At the end of March 6th, after a bullish phase, the stock market witnessed a “correction” session as the VN-Index dropped 7.25 points to 1,262.73 points. On HoSE, there were a total of 356 declining stocks, with only 130 gaining and 67 stocks at reference.

In the context of the “red market,” the stocks of “Masan Group” including MSN, MCH, MSR, MML, VCF, and NET continued their “soaring” streak in the March 6th session. With the recent increase, the market capitalization of Masan Group has reached over VND 239.5 trillion (about USD 9.7 billion). Moreover, “Masan Group” also has 2 members in the list of the 20 largest companies on the stock market today.

MCH stock increased by 56% year to date

Specifically, MCH stock of Masan Consumer has had the most impressive increase in the Masan Group recently. At the end of the trading session on March 6th, the price of MCH stock increased by 3.74% to VND 136,000 per share, marking the 14th consecutive gain session. This is also the historical price of this stock.

Compared to the beginning of the year, MCH stock has increased by 56%, bringing the market capitalization up by VND 35 trillion to VND 97.58 trillion. This figure also helps Masan Consumer enter the list of the 20 largest companies on the stock market.

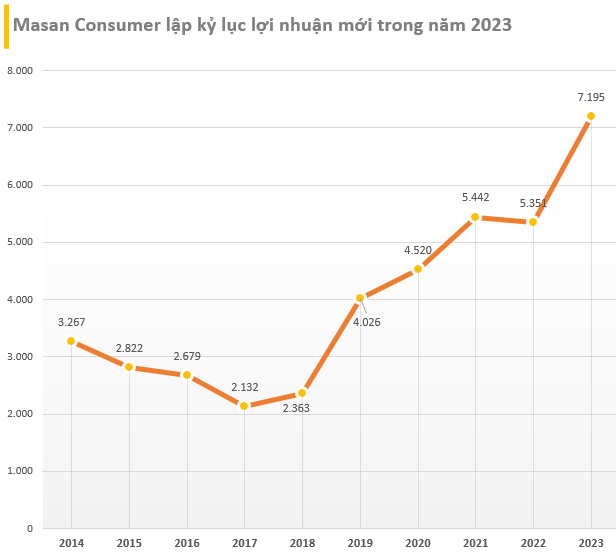

The upward trend of MCH stock is supported by positive business results. In 2023, Masan Consumer recorded a post-tax profit of VND 7.195 trillion, a 30% increase compared to 2022. The 2023 EPS reached VND 9,888 per share, a significant increase compared to the 2022 EPS of VND 7,612 per share.

Especially, Masan Consumer’s gross profit margin reached nearly 50% for the first time. Specifically, Q4 gross profit was VND 4.017 trillion, with a gross profit margin of 47.29%, a significant increase from 41.48% in Q4/2022.

According to Bao Viet Securities (BVSC)’s assessment, excluding the impact of transferring MSN Jinju to Masan MeatLife, MCH’s revenue grew by 9% compared to last year. BVSC considers this an extremely impressive figure in the context of tight spending due to the low consumer confidence affected by unfavorable macroeconomic conditions.

The Spice, Convenience Food, and Home Care product lines benefit from the increased trend of household consumption, while Beverage and Beer experienced slower growth due to reduced spending on dining out and entertainment. Revenue from new products increased by 39% compared to last year, contributing 4.4% to the total revenue in 2023.

Other stocks in the Masan Group are also on the rise

MSN stock of Masan Group is the largest in terms of market capitalization. Since the beginning of the year, MSN has also witnessed an impressive growth with 7 consecutive “green” sessions. Moreover, this stock even hit the ceiling price on March 5th with a record trading volume.

At the end of the trading session on March 6th, MSN stock increased by 1.59% to VND 76,800 per share. The price also increased by nearly 15% since the beginning of the year, driving Masan Group’s market capitalization up by VND 14 trillion to nearly VND 110 trillion (equivalent to USD 4.4 billion).

In addition to MSN and MCH, other stocks of the Masan Group such as MSR of Masan High-Tech Materials, MML of Masan MeatLife, VCF of Vinacafe Bien Hoa, and NET of NET Detergent have also been on the rise recently. Specifically, NET stock is currently trading at its peak following a record-breaking profit announcement.

In 2024, Masan Group is expected to achieve consolidated net revenue ranging from VND 84 trillion to VND 90 trillion, representing a growth of 7% to 15% compared to the same period last year. Moreover, the company targets a profit ranging from VND 2.29 trillion to VND 4.02 trillion. In an optimistic scenario, Masan’s profit will double compared to the VND 1.95 trillion achieved in 2023.

BSC Research forecasts that the core consumer segments including Masan Consumer and WinCommerce are gradually moving towards efficiency as the compound annual growth rate (CAGR) of pre-tax profit and interest (EBIT) for the 2023-2025 period will reach 20.8%, compared to 9% for the 2021-2023 period.

Furthermore, there are expectations of a recovery in consumer demand and a decrease in interest costs. Moreover, Masan is divesting from non-core businesses and planning to IPO The CrownX (the unit that owns Masan Consumer and VinCommerce) in the medium term. The divestment from non-industry businesses and the IPO plan for The CrownX will support profit growth, as well as stock prices in the near future.

BVSC Research also believes that the most difficult financial pressure period for Masan has passed, and the company’s profit will recover strongly thanks to the stability of the core consumer business and the decrease in interest costs. This will create positive momentum for the stock price in 2024. BVSC also emphasizes that MSN stock, along with some other blue-chips, may attract capital inflows in the upcoming market upgrade of the Vietnamese stock market.

According to VietCap’s viewpoint in the latest analysis report, MSN owns various consumer businesses from food and beverages production to nationwide retail networks, and each segment has a meaningful synergy with each other.

Over the past 3 years, the leadership has positioned MSN more clearly as a consumer company, increasing ownership and investment in businesses related to the consumer segment while divesting from non-core animal feed businesses.

Specifically, the company is targeting a decrease in ownership percentage in another non-core business, Masan High-Tech Materials (MHT). VietCap considers this activity as a significant supporting factor for MSN’s enterprise value.