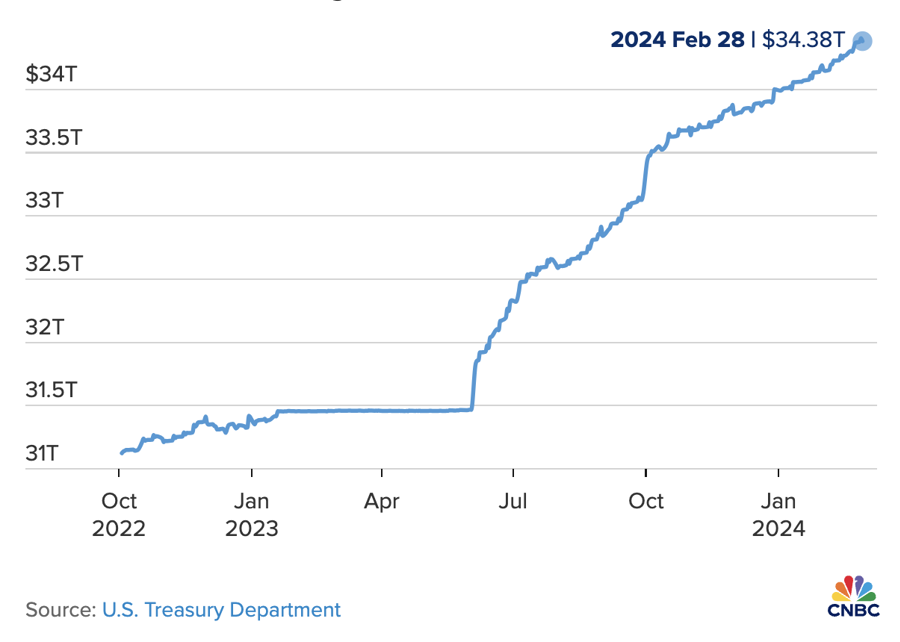

According to data from the US Department of the Treasury, the country’s national debt has officially exceeded $34 trillion as of January 4th, after briefly reaching this milestone on December 29th last year. Prior to that, the massive national debt of the world’s largest economy surpassed $33 trillion on September 15th, 2023, and $32 trillion on June 15th, 2023.

As such, the pace of the US national debt increase is accelerating. It took an additional trillion dollars, or 1,000 billion dollars, to increase from $31 trillion to $32 trillion, a process that took 8 months.

The amount of money that the US federal government borrows to finance its operations has reached $34.4 trillion as of last Wednesday. Michael Hartnett, a strategist at Bank of America, predicts that the trend of “adding $1 trillion in 100 days” to the US national debt will continue as the debt expands from $34 trillion to $35 trillion.

The sharp increase in US national debt contributes to the global surge in “debt bombs.” Data from the Institute of International Finance (IIF) at the end of February showed that total global debt reached a new record of $313 trillion in 2023, an increase of $15 trillion in the fourth quarter compared to the same period last year. In just a decade, global debt has increased by over $100 trillion from $210 trillion.

“About 55% of this additional debt is owed by developed countries, mainly the United States, France, and Germany,” the IIF said in a report titled Global Debt Monitor. However, the debt-to-GDP ratio, which is a measure of a country’s ability to repay its debt, decreased by about 2 percentage points in 2023, but is still close to 330%, according to the report.

“It is not surprising that investors are diving into transactions based on concerns about the explosion of US debt, such as buying gold or investing in cryptocurrencies like Bitcoin. The price of gold has reached $2,077 per ounce, while the price of Bitcoin has exceeded $67,700,” Hartnett wrote in a report last Thursday.

Last Friday, spot gold prices in the New York market surged nearly 2%, closing at $2,083 per ounce. Bitcoin completed February with a 40% increase, marking its strongest month since 2020.

The debt-to-GDP ratio, an index reflecting a country’s ability to repay its debt, has decreased more in developed countries, but has reached new peaks in some emerging markets. India, Argentina, Russia, China, Malaysia, and South Africa are among the countries experiencing the largest increase in this ratio, indicating increasing challenges in debt repayment.

“The US Federal Reserve is about to start cutting interest rates, but the path of the Fed’s interest rates and the exchange rate of the US dollar is uncertain. This could increase market volatility and lead to tightening of lending conditions for countries with high reliance on external borrowing,” according to IIF’s report.

However, the report states that the global economy is demonstrating resilience in the face of interest rate fluctuations, which is boosting investor confidence. In this context, the demand for borrowing is increasing this year, especially in emerging economies, as evidenced by the increase in government bond issuances in the international market.

The beginning of the year, which is a busy period for bond issuances to raise funds, witnessed large-scale bond issuances by Saudi Arabia, Mexico, Hungary, Romania, and other countries. In January, global bond issuances reached a record $47 billion.

“If maintained, this optimistic sentiment could reverse the ongoing debt reduction trend of European governments and non-financial corporations in developed markets. Both of these entities currently have less debt compared to the period before the Covid-19 pandemic,” the report states.

However, the IIF expresses concerns about the potential resurgence of inflation, leading to higher borrowing costs. Furthermore, geopolitical issues have quickly emerged as a “market structural risk,” with deeper fragmentation between countries raising concerns about fiscal discipline. “Government budget deficits are still much higher than pre-pandemic levels, and the increase in regional conflicts may lead to sudden increases in defense spending,” the report concludes.

In November last year, credit rating agency Moody’s Investors Service downgraded the credit outlook for the United States from ‘stable’ to ‘negative’ due to increasing risks relating to the health of the country’s public finance. “With rising interest rates, if there are no effective fiscal policy measures to reduce public spending or increase revenue, the fiscal deficit of the United States will continue to remain at a very high level, weakening the ability of the US government to borrow at reasonable interest rates,” Moody’s report states.