VN-Index

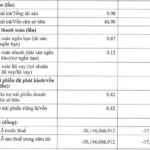

ended the week at 1,258.28 points, up 46.28 points (3.82%) from the previous week. The market received many news during the week such as: February CPI increased by 1.04% compared to the previous month; total import and export turnover in 2 months reached 113.96 billion USD, with a trade surplus of 4.72 billion USD; many important directives at the conference on implementing the stock market development tasks for 2024 under the chairmanship of the Prime Minister.

VCB had the strongest impact on the main index, helping the index increase by 11.6 points. The following positions are HPG, FPT, GVR, MSN, DGC, SSI, MWG. The upward momentum contributed from many different sectors. Foreign investors were net buyers with a value of over 10.7 billion VND in the week, of which the strongest buying was HPG with a value of 621 billion VND, SSI ranked second with a value of 521 billion VND. The leading net selling in the week was VN-Diamond fund certificate (code FUEVFVND) with 352 billion VND.

VCB made a significant contribution to the upward momentum of VN-Index last week.

Mr. Pham Binh Phuong – an analyst at Mirae Asset Securities – said that VN-Index successfully surpassed and held firmly at the 1,250 mark is a positive development for the week. However, the market may face significant selling pressure at the 1,250 – 1,270 range and VN-Index will need more time to consolidate.

The analyst team at Saigon – Hanoi Securities (SHS) commented that the market’s upward trend in the past week was enthusiastic, in the short term, VN-Index could continue to increase, aiming for a strong resistance zone of 1,300 points.

However, according to SHS, the recent upward trend does not rely on a reliable accumulation base. SHS does not value the possibility of VN-Index forming an uptrend. The market may return to a correction trend and return to the accumulation range of 1,150 – 1,250 points.

In the medium-term perspective, VN-Index is gradually moving to form a wide medium-term accumulation channel of 1,150 – 1,250 points. Currently, VN-Index is approaching the upper resistance level of the accumulation channel, so the medium-term risk is increasing.

“At this stage, short-term and

medium-term

risks are increasing. Short-term investors should be

cautious

and limit trading, as well as chasing buying. With medium and long-term views, the market is moving in the uptrend of the accumulation channel but is approaching the upper resistance level, so it may experience strong fluctuations. We do not recommend opening positions at the current stage but should wait for the market to enter a short-term decline phase,” SHS analyst team commented.

Under the observation of Rong Viet Securities (VDSC), the market continues to be in a tug-of-war and explore the 1,250 point range.

Liquidity

decreased with supporting movements in the last session, showing that the supply side is cooling down. The 1,250 point range is having support momentum and the retest of this range is heading in an optimistic direction.

It is expected that the market will continue to be supported and have the opportunity to expand the upward trend in the next trading week. Therefore, investors need to observe the supply and demand situation to evaluate the market’s condition. Currently, investors should prioritize stocks with good signals from the support zone to hold or accumulate, but also take advantage of the upward trend to close positions on cautious stocks at the resistance zone.

VPBank Securities believes that in the upcoming trading sessions, the index may retest the resistance level of 1,275 – 1,285 points. Short-term investors can hold stocks that still have growth potential and have not become overheated yet. For medium and long-term investors, priority should be given to leading sectors such as

banks

,

securities

, real estate, construction

materials

, retail and consumer goods, oil and gas…