Trading activity in the afternoon session was very slow due to many companies experiencing connection issues to the HoSE system. New orders were not confirmed, and old orders could not be cancelled or modified, resulting in a freeze on stock trading on this exchange. In the afternoon session alone, HoSE only traded over 7.518 trillion VND, a 52% decrease compared to the morning session and the lowest level in the past 20 afternoon sessions.

Not all companies were affected by the connection issues, as some investors were still able to trade normally in a few companies. However, the abnormally low trading speed and liquidity mentioned above indicate that the stock price fluctuations in the afternoon session are based on an unstable supply-demand foundation, especially after the market experienced a record-selling session in the morning.

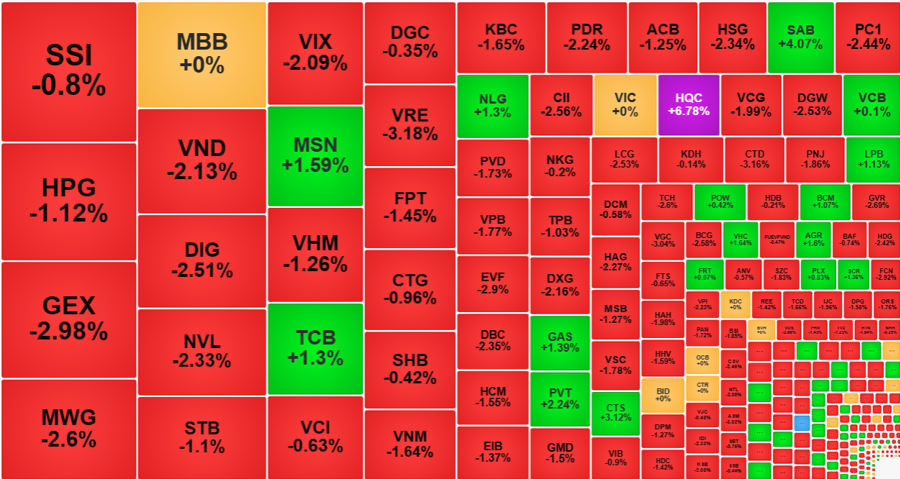

Nevertheless, this “order jam” also brought positive results for many stocks, as prices were pushed up by very small orders. Selling pressure could also be frozen due to these “order jams.” VN-Index hit a new low at 2:00 PM, falling nearly 14 points, but later recovered and closed down 7.25 points, equivalent to -0.57%.

Leading the index today are SAB, up 4.07%; GAS, up 1.39%; TCB, up 1.3%; and MSN, up 1.59%. However, the liquidity in these stocks was relatively low: SAB only traded 54.2 billion VND in the afternoon session, a 74% decrease compared to the morning session; GAS traded 43.8 billion VND, down 69%; TCB traded 137.4 billion VND, down 60%; MSN traded 168.9 billion VND, down 53%. Overall, stocks in the VN30 basket traded 52% less in the afternoon session compared to the morning session.

In a normal market, stocks would rebound after a strong morning selling session, and the afternoon liquidity would be low, which is a positive signal indicating reduced selling pressure. However, in the context of today’s afternoon session, there is no guarantee that the selling pressure has actually decreased and that investors would be able to sell even if they wanted to.

Regardless of the situation, today’s closing price will serve as an effective reference level for tomorrow’s session. HoSE closed with 130 gainers/356 losers, even worse than the morning session (133 gainers/339 losers). The number of stocks that fell by more than 1% was also similar to the morning session, with 141 stocks. The breadth and price level confirm the gradual recovery in the afternoon session based on support structures. Even if there is a price rebound, the selling pressure is still evident.

On the whole HoSE, among 61 stocks with a trading value of over 100 billion VND, 48 were in the red, with 38 experiencing declines of over 1%. VRE, CTD, GEX, EVF, GVR, MWG, TCB, CII, DGW, LCG, DIG… all dropped from 2.5% to over 3%, with trading values in the hundreds of billions of VND.

Of course, it is entirely possible to think the other way round, that many investors wanted to buy at the bottom, but their orders got stuck, making it impossible to push prices up and causing many stocks to close with significant losses. Both sides have their reasons to justify their viewpoints, but this is also the factor that makes today’s afternoon session unreliable. The trading system is not functioning normally, and money and stocks are not comfortably moving, so the prices are not certain either.