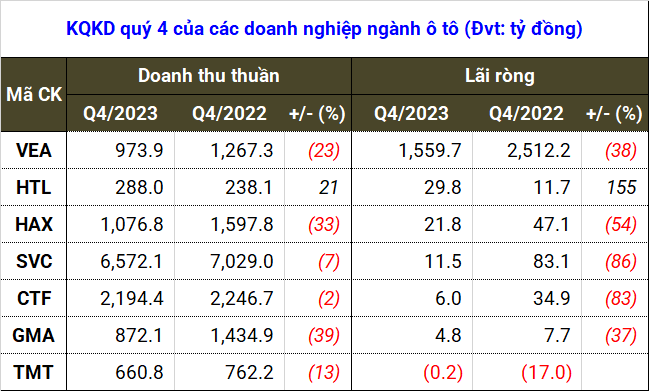

According to statistics from VietstockFinance, there are 7 automobile companies on the stock exchange (HOSE, HNX, and UPCoM) that have announced their Q4/2023 financial statements, including SVC, CTF, HAX, VEA, TMT, HTL, and GMA. Except for TMT reducing losses and HTL increasing both revenue and net profit, the other companies have reported less favorable results compared to the same period last year.

Source: VietstockFinance

|

Specifically, in the fourth quarter, the companies recorded a total revenue of VND 12.6 trillion, a 13% decrease compared to the same period; net profit decreased by 40% to only VND 1.6 trillion. SVC still contributed more than 50% of the total industry revenue, while VEA accounted for the majority of the profit, representing 95%.

The global recession and general economic difficulties have continued to impact consumer demand for automobiles. This is the reason given by the car companies on the exchanges after the fourth quarter.

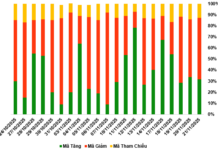

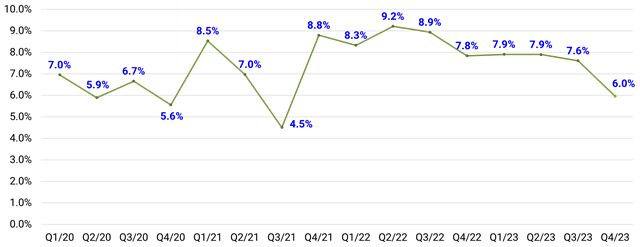

Discounts and promotional activities aimed at reducing inventory in the final quarter of 2023 have led to a gradual decrease in gross profit margins for these companies, reaching a low of 6% in Q4/2023, the lowest in 9 quarters.

|

Trend of gross profit margin by quarter for car companies on the exchange from 2020 (Unit: %)

Source: VietstockFinance

|

Sharp decline in net profit in Q4

For example, Saigon General Service (HOSE: SVC) witnessed an 86% decline in net profit in Q4/2023, down to just over VND 11 billion. The company stated that the automotive business was still facing many difficulties. Member units had to increase selling expenses and operating costs to maintain sales volume, leading to a decrease in gross profit and net profit from business operations. Not to mention the interest from associate and joint venture companies only contributed about VND 7 billion, while in the same period last year, it reached VND 50 billion.

The fourth quarter is usually a time when car companies generate significant profits as vehicle sales typically increase. However, this advantage for SVC was significantly reduced, resulting in a full-year net profit of only VND 23 billion, far behind the VND 332 billion of the same period and a record low since 2005 for SVC.

| Trend of net profit for SVC from 2001 to present |

City Auto (HOSE: CTF) also had lower net profit compared to recent quarters. Despite a slight 2% decrease in revenue, reaching nearly VND 2.2 trillion in Q4/2023; CTF’s second highest gross profit since being listed in 2017, net profit of CTF decreased by 83%, reaching VND 6 billion.

For CTF, the reason lies in the global recession’s serious impact on car purchases. Rising costs across the board have also led the Ford distributor to reduce its profit.

