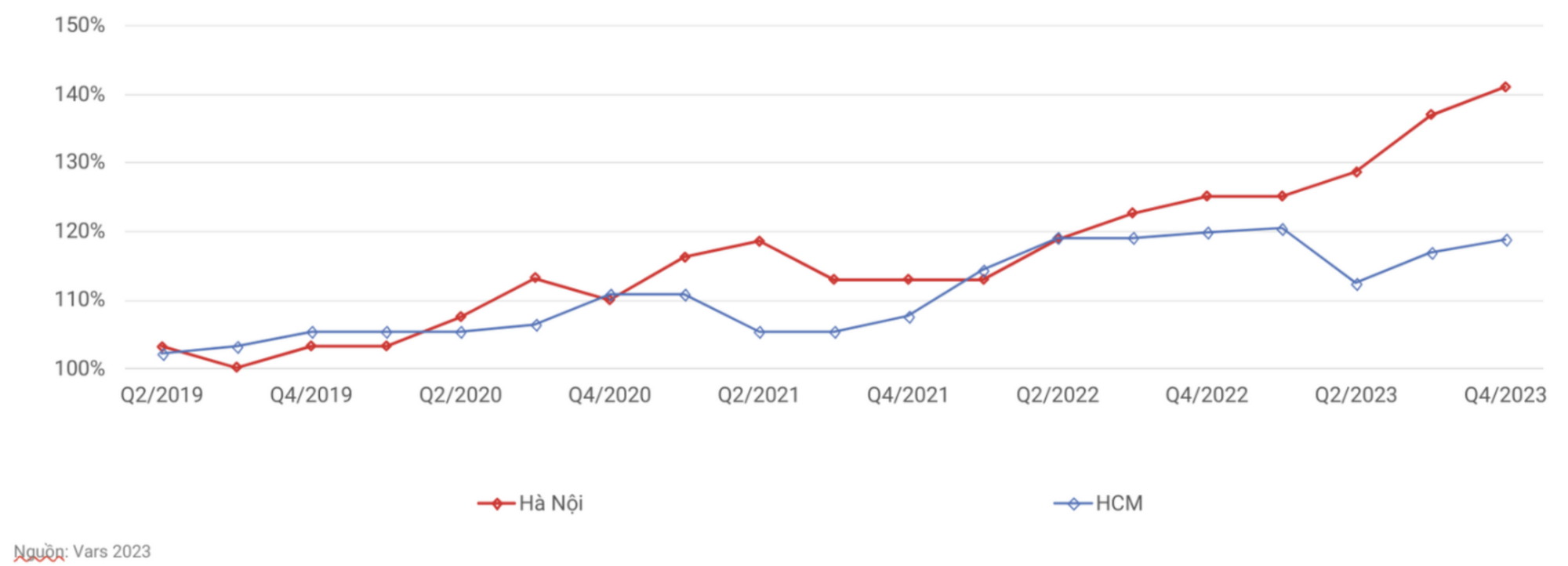

Price index of apartments in Hanoi and Ho Chi Minh City

Research data from the Vietnam Real Estate Brokers Association (VARS) shows that the apartment price index in Hanoi in 2023 increased by about 38 percentage points compared to 2019. In Ho Chi Minh City, the index increased by 16 percentage points.

Among them, the index of apartment prices is one of the indices of the real estate price index project that the Vietnam Real Estate Brokers Association is researching to reflect the fluctuations in real estate prices under the influence of market movements through different periods.

In particular, apartment prices in Hanoi have continuously increased in both primary and secondary markets. Meanwhile, apartment prices in Ho Chi Minh City have also started to enter a cycle of price increases along with a gradual decrease in prices at high-end projects on the secondary market.

The strong demand for housing not only comes from the needs of urban households, the continuous increase in the workforce, students flocking to cities for work and study, especially in Hanoi. It is also contributed by a large amount of investment demand that is increasing as the rent prices of old and new apartments in residential areas continue to rise since the social distancing period, especially in the context of the recovery of the market.

