The CASA race intensifies: Techcombank leads the pack

In recent years, increasing CASA (current account savings accounts) ratios have become a strategic objective for banks. Banks that maintain high and stable CASA ratios will gain numerous advantages. As such, the competition to increase CASA ratios has become extremely fierce, especially in an environment where most commercial banks are investing heavily in providing digital banking services and free money transfers.

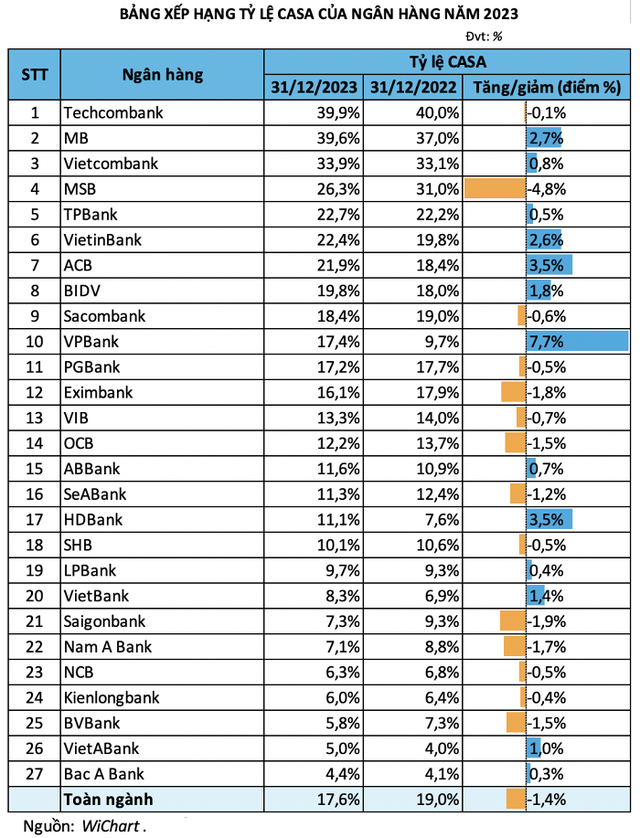

According to the 2023 banking industry performance report, the top three CASA ratios are still led by Techcombank, MB and Vietcombank, with a very tight margin between the winner and the runner-up in this race.

Among the banks that recorded impressive CASA recovery is Techcombank, with the bank’s CASA balance increasing for three consecutive quarters. In Q4/2023 alone, the bank recorded CASA reaching VND 181.5 trillion, an increase of 37% year-on-year, bringing the CASA ratio to 39.9%.

Techcombank has become the bank with the best profit margin in the system, thanks to its abundant and stable CASA. With this CASA source, the cost of capital or mobilization cost of the bank will also be lower, and from there, the lending rate will decrease. “The reason why Techcombank has been very successful in its transformation journey over the past four years is because we have the capabilities to compete with Vietnamese state-owned banks in terms of pricing policy (interest rates). CASA ratio is one of the important goals in Techcombank’s business activities, from which to realize the strategic goals of low-cost capital sources and promote growth,” said Mr. Alex Macaire, Group Chief Financial Officer (CFO) of Techcombank.

Three drivers of CASA growth

Sharing his experience in attracting CASA, Mr. Phung Quang Hung, Deputy General Director of Techcombank said that CASA growth momentum comes from two main transaction sources of customers: daily transactions such as household spending, travel, etc. and transactions serving the need for accumulation, investment to optimize assets.

Grasping this, the bank has focused on three important pillars to grow CASA. The first is a solution to promote transactions, providing tailor-made, personalized transaction-related products and experiences to each customer. At the level of large enterprises and manufacturers, Techcombank provides cash flow management solutions to optimize liquidity.

The second is to promote credit, providing capital to customers to promote consumption and production. According to Mr. Hung, the bank aims to help customers access credit the easiest, most suitable way, but still manage risks and maintain costs at a healthy level. Because in consumption or in business, customers always have capital needs, if that demand is met, it will promote transactions, boost business, thereby bringing CASA growth to the bank.

Finally, for investment products and asset optimization, the bank helps customers have many investment assets with different risk appetites, achieving good performance but ensuring sustainability without taking unforeseen risks.

Techcombank is the market leader in CASA

In a discussion with the press in March 2024, Techcombank’s CFO also affirmed that “our pioneering position in card payments has created a foundation for our CASA momentum.” Techcombank is the leading credit card bank in Vietnam, accounting for over 20% of Visa payment market share. Transaction volume on our digital platform increased by 57% from January to the end of 2023. Techcombank has also achieved significant achievements with its corporate payment solutions, including reverse factoring, dynamic discounting and distributor financing solutions. As a result, CASA balances from the bank’s corporate customers increased by 59% in 2023, accounting for more than 40% of Techcombank’s total CASA base.

Driven by deposits from corporate customers

According to experts, CASA will continue to increase in the coming period, as the economy shows signs of recovery, people’s incomes improve, leading to increased spending, which will result in more money in payment accounts, leading to improved CASA for banks.

Mirae Asset Vietnam Securities commented that the continuous decline in mobilization interest rates has positively impacted non-term deposit (CASA) ratios from around mid-2023. Analysts expect the CASA ratio to continue to recover in the coming quarters of 2024, as mobilization interest rates become less attractive, thereby reducing the cost of mobilization for banks.

“Enterprises increase the amount of cash due to large spending demand at the end of the year, which is a factor driving CASA to increase sharply in Q4/2023. We expect Techcombank to restore and maintain its No. 1 position in CASA ratio in the following years thanks to the recovery growth of deposits from corporate customers and the economic recovery,” said MBS.