The Investment Corporation Hải Phát (code HPX-HOSE) has announced the decision of the BOD regarding the approval of the business plan for 2024.

According to the plan, HPX sets a business target for 2024 with a parent company revenue of 2,223 billion VND, a post-tax profit of 69 billion VND, and an expected dividend payout of 5%.

Consolidated revenue for 2024 is expected to reach 2,800 billion VND, an increase of 64% compared to the same period. However, post-tax profit is expected to reach 105 billion VND, a decrease of 22% compared to the actual results achieved in 2022 (142.4 billion VND).

In addition, the company has outlined some key tasks and solutions for 2024, including:

– Focusing on balancing cash flows to implement projects; Balancing sources to repay principal and interest on bond and credit packages when due, including negotiating with bondholders to extend bond and credit packages; Issuing and disclosing information on time; Restructuring ownership ratios in subsidiary and affiliated companies.

Regarding M&A activities: HPX will focus on resolving projects that are facing difficulties and legal issues, as well as seeking partners to transfer some projects that are no longer in the development target. In addition, the company will continue to seek investment opportunities in new projects.

In terms of project implementation, in June 2024, Hải Phát is expected to complete and hand over the Bắc Giang project, and commence construction of the Cao Bằng project (phase 2), the Lào Cai project, and the Đảo Ngọc Hòa Bình project.

Recently, HOSE has removed HPX shares from the warning list as of November 3, 2023, as the listed organization has resolved the cause of the securities being warned in accordance with regulations in Clause 4, Article 37 of the Listing Regulations and Securities Trading issued with Decision No. 17/QD-HDTV dated March 31, 2022 by the Vietnam Stock Exchange.

In addition, HPX shares are still subject to trading suspension under Decision No. 546/QD-SGDHCM dated September 11, 2023, of the Ho Chi Minh Stock Exchange due to the listed organization continuing to violate the information disclosure regulations after being put under restricted trading.

Regarding the business results, HPX’s net revenue in Q4/2023 reached nearly 502.6 billion VND, an increase of 53% compared to the same period last year. Post-tax profit reached 72.8 billion VND, an increase of 278.71% compared to the same period (19.223 billion VND) due to the transfer of capital in subsidiary companies and delivery of houses to buyers during the period.

For the full year 2023, net revenue reached 1,699.6 billion VND, an increase of 4% compared to the previous year, and post-tax profit reached over 134 billion VND – a decrease compared to the 142.4 billion VND recorded in the same period.

As of December 31, 2023, HPX’s total assets reached 8,298.3 billion VND, a decrease of 1,169 billion VND compared to 2023; inventory decreased by 798 billion VND to 2,980 billion VND and long-term receivables decreased by 697 billion VND to 647.8 billion VND. As a result, the debt decreased by 852.5 billion VND to 2,465.4 billion VND.

Previously, HPX had just announced an adjustment to its 2023 management report. Accordingly, Mr. Đỗ Quý Hải, Chairman of the BOD, now owns 40.8 million shares, equivalent to a stake of 13.43%. The number of shares announced by Mr. Hải previously was 43.74 million shares. The explanation for the reduction in ownership is a typographical error in the document.

According to the report, in 2023, Mr. Hải sold 17 million shares, of which he had previously pledged to sell the shares for a long time.

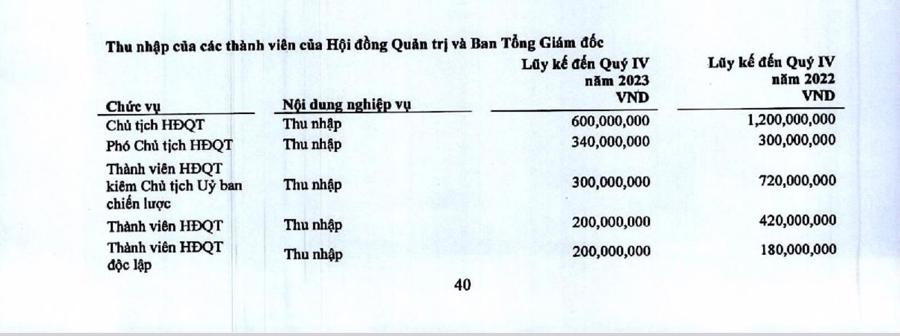

Regarding remuneration, Chairman Hải Phát received only half of the remuneration compared to 2022, from 1.2 billion to 600 million VND in 2023.

On April 26, the company is planning to hold the 2024 Annual General Meeting of Shareholders. The venue will be announced later. The final registration date is March 18.