The stock market in the first trading session of the week, despite some fluctuations, still showed resilience thanks to the stability of some pillar stocks and the rise of the Midcap group. The real estate group unexpectedly broke out strongly, contributing to the market’s upward momentum. At the end of the session, the VN-Index increased by 3.13 points (0.25%) to 1,261.41 points.

There was a strong increase in money flow with a trading liquidity on HoSE reaching one billion USD, equivalent to over 26,000 billion VND. Foreign investors made relatively positive transactions with a net purchase of 60 billion VND across the market. In particular, the net purchase value on HoSE reached approximately 102 billion VND.

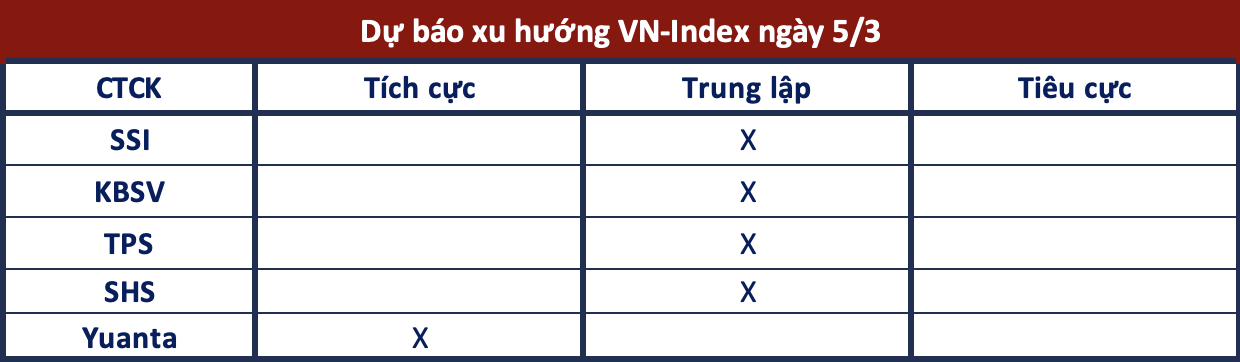

Regarding the market outlook in the coming sessions, most securities companies have given contrasting views:

Stable growth momentum

SSI Securities: The VN-Index fell below the resistant zone of 1,264-1,267 points despite surpassing this range at times. Technical indicators RSI and ADX have stabilized in a positive range. This indicates that the growth momentum of the VN-Index is showing signs of weakness and it is expected that the index will fluctuate in the short term within the range of 1,245-1,263 points.

Possibility of correction at any time

KBSV Securities: The VN-Index experienced a slight increase with a tug-of-war trend. The formation of a spinning candlestick pattern with increased liquidity shows intense competition in the trading activities of both sides. However, the continuous capital flow in the Midcap stock group with a wide range of increases has helped counter the increasing selling pressure on the pillar stock group and provide support for the index.

Technical signals show that there is a possibility of an unexpected correction at any time, but the upward trend of the VN-Index is expected to soon recover under the active control of the buying force. Investors are recommended to avoid chasing in early growth phases and can make small disbursements when target stocks and indexes move to near support levels.

Tug-of-war with an almost sideways state

TPS Securities: In the short term, it is highly likely that the VN-Index will have episodes of tug-of-war with an almost sideways state to accumulate for new momentum to rise to the next strong resistant zone of 1,280-1,290 points. The support range of the index is currently located at 1,240-1,250 points. Capital flow will tend to alternately shift between sectors and large-cap, mid-cap, and small-cap segments.

Possibility of abnormal volatility

SHS Securities: The market is operating in the medium-term resistance zone of 1,250 points and is showing good upward momentum, possibly heading towards the strong resistance around 1,300 points. However, due to the lack of reliable accumulation foundation, the VN-Index may experience abnormal volatility in the near future and a correction within the accumulation channel of 1,150-1,250 points is still possible.

The medium-term trend of the index also indicates an increasing risk as the VN-Index is trading around the upper resistance of the medium-term accumulation channel of 1,150-1,250 points. Short-term investors should be cautious at the present stage as the short-term and medium-term risks of the VN-Index are increasing even though the index may continue to increase towards the target of 1,300 points.

Continued momentum

Yuanta Securities: The market may continue its upward momentum and the VN-Index may retest the resistance level of 1,268 points in the next session. At the same time, the market may still have correction periods in the trading sessions ahead, but the market will not have a strong correction in this period.

The positive point is that investor sentiment is still optimistic about the current market developments and the opportunities for new purchases continue to increase. The short-term trend of the overall market is still maintained at a positive level. Therefore, Yuanta recommends that investors prioritize holding a high proportion of stocks in their portfolios and make new purchases with a low proportion if the VN-Index continues to trade below the resistant level of 1,268 points.