On March 5th, the domestic gold price continued to rise sharply, especially the price of smooth round gold set a new high. Specifically, at Bao Tin Minh Chau, the price of smooth round 24k gold is listed at 67.38-68.58 million VND/tael. This price increased by 600 thousand VND/tael compared to the previous day. This is also the highest price of this type of gold ever.

The SJC gold price also increased sharply and approached the 81 million VND/tael mark, which is equivalent to the peak achieved last weekend.

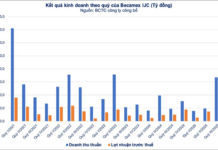

Gold prices posted at Bao Tin Minh Chau today.

Two days before, on March 3rd, the price of gold rings also set a new record. Accordingly, the price of smooth round gold approached the 68 million VND/tael mark.

Meanwhile, on March 2nd, the SJC gold price reached the 81 million VND/tael mark, surpassing previous highs. However, the SJC gold price quickly turned around slightly.

Regarding the continuous peak of gold prices in recent times, Mr. Huynh Trung Khanh, Vice Chairman of the Vietnam Gold Business Association, advisor to the World Gold Council in Vietnam, believed that the increase in gold prices is not only in Vietnam but also worldwide due to monetary policy and economic developments in the United States.

However, in Vietnam, the increase in domestic gold prices is not only due to the rising global price but also due to scarcity. Therefore, when the State Bank has not intervened in the market, the SJC gold price continues to increase and has a high difference compared to the world price.

According to Mr. Khanh, if the gold supply increases and meets market demand, the SJC gold price may decrease by tens of millions of VND, down to 70 million VND/tael. Conversely, if the supply does not increase, the SJC gold price may increase to 85 million VND/tael. The forecast for gold prices depends on the solution to increasing supply.

Meanwhile, Mr. Ngo Thanh Huan, CEO of FIDT Investment and Asset Management JSC, commented: “As long as the US Federal Reserve (FED) does not have a roadmap for lowering interest rates, the domestic gold price cannot decrease. When knowing that the upward trend of gold still exists, no one has a large demand to sell gold to the market.”

Mr. Huan added that, on the other hand, there have been complex changes in the world, resulting in a break in the global supply chain, affecting both exports and imports. When political instability still exists, gold prices are still strongly supported.

According to this expert, the economy in Vietnam is in a recovery state. Macroeconomic indicators are closely related to gold prices. Looking back at the previous period, after the SJC gold price peaked at 43 million VND/tael in 2014 when the economy began to recover. And from 2015 to 2018, as the economy developed, gold prices fluctuated and declined. At present, in a time of unclear economic turnaround, macro factors do not support a decrease in gold prices.

Mr. Huan recommended: “2024 is a year not to sell gold. But in the investment portfolio, gold should not account for more than 15% of the total.”

Regarding gold prices in the coming time, Mr. Huan believed: “Gold prices will definitely continue to rise in 2024. The price of smooth round gold can reach 70 million VND/tael. The SJC gold price may reach 85 million VND/tael.”

However, Mr. Huan advised against buying more gold at the current level. If the gold price drops by 5-7%, it is possible to buy more with a small proportion. This expert believes that, in the long term, gold is not a long-term investment channel. And in reality, no one accumulates an asset that tends to decrease in the long term.