When we talk about the most valuable business group in the stock market, we cannot ignore ACV – the “giant” of the aviation industry trading on the UPCoM. Since the beginning of 2024, this stock has increased more than 30% and reached its highest price in 15 months since the beginning of December 2022.

The market value of ACV has also increased by nearly VND 44 trillion (~USD 2 billion) to over VND 188 trillion (~USD 7.7 billion). This figure is totally superior to the rest of the companies on the UPCoM, nearly double the market capitalization of Viettel Global (VGI), Masan Consumer (MCH), and more than 3 times the value of Binh Son Refining and Petrochemical Company (BSR) and VEAM (VEA),…

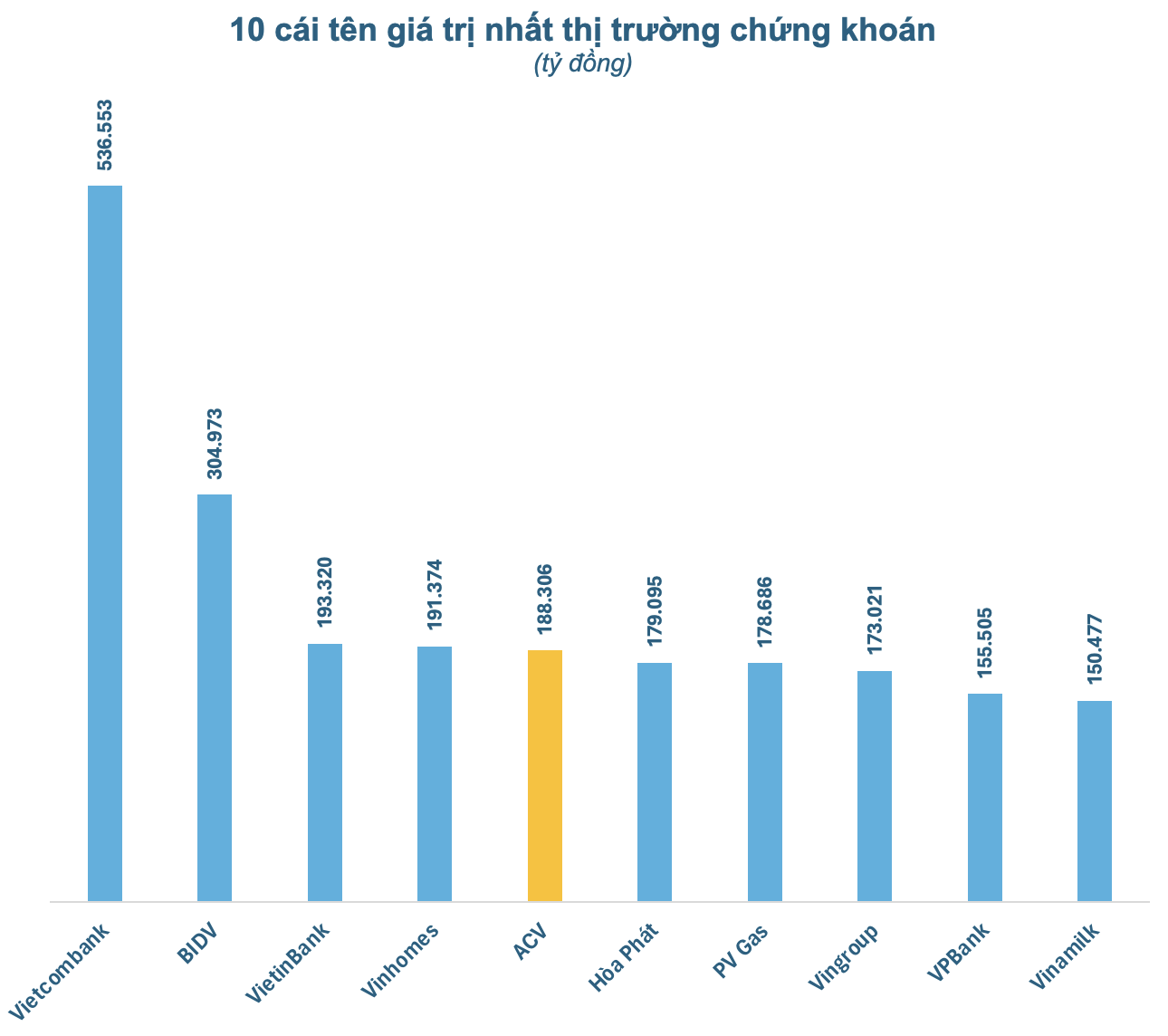

The strong increase since the beginning of the year has brought ACV to the 5th position in the list of the largest companies on the entire stock market, surpassing many well-known names such as Hoa Phat Group, Vingroup, Vinamilk, VPBank, Techcombank,…