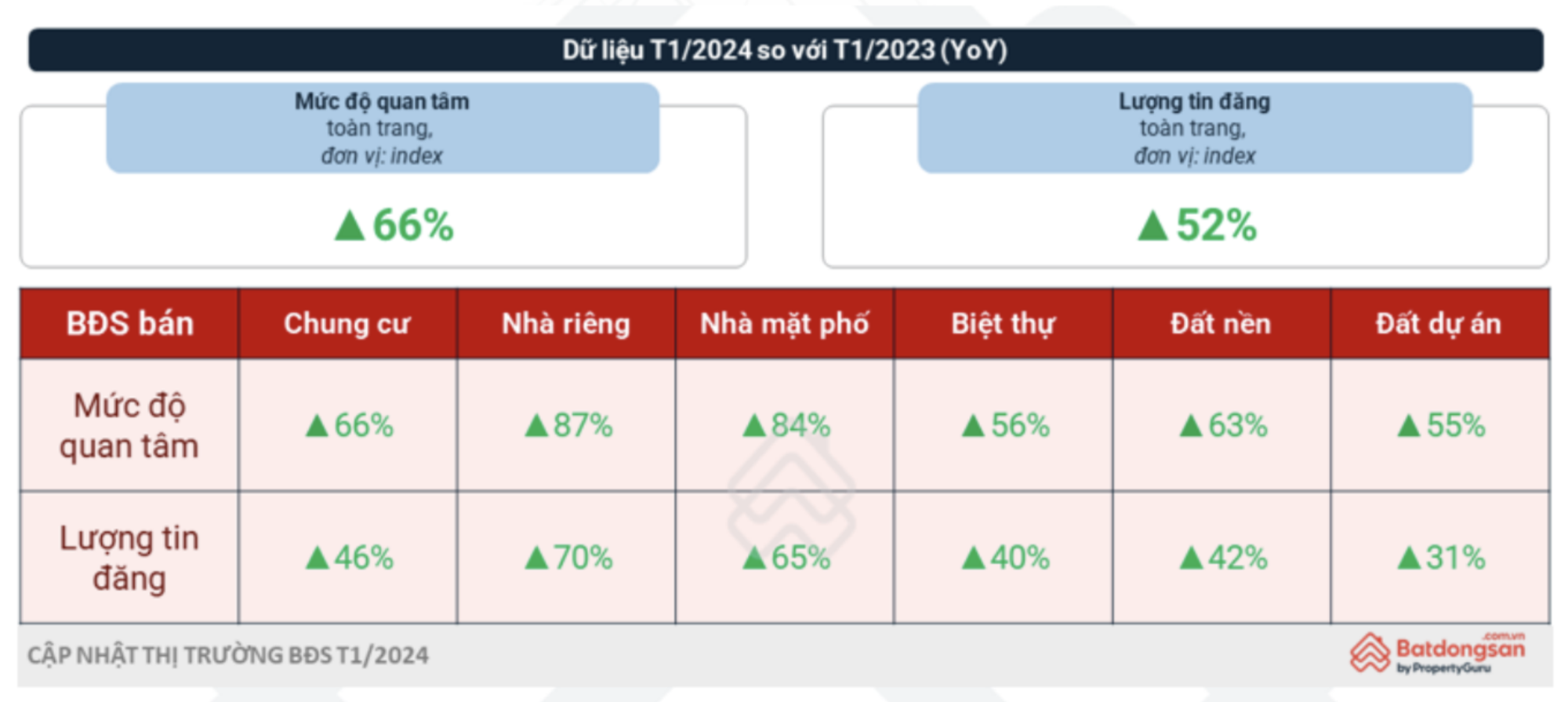

Statistics from Batdongsan.com.vn show that the level of interest in apartments nationwide in January 2024 increased by 66% compared to the same period in 2023, and the number of real estate advertisements also increased by 46%. Specifically, the search volume for apartments in Hanoi in January 2024 increased by 71% compared to the same period last year. Similarly, in Ho Chi Minh City, the demand for apartment searches also increased by 59%. This trend is taking place in most other provinces and cities.

Despite the strong increase in demand from homebuyers, the supply of apartments is still not proportionally increasing. The supply of apartments in 2023 has decreased in both the Hanoi and Ho Chi Minh City markets.

In Hanoi, the newly supplied apartments in 2023 are estimated to reach 10,500 units, a decrease of about 31% compared to the previous year. In Ho Chi Minh City, the newly supplied apartments are estimated to reach nearly 7,500 units, a decrease of over 50% compared to the same period in 2022.

The decrease in apartment supply in recent times is due to the scarcity of newly approved real estate projects while ongoing projects are facing difficulties related to legal and financial issues. Although efforts to overcome difficulties by the Government, Ministries and Departments have achieved some notable results, the number of projects implemented and restarted in 2023 has increased significantly. However, the pressure on cash flow has not yet eased for real estate enterprises.

Expectations of social housing rise and apartment prices decrease

Accordingly, the mobilization of funds through corporate bond issuances has gradually improved since mid-2023 thanks to the efforts of state management agencies.

