Illustrative photo

BYD Explores Multiple Segments

After surpassing Tesla to become the world’s largest electric vehicle manufacturer in 2023, BYD has begun launching higher-end models.

The latest is the Yangwang U9 electric sport utility vehicle with a price tag of $230,000, marking its entry into the luxury electric vehicle market and testing its luck.

Beyond simply challenging automakers like Ferrari, BYD’s strategy is starting to emerge after its expansion:

it will not only compete based on price but will also expand its market share in other vehicle segments, including the fuel-powered car market.

Alongside the U9 sport utility vehicle, BYD has released new versions of its plug-in hybrid model, making efforts to expand the market.

Plug-in hybrids, equipped with both electric batteries and traditional internal combustion engines, may seem like a step backward for the world’s best-selling electric vehicle manufacturer.

But what if BYD, known primarily for its affordable electric cars, wants to not only cut into Tesla’s market share but also challenge the world’s two largest automakers, Toyota and Volkswagen?

BYD has launched a new version of its Qin Plus DM-i plug-in hybrid sedan at a starting price lower than $11,000, reducing it by 1/5 compared to the previous model.

New Han sedans, available as both plug-in hybrids and electric vehicles, as well as the Tang crossover SUV, have been rolled out in recent weeks.

BYD now finds itself directly competing with gasoline-powered car manufacturers.

The price of the Qin hybrid is over 40% lower than that of Toyota’s Corolla, nearly 1/10th that of Volkswagen’s Lavida, and about half the price of other pure hybrid models like Toyota’s Prius in the Chinese market.

The company’s European strategy follows a similar pattern.

The new Seal U DM-i plug-in hybrid model, with a starting price of $23,000 in its home market, will be sold in the coming months.

The model’s 109 km electric range is enough to cover the average 28 km daily distance traveled in the UK.

Significant Profit Potential

Hybrid vehicle sales are rapidly increasing worldwide.

In the US, these sales increased by nearly 2/3 last year, surpassing the 46% growth rate of electric vehicle sales.

The total number of hybrid vehicles sold is around 1.2 million.

For Toyota, hybrid vehicle sales increased by 47% in the third quarter, far exceeding the group’s 10% sales growth.

This trend is even more pronounced in Asia.

In Japan, hybrids accounted for 55% of total standard-sized passenger vehicle sales last year.

According to the Korea Automobile Manufacturers Association, hybrid cars accounted for nearly 1/3 of new registrations in South Korea in the previous month, contributing to a more than 40% increase in sales last year.

At the same time, BYD is placing a big bet on moving up the luxury segment.

The company announced a $14 billion investment in developing intelligent vehicles to compete with rivals in the premium segment after launching luxury electric sports cars and SUVs.

In the current unprecedented period of change for the automotive industry, a new approach is essential.

Electric vehicles are becoming cheaper while sales are on the rise.

However, nearly all electric vehicle manufacturers worldwide are still operating at a loss.

On the other hand, hybrid vehicles use older technology and provide automakers with cost advantages.

Toyota’s strong operating profit margin of 14% is partly due to the increasing sales of hybrid vehicles, which account for about 1/3 of the total sales.

For BYD, profits are starting to rise.

Despite price reductions in recent years, the company’s operating profit margin has increased to over 5% from 3% two years ago as sales of hybrid vehicles have increased.

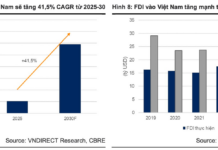

In Southeast Asia, where Toyota has had a long-standing stronghold for decades, BYD’s diverse lineup has proven to be a successful strategy in gaining market share.

According to Counterpoint Research, less than two years after entering the Thai market, the second-largest automotive market in the region, BYD ranks as the largest electric vehicle manufacturer and the third-largest passenger car manufacturer overall.

The shortage of raw materials and the delayed deployment of electric vehicle infrastructure in many countries suggest that the transition process may take much longer than previously expected.

Automakers who are capable of building a balanced portfolio of electric, gasoline, and hybrid vehicles are likely to perform better than their industry peers.

Source: FT