Ms. Nguyen Thi Quynh Giao, Deputy General Director of BIDV, receiving the award from The Asian Banker

Strong and impressive position

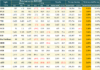

In 2023, with flexible and insightful business strategies that put customers at the center, BIDV continues to maintain its position as the number one retail bank in terms of market share in deposits, loans, and especially the retail customer segment with remarkable growth rates. Among them, the retail credit portfolio scale leads the market and is far ahead of the bank in second place; the NPL ratio is well controlled. Deposits from individual customers grew by 15%, with savings deposits continuing to increase steadily. The retail customer segment recorded a 50% growth compared to 2022, with new international credit card issuance increasing by 75%, setting a new record.

These achievements are the result of research and implementation of customer segmentation service models, the development of new sales models, the construction of product and service packages suitable for customer characteristics, and a focus on digitizing operational processes and bringing products and services to the digital channel.

Superior technology leading the way

With a solid foundation built and continuously nurtured over 67 years of development, BIDV identifies digital transformation as a key strategy to increase customer satisfaction and better meet customer needs, while helping BIDV maintain its position and aim to become a leading financial institution in the region.

The successful digital transformation of the core banking system in September 2023 marked a major leap in information technology systems and served as the main platform for a series of key projects: Digitalization of over 60% of traditional products, development of breakthrough and differentiated features on BIDV SmartBanking; transforming BIDV Home into an all-in-one application with comprehensive online lending ecosystem, and becoming the first state-owned bank to implement credit approval on all digital channels with retail credit appraisal and approval process fully executed on the RLOS system.

In addition to focusing on developing the digital product ecosystem, BIDV also focuses on elevating the seamless multi-channel superior customer experience with high-tech features.

Achievement commensurate with international standards

In an effort to become the Top of Mind Private Banking institution and redefine BIDV Premier with services for high net worth customers, in 2023, BIDV signed a strategic cooperation agreement with Edmond de Rothschild – the leading global financial institution in investment – to accompany and provide high-end individual customers in Vietnam with access to financial services of global standards.

In addition, BIDV also focuses on optimizing the model, expanding the network, and implementing specialized, comprehensive, and differentiated product and service portfolios for the high-end market: Smart Advisory – Specialized advisory services; Smart Financing – Premium real estate solutions; BIC Smart Care – High-end health insurance…

With strategic, comprehensive, and internationally standardized steps, BIDV is honored to be the only representative of Vietnam to receive the “Best Retail Bank” award for the 9th time, as voted by The Asian Banker Magazine at the “Excellence In Retail Financial Services Global Awards Ceremony 2024”.