ACV was established in 2012 on the basis of the merger of 3 Airports Corporations in the North, Central, and South. In 2015, the corporation was equitized and officially operated as a joint-stock company from April 1, 2016, with a charter capital of VND 21.771 trillion, of which the State owns 95.4% of the capital shares.

Nearly 2.18 billion ACV shares were officially traded on the UPCoM on November 21, 2016, with a reference price of VND 25,000/share, equivalent to an initial valuation of about VND 54.4 trillion (~USD 2.3 billion). After more than 7 years of ups and downs in the stock market, the market capitalization of the “airports tycoon” has tripled.

“The giant” owns 22 airports

Currently, ACV holds the exclusive rights to provide aviation services for domestic and international airlines, such as security service, ground service, passenger service, takeoff and landing,… The corporation is assigned to manage, coordinate operations, and invest in the entire system of 22 airports throughout Vietnam, including 9 international airports and 13 domestic airports.

The corporation currently has 2 subsidiaries, namely Noi Bai Airport Fuel Services Company (NAFSC) and Tan Son Nhat Airport Maintenance Service Company (SAAM). In addition, ACV also has 10 affiliated companies, mainly operating in the aviation services sector, including many listed companies on the stock market such as Tan Son Nhat Airport Services Company (SASCO – stock code SAS), Saigon Ground Services (SAGS – stock code SGN), Saigon Cargo Services (stock code SCS),…