The automobile industry is already heavily affected by non-essential products during difficult times, and this is especially true for luxury brands like Mercedes, which caused HAXACO (HAX) to lose more than half of its net profit in Q4/2023, leaving only nearly VND 22 billion. Throughout the entire year, revenue and profit accounted for only 58% and 14% respectively compared to the previous year. This is the lowest profit level since 2015 for HAX.

| Trend of net profit for HAX from 2005 to present |

Similarly, the decline in results for G-Automobile (HNX: GMA) in Q4/2023 reflects the general difficulties in the economy and specific market conditions. Due to a decrease in sales, GMA’s revenue and net profit decreased by 39% and 37%, reaching VND 872 billion and VND 4.8 billion in Q4/2023.

Motor and Agricultural Machinery Corporation (UPCoM: VEA) achieved most of its profit from its affiliated and joint venture companies, such as Toyota or Honda. However, VEA still faced difficulties with a 23% narrower revenue of VND 973 billion and a 38% decrease in net profit, reaching nearly VND 1.6 trillion.

Rare positive results

Only Motors and Techniques Tường Long (HOSE: HTL) “bucked the trend” with a gross profit of VND 59 billion. This remarkable figure is due to a large number of specialized vehicles being completed and delivered to customers in the fourth quarter, resulting in high profits for the period.

This positive result enabled the truck manufacturer to achieve a net profit of VND 30 billion, a 155% increase compared to Q4/2022, a record high profit figure for several years.

| Trend of gross profit for HTL by quarter from 2015 to present |

Despite a loss of VND 18 billion due to a decrease in revenue and an increase in cost of goods sold, TMT Auto (HOSE: TMT) achieved better results in Q4/2023 thanks to revenue from financial activities and other income, reaching VND 69 billion and VND 47 billion respectively, while in the same period last year, the company only recorded a total of VND 25 billion. As a result, TMT incurred a loss of VND 213 million, compared to VND 17 billion in Q4/2022.

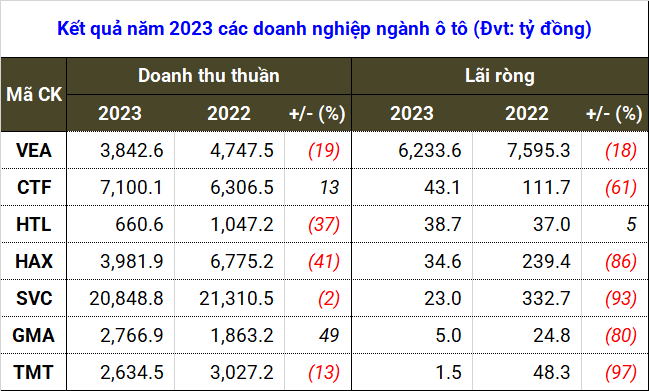

At the end of 2023, automobile companies generated nearly VND 42 trillion in revenue, a slight decrease of 7%; however, net profit decreased by as much as 24%, reaching only VND 6.3 trillion.

It is surprising that after a highly successful automotive industry in 2022, the majority of the profits were lost just one year later. The results reflect the challenging period as SVC, HAX, and TMT all experienced a 86% to 97% decrease in net profit compared to the same period. Only HTL maintained a flat position. HAX “missed out” on nearly half of its revenue.

Source: VietstockFinance

|

Sales pick up at the end of the year

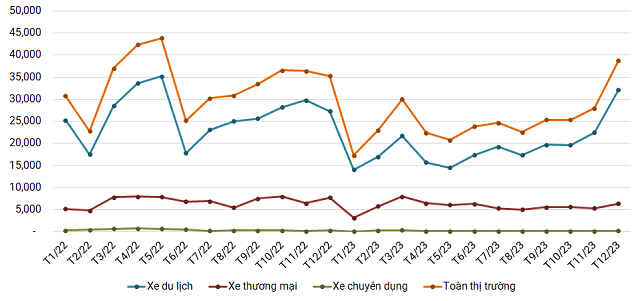

Data from the Vietnam Automobile Manufacturers’ Association (VAMA) shows that in Q4/2023, the entire market sold 92 thousand vehicles, a 15% decrease compared to the same period; however, there were clear positive signals compared to the end of 2022.

