Illustrative image

|

Maserco Supply and Technical Services Corporation (MAC, HNX: MAC) has recently approved the plan to hold its annual general meeting of shareholders in 2024, scheduled to take place at the company’s headquarters at 8A Van My Street, Van My Ward, Ngo Quyen District, Hai Phong City, according to the record date of March 22, 2024.

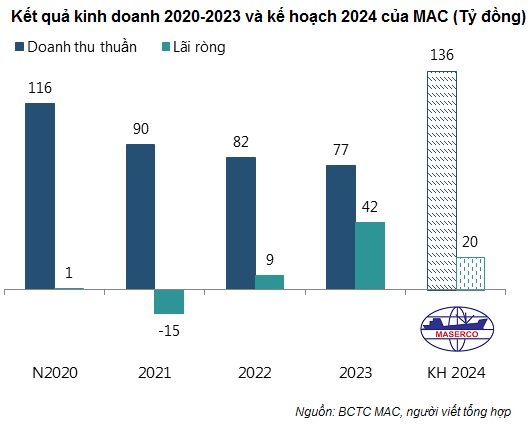

The profit target for 2024 is expected to decrease by more than half compared to the previous record high.

According to the shareholder meeting agenda, in 2023, MAC recorded a turnover of more than VND 7.7 billion, a 6% decrease compared to the previous year and achieving 91% of the annual plan. Thanks to the profit from selling investments, the company achieved a record net profit of VND 4.2 billion, a 4.7-fold increase compared to the same period and exceeding the profit target of VND 3.5 billion set for 2023 by 21%.

In 2024, MAC targets a turnover of VND 13.55 billion, a 74% increase compared to the performance in 2023. Leading the revenue growth will be the exploitation activities, which are expected to contribute VND 3.8 billion in revenue (a 286% increase); container suspension estimated to reach VND 3.6 billion (a 110% increase)… However, the net profit is projected to decrease by more than 52% to VND 2 billion.

Proposal to increase the capital to over VND 600 billion.

One of the important issues that MAC will present to shareholders is the plan to increase the charter capital to VND 45.4 billion or VND 60.6 billion, through issuing shares to existing shareholders at a ratio of 1:2 or 1:3.

Thus, the company plans to increase the capital 3-4 times compared to the current VND 15.1 billion, and more than 113-151 times compared to the initial capital of VND 0.4 billion (in 2003). If successful, this will be the largest capital increase in the history of Maserco.

The company stated that the purpose of using the capital is to invest in subsidiary companies, logistics service providers, maritime transport, and inland waterway ports.

The strong capital increase request took place while MAC’s ownership structure has undergone many fluctuations recently. The extraordinary shareholders’ meeting in 2023 approved the Sao A D Investment Corporation and TM Holding Company Limited to buy more MAC shares to increase their ownership to 65% of the capital without making a public bid. The sellers were Mrs. Nguyen Thi Thu Nga, the wife of Mr. Vu Hai Truong – a member of the Board of Directors, and Mrs. Pham Thi Hong Giang – Chief Inspector of Maserco.

At the upcoming shareholders’ meeting, MAC will present to shareholders the business cooperation contract for 2024 with related parties such as Macstar Ho Chi Minh Joint Stock Company, Macstar Coastal Container Transportation Joint Stock Company, Sao A D Investment Corporation, and TM Holding Company.

In addition, MAC also proposes to establish subsidiaries with its partners to manage repair workshops at 173 Ngo Quyen Street, May Chai Ward, Ngo Quyen District, Hai Phong City. Maserco contributes capital by the land use rights and assets on the land.

Hanoi Stock Exchange (HNX) has decided to remove MAC shares from the warning list after the company’s semi-annual financial statements for the fiscal year 2023 have been fully audited and undistributed after-tax profits until June 30, 2023 are positive.

However, MAC shares are still under control as Maserco has not yet resolved the reason for the control, which is “The audit firm has an audit opinion other than the audit opinion for the audited financial statements for 2021 and 2022”.

At the end of the session on March 4, MAC’s price stopped at VND 14,600/share, up 8% from the historical peak of VND 15,800/share set on December 15, 2023.

| Compared to the beginning of 2023, MAC’s stock price has increased by 65%. |