Following a smooth morning session on March 6, trading on HoSE suddenly experienced order congestion and the electronic board froze at certain times during the afternoon session. According to many investors on stock forums, the electronic board hardly displayed any trading activity for stocks on HoSE. Some investors even couldn’t place orders.

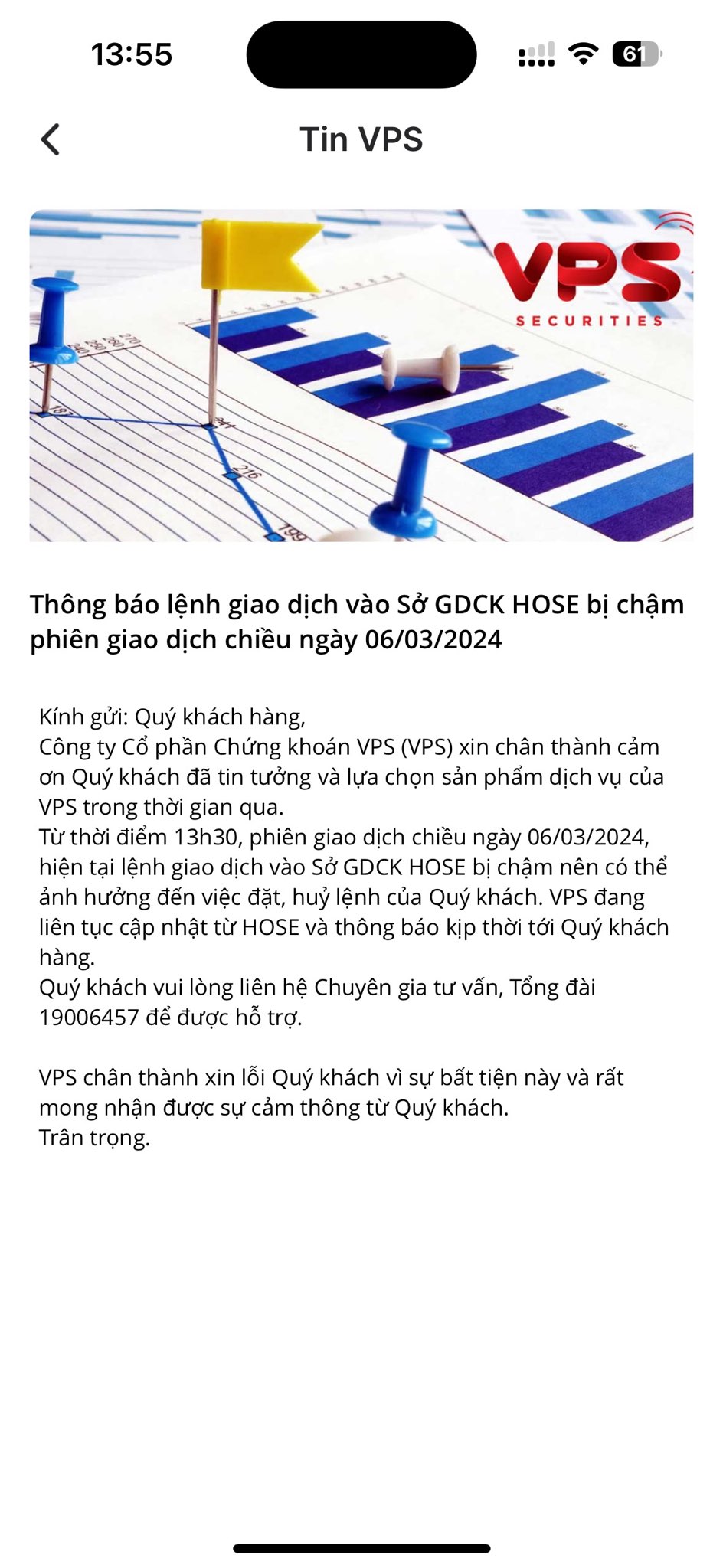

Immediately after this situation occurred, some securities companies such as VPS, MBS sent notifications to investors about the slow order execution on HoSE, affecting investors’ order placement and cancellation.

Prior to this, during the early stage of 2021, order congestion on HoSE was quite intense. At that time, FPT and Sovico joined hands to temporarily “rescue” and help resolve the tense situation while waiting for the new system. Thus, after 3 years, order congestion has once again occurred on HoSE.

Order congestion occurs in the context of the new KRX system entering the final testing phase before operation. KRX is the information technology management and operation system for trading on the Vietnamese stock market, which HoSE signed with the Korea Exchange in 2012 and is expected to be operational in 2024.

Speaking at the seminar “Stock Market: Building Foundation – Accumulating – Breaking out” organized by Investment Newspaper on March 5, the leaders of the Market Development Department, the State Securities Commission (SSC) stated that the KRX system is being tested and will be put into operation immediately after successful testing.

In terms of the impact of the KRX system on the stock market, Mr. Tran Hoang Son, Director of Market Strategy, VPBank Securities JSC, believes that it will have a significant impact on both liquidity and products in the market.

According to Mr. Son, in many stages of market development, the old trading infrastructure experienced order congestion and order blocking. Therefore, the changes of the new trading infrastructure will ensure smoother transactions. In the near future, the new trading infrastructure will help investors trade faster, and many organizations will be able to trade automatically.

On the new infrastructure, there will be new products, shortening the trading time from T2.5 to T2. Not only derivative securities in the stock index, but also derivative securities in individual stocks will exist in the future. The changing system will greatly benefit investors in terms of trading products, extending trading time and increasing market liquidity.