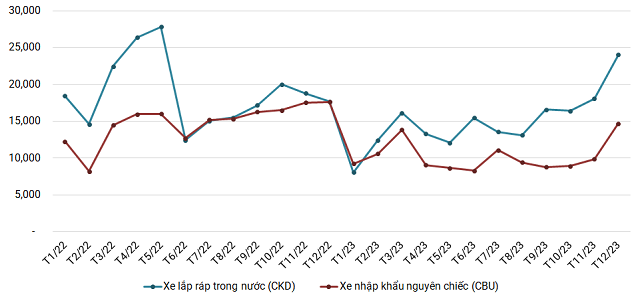

81% of the vehicles sold continue to be common types of passenger cars (sedan, SUV, MPV, hatchback, etc.); of which, domestically assembled vehicles (CKD) accounted for 63% of total vehicle sales in Q4/2023.

|

Trend of vehicle sales by month from the beginning of 2022 (Unit: vehicles)

Source: VietstockFinance

|

A year full of challenges in 2023 is reflected in the overall vehicle sales as the market only reached slightly over 300 thousand vehicles, a 25% decrease; heavily impacted by a significant decrease in passenger car sales (1,760 vehicles), down 27% to 230 thousand units.

A positive development may be seen in the increased share of domestically assembled and manufactured vehicles, rising from 56% to 60%, while completely built-up imports (CBU) decreased from 44% to 40%. The gap between CKD and CBU vehicles is widening, especially after the 50% reduction in registration fees for domestically assembled and manufactured vehicles took effect from July 2023.

|

Trend of vehicle sales classified by origin from the beginning of 2022 (Unit: vehicles)

Source: VietstockFinance

|

Huyndai rises to the top, Thaco improves market share

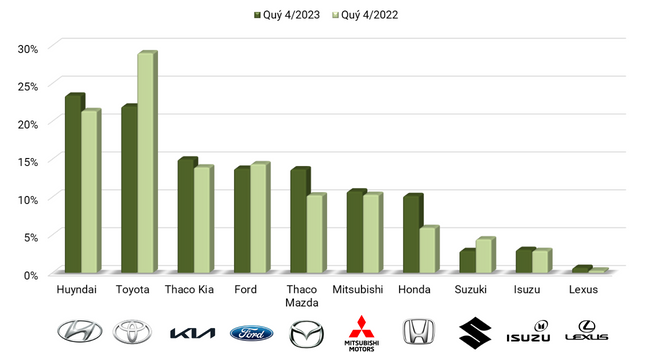

In terms of brands, Huyndai, distributed by TC Group, sold over 26,000 vehicles in the last three months, accounting for a 23.4% market share, officially surpassing Toyota as the Japanese brand decreased from 22.8% to 16.8%, with nearly 19 thousand vehicles sold.

In Q4/2023, Thaco sold over 30 thousand vehicles of various types, a slight 6% increase. Thaco’s market share reached 27.1%, lower than Q3 but up by 3 percentage points compared to the same period.

Throughout 2023, Thaco’s market share stood at 28.4%, a negligible decrease from 2022. In terms of brands, Huyndai led with 19.6%, an increase of 1 percentage point, while Toyota reluctantly ranked second with 16.7%, down from 20.7% the previous year.

|

Market share of some major brands in Q4/2023 (Unit: %)

Source: VietstockFinance

|

Slow recovery and continued intensity in the market in 2024

SSI Securities evaluates that in the first half of 2024, the automobile market will still face difficulties due to weak consumer demand and buyers waiting for new models. However, overall, the market is expected to recover in terms of both quantity and value for the whole year. This recovery will mainly be driven by economic recovery, the introduction of new car models, resolution of chip shortage issues, and lower interest rates for loans compared to 2023.

On the other hand, competition in the market will continue to be intense. Major brands such as Toyota and Honda have lost market share in 2023, while Ford, Kia, Mazda, and Mitsubishi are growing thanks to better pricing strategies. Not to mention Chinese brands that have started operating assembly plants in Vietnam since 2023.

By Tử Kính