On the international market, the USD-Index decreased by 0.1 point compared to the previous week, reaching 103.89 points.

The price of USD in the global market continues to decline after bleak economic data reinforced expectations of a US interest rate cut in June 2024.

Specifically, the data shows that manufacturing activity in the US continued to decline in February and the University of Michigan consumer sentiment survey also weakened. Another dataset on February 29 showed that the US’ annual inflation rate in January was the smallest in nearly 3 years (the core PCE index only increased by 0.4% in January 2024), prompting the consideration of an interest rate cut in June by the Fed.

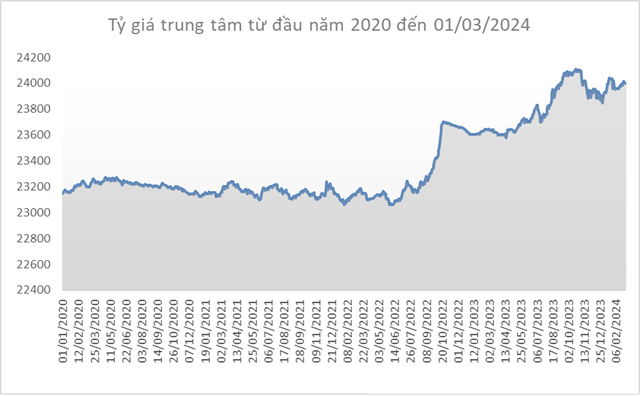

Source: SBV

|

Domestically, the central exchange rate between the Vietnamese dong and USD increased by 6 dong/USD compared to the previous week (session on February 23), reaching 24,002 dong/USD in the session on March 1.

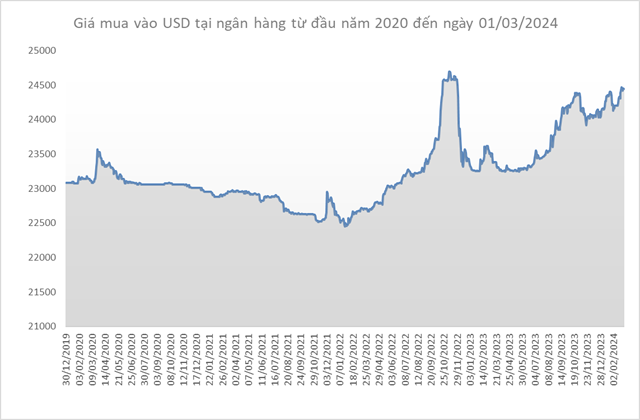

The State Bank of Vietnam (SBV) kept the spot buying price unchanged at 23,400 dong/USD. Meanwhile, commercial banks increased the spot selling price by an additional 7 dong/USD compared to February 23, reaching 25,152 dong/USD.

Source: VCB

|

Along with that, the listed exchange rate at Vietcombank increased by 20 dong/USD in both directions, reaching 24,440 dong/USD (buying) and 24,810 dong/USD (selling).

Source: VietstockFinance

|

Khang Di

![VPBank Proudly Presents G-DRAGON 2025 WORLD TOUR [Übermensch] IN HANOI as Title Sponsor](https://xe.today/wp-content/uploads/2025/10/screen-sho-2-100x70.png)