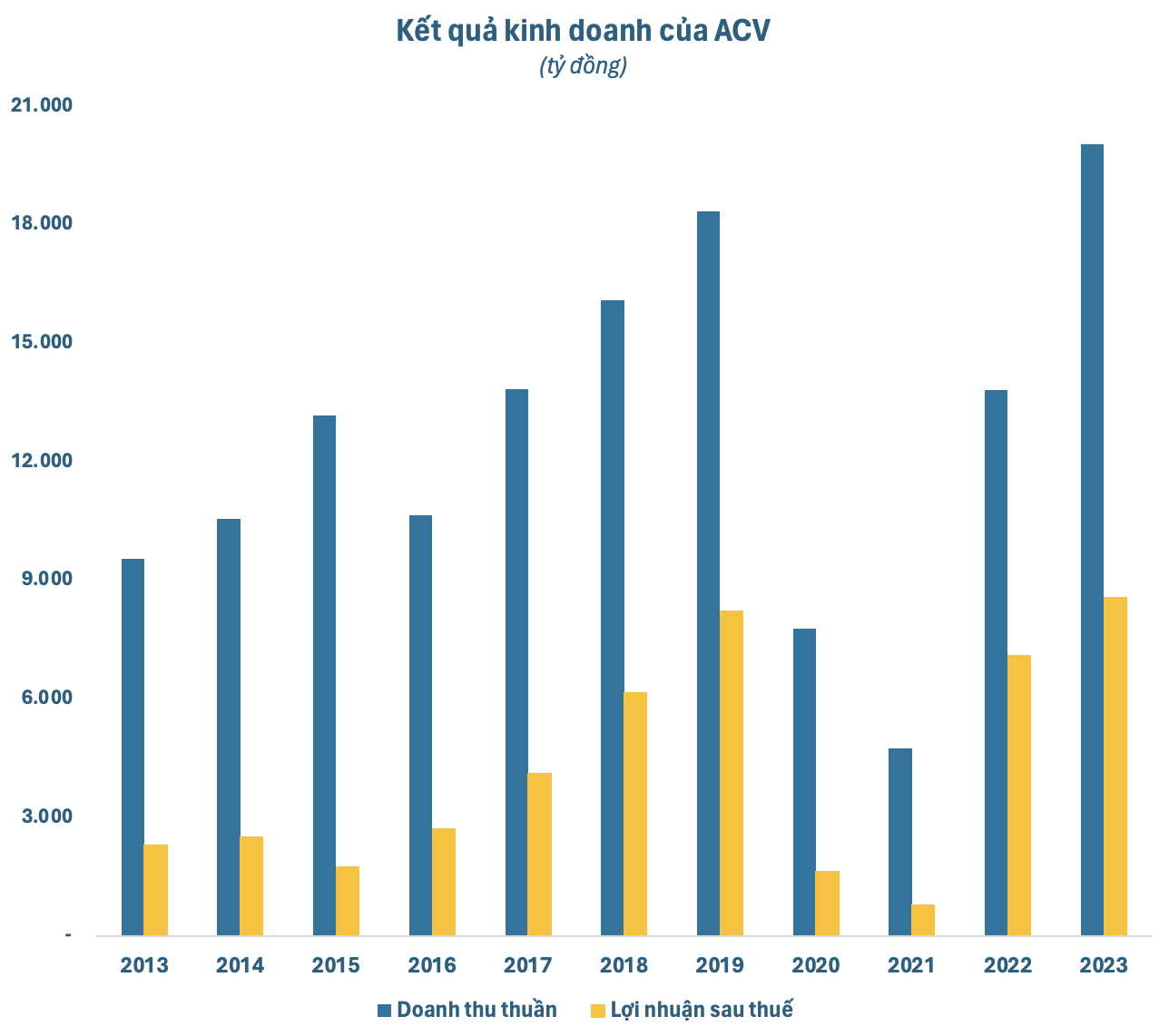

After being listed on the stock market, ACV’s business results have continuously improved with increasing revenue and profit growth each year before the appearance of Covid-19. After a difficult period in 2020-2021, ACV quickly recovered after the pandemic was pushed back and the economy entered the recovery phase.

In 2023, ACV served 113.5 million passengers, an increase of 15% compared to 2022, of which international passengers reached 32.6 million, an increase of 173%; The total amount of cargo through the airport reached 1.2 million tons; The total number of takeoffs and landings reached 710,000 flights. Thanks to that, the revenue reached a record level of over VND 20,000 billion, an increase of 45% compared to the previous year. After-tax profit also increased nearly 21% compared to 2022, reaching nearly VND 8,600 billion, the highest level ACV has ever achieved.

Continuing to “take off”

In 2024, the aviation industry is expected to continue to recover. International passenger traffic is assumed to return to the level of 2019 in the 4th quarter of 2024, while domestic passenger traffic is expected to remain stable. According to IATA, the Asia-Pacific airline industry has the strongest growth potential with a growth rate of 4.5% per year until 2050 in terms of passenger traffic, and Vietnam is one of the fastest-growing countries in the region.

The recovery of the aviation industry will be the foundation for ACV to continue to grow in the coming year. In addition, the forthcoming amendment of Decree 91/2015 will allow ACV to pay dividends in shares to increase charter capital and enable ACV to have sufficient capital for large-scale expansion projects, thereby becoming a catalyst for the stock.

Currently, ACV is the investor in many aviation projects, with a total investment amount of projects under implementation of over VND 133 trillion. Among them, the most notable are the Long Thanh International Airport project and Terminal 3 of the Tan Son Nhat International Airport.

Regarding the project “Component 3 of essential works in the airport under the Investment project of construction of the Long Thanh International Airport Phase 1”, by the present time, the implementation progress of the project’s items is in line with the plan, meeting the guidance of the Government.

Securities company DSC considers this as ACV’s long-term expectation story. With an expected completion time of 4 years, the 2024-2027 period will be the period when ACV focuses on capital. The basic construction investment capital is expected to reach USD 4.2 billion, more than double the cash flow from business activities.

Regarding the construction project of Terminal 3 of the Tan Son Nhat International Airport, ACV has started the 12th bidding package “Construction and installation of Terminal 3” with a contract value of VND 9.034 trillion on August 31, 2023. “At present, the basic site clearance work has been resolved, the construction progress ensures the schedule and is in accordance with the plan, the completion of the construction work is in line with the schedule for implementing bidding package No. 12″, a representative of ACV said.