Illustrative image

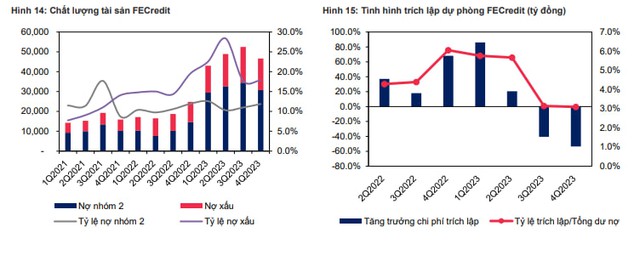

In the newly released analysis report, Securities company MB (MBS) stated that in the fourth quarter of 2023, FE Credit recorded VND 4,234 billion in operating income, a decrease of 6.9% compared to the same period in 2023 and an increase of 0.6% compared to the previous quarter. This decrease has improved significantly compared to the decrease of 15.4% and 27.1% compared to the same period in 2022 in the second quarter and the third quarter of 2023.

Operating expenses in the fourth quarter of 2023 decreased by 32.8% compared to the same period in 2022 and decreased by 10.2% compared to the previous quarter. The provision expenses in the fourth quarter of 2023 reached VND 2,162 billion, a decrease of 53.4% compared to the same period in 2022 and an increase of 1.7% compared to the previous quarter.

Notably, this is the second consecutive quarter FE Credit has recorded a decrease in provision expenses compared to the same period in 2022. As a result, the pre-tax profit in the fourth quarter reached VND 208 billion, while in the same period, a loss of VND 1,774 billion was recorded.

For the full year of 2023, FE Credit recorded an operating income of VND 17,756 billion, a decrease of 13.8% compared to 2022, and a pre-tax loss of VND 3,529 billion, which is higher than the loss of VND 408 billion in 2022.

Operating expenses and provision expenses decreased by 10.1% and 10.4% respectively compared to 2022. Bad debt and group 2 debt at the end of 2023 of FE Credit reached 11.9% and 17.8% respectively, increasing slightly by 0.9 and 0.1 percentage points compared to the third quarter of 2023.

According to MBS, the improvement in the asset quality of FE Credit and the signs of bottoming out since the second quarter of 2023 (NPL and group 2 debt reached 28.4% and 10.3% respectively).

The analysis group believes that FE Credit’s consecutive pre-tax profit in the two quarters and the signs of bottoming out in asset quality indicate that the pressure of provision in the next quarters will gradually decrease. In addition, the slowdown in loan growth has also begun to stabilize and bottom out in the third quarter of 2023, increasing expectations that FE Credit can regain positive growth in 2024 and make significant contributions to the earnings capacity of VPBank. MBS forecasts that FE Credit’s outstanding loans could reach 16.1% in 2024.

Source: MBS

FE Credit is the largest consumer finance company in Vietnam in terms of total assets and market share for lending. With its predecessor as the Consumer Credit Division of VPBank, FE Credit has established a strong foundation and consistently maintained its leading position in the consumer finance market with a nationwide network at more than 21,000 points of sale and over 16,000 employees.

After a period of explosive growth, FE Credit has encountered many difficulties in recent years due to the impact of the Covid-19 pandemic and the slowdown in economic growth, which has created financial burdens for individuals with low incomes, who are the main customers of FE Credit.

Analysts forecast that the operations of FE Credit will gradually stabilize from the second half of 2023 and start to recover from 2024. However, the overall loan growth rate will slow down compared to the previous period but will focus on customers with lower risks.