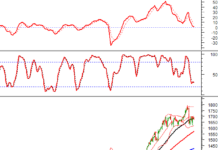

Signals of interest rate cuts from major central banks “fuel” gold prices, setting the precious metal at a new all-time high, inching closer to the $2,200/oz mark. Domestic gold prices this morning (March 8) also reached a new record, with SJC gold bars reaching nearly 82 million VND/tael and gold rings reaching approximately 69 million VND/tael.

At around 9 am, Phu Quy Group listed SJC gold bar prices for the Hanoi market at 79.8 million VND/tael (buying) and 81.8 million VND/tael (selling). Compared to the same time yesterday morning, the price of SJC gold bars at this company has increased by 500,000 VND/tael at each end of the price.

Phu Quy 999.9 smooth round rings are priced at 67.6 million VND/tael and 68.9 million VND/tael, for buying and selling respectively, an increase of 100,000 VND/tael at each end of the price.

Bao Tin Minh Chau Company quoted the price of the Rong Thang Long 999.9 smooth round gold rings at 67.78 million VND/tael and 68.98 million VND/tael, an increase of 150,000 VND/tael compared to yesterday morning.

In the Ho Chi Minh City market, SJC Company quoted prices for SJC gold bars of the same brand at 79.8 million VND/tael and 81.8 million VND/tael, an increase of 500,000 VND/tael compared to yesterday morning. SJC round rings are priced at 67 million VND/tael (buying) and 68.25-68.35 million VND/tael (selling), depending on the weight of the product, an increase of 200,000 VND/tael and 250,000 VND/tael respectively.

At the same time, spot gold in the Asian market stood at $2,158.5/oz, down $1.9/oz, or 0.09%, from the close of the Wednesday session in the US market – according to data from Kitco Exchange.

This price level is equivalent to about 64.7 million VND/tael if converted according to the USD selling rate at Vietcombank, an increase of 500,000 VND/tael compared to yesterday morning, bringing the total increase since the beginning of the week to 2.5 million VND/tael.

Closing the session on Thursday in the New York market, spot gold increased by about $14.5/oz, or nearly 0.7%, closing at $2,156.5/oz. In the Asian market trading session on the same day, gold prices reached $2,164/oz at one point, the highest in history.

At the end of its regular monetary policy meeting on Thursday, the European Central Bank (ECB) left its policy interest rate at a record high of 4%. However, eurozone monetary policy planners lowered 2024 inflation forecasts to 2.7% from 2.3% in the previous forecast – a “road clearing” move to enable the ECB to start cutting interest rates in June.

Earlier that same day, when testifying before the US Senate Banking Committee on March 7, Federal Reserve Chairman Jerome Powell said the central bank was “not far” from a place of confidence to begin cutting interest rates. Powell’s statement increased market bets on the likelihood of the Fed starting to cut interest rates in June.

Data from the FedWatch Tool of the CME Exchange shows that traders are betting with a 72% likelihood that the Fed will cut interest rates in June, compared to a 63% betting level at the end of February.

Gold is an interest-free asset, so a decrease in interest rates means a decrease in the opportunity cost of holding gold. In addition, the Fed’s move towards interest rate cuts also puts pressure on the depreciation of the USD, providing additional support for gold prices – an interest-free asset.

According to strategist Joseph Cavatoni of the World Gold Council, betting on interest rate cuts is the dominant driving force behind gold price movements, and investors believe that interest rate cuts are imminent. Cavatoni also emphasized that central banks continue to buy gold aggressively.

Investors’ attention during Friday’s trading session will focus on the overall employment report for February from the US Department of Labor. Recently, the US labor market has shown resilience despite high interest rates. Any signs of weakness in the upcoming report will reinforce the possibility of the Fed cutting interest rates.

Analyst James Steel of HSBC Bank believes that geopolitical risks are another important reason for the rise in gold prices. “There aren’t many assets for investors to truly view as safe havens. Gold is one of them,” Steel said.

Since the outbreak of the Israel-Hamas war last October, global gold prices have risen by over $300/oz. However, in recent days, gold prices have risen in parallel with the prices of other risky assets. The US stock market set a new record in Thursday’s trading session, and the price of the virtual currency bitcoin reached an all-time high earlier this week.

However, the world’s largest gold exchange-traded fund (ETF), SPDR Gold Trust, continues to see net outflows. Selling an additional approximately 0.9 tons of gold in Thursday’s session, reducing the holding volume to over 816.6 tons of gold. This week, the fund has sold over 7 tons of gold, after unloading 28 tons of gold in the previous 4 weeks.