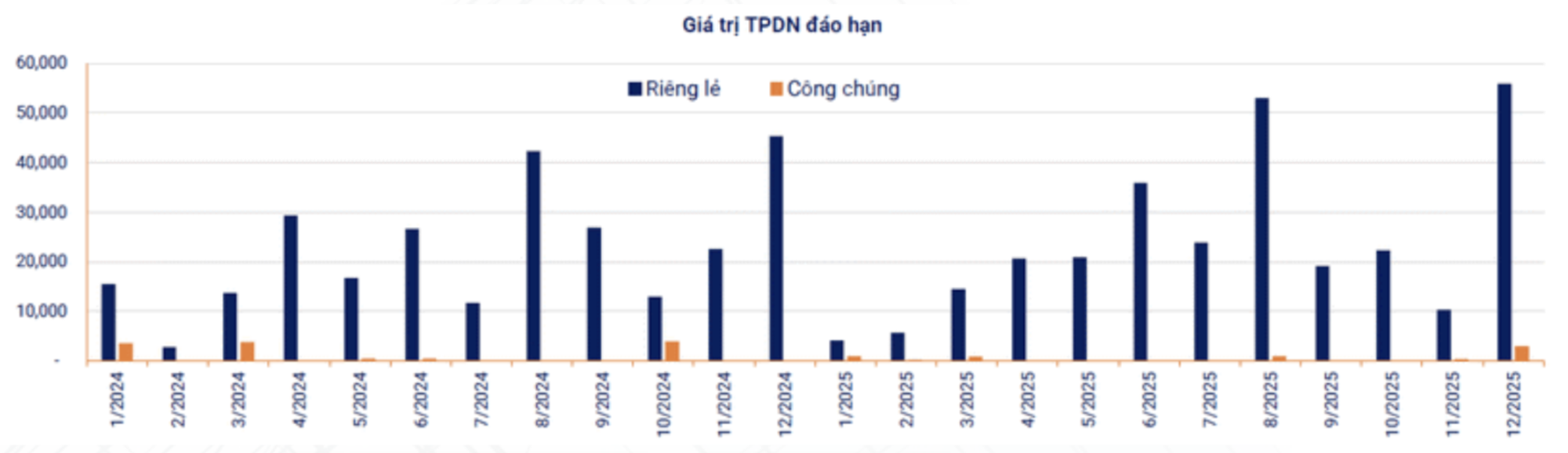

However, corporate bond redemption pressure is still a challenge for businesses in 2024, especially real estate businesses, with nearly VND 115.7 trillion of real estate corporate bonds maturing, accounting for 41.4% of the total value of business bonds due this year, according to the latest data from the Vietnam Bond Market Association (VBMA).

The issuance activity in the early months of 2024 has also encountered obstacles due to more difficult bond issuance and trading conditions such as regulations on professional securities investors, regulations on mandatory credit rating when re-implementing Decree 65/2022/NĐ-CP from early 2024 after a period of postponement according to Decree 08/2023/NĐ-CP. However, these are only short-term difficulties, in the long run, the implementation of Decree 65 will help the corporate bond market develop more robustly.

Source: VBMA

In terms of credit capital, outstanding credit for real estate business activities is still continuously increasing thanks to the measures of the banking sector, the Government and relevant agencies in overcoming difficulties for projects.

However, consumer credit, borrowing to buy real estate in the first months of 2024 continues to decline from 2023 even though lending interest rates have been maintained at a low level. This is due to unpredictable events such as inflation, interest rates… Varying factors have made it difficult to predict. Borrowing to buy a house and monthly repayments with amounts over 10 million dong have become burdensome for many families, as they are not truly confident in the future job situation and income.

However, after the Lunar New Year, housing credit has increased slightly at some commercial banks that have a diverse real estate ecosystem, as people have started to show investment intentions.

After a long period of decline, the supply of apartments in both cities is also expected to increase again thanks to the recovery of the market and efforts to remove legal obstacles for projects by state management agencies. Especially, the supply of social housing and worker housing. However, this supply source requires time to complete legal procedures before officially being brought to the market and it mainly comes from the outskirts of the city.

Mr. Dinh expects that along with the foundation of a series of positive market factors, by mid-2025, when the new Laws related to the real estate field are passed with new regulations towards removing difficulties for investors, and social housing for workers is officially effective. The supply of social housing will rise and apartment prices will decrease to a more suitable level for people with real housing needs.