Real Estate Investment Joint Stock Company No Va (Novaland, NVL) has just sent a notification to the Hanoi Stock Exchange (HNX) regarding the bond interest payment situation.

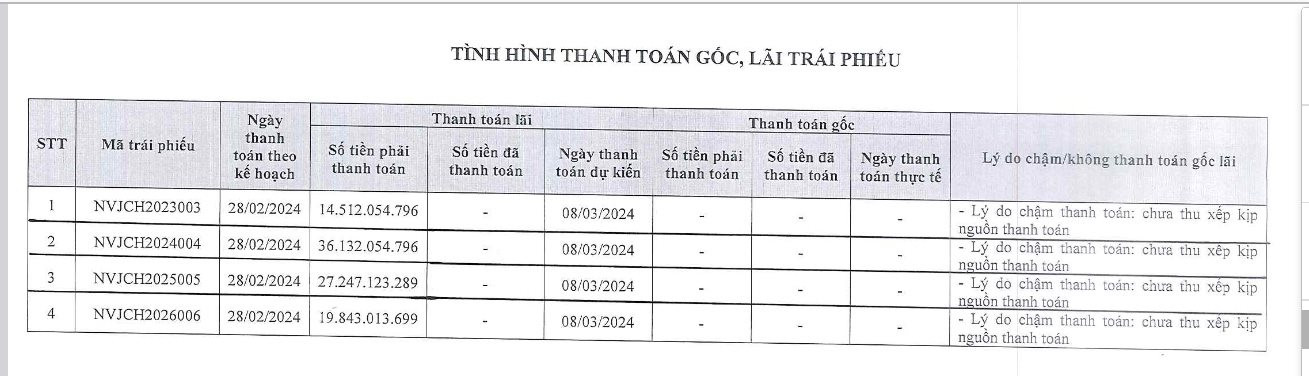

Specifically, NVL requested to delay the payment of interest for 4 batches of bonds on February 28 with the reason “not being able to arrange payment sources in time”. The total expected interest to be paid for these 4 batches is nearly 98 billion VND. NVL stated that the payment is expected to be made on March 8.

Regarding NVL, recently Novagroup announced that BIDV Securities (BSC) sold the pledged 39,125 NVL shares owned by Novagroup on February 27. Similarly, Petroleum Securities (PSI) sold the pledged 20,828 NVL shares on February 23. After 2 rounds of pledging, Novagroup’s ownership in NVL decreased to 18.834%, equivalent to 367.18 million shares.

At the end of 2023, Novaland’s revenue reached 4,800 billion VND – a decrease of 57% and post-tax profit after minority interests reached 805 billion VND – a decrease of 63% compared to the same period last year. It is worth noting that in the accumulated of 9 months, Novaland had a loss of 841 billion VND, but recorded extraordinary profits in the fourth quarter which helped the company escape the loss in 2023.

As of December 31, 2023, Novaland’s financial borrowings amounted to 241,376 billion VND, a decrease of 16,000 billion VND compared to the beginning of the year. In which, the item with the sharpest decrease is the long-term receivables, from 44,081 billion VND to 33,857 billion VND. The company’s cash and deposits decreased by 5,200 billion VND.

Novaland’s financial borrowings were at 57,704 billion VND, a decrease of nearly 7,000 billion VND compared to the beginning of the year. In which, bond liabilities were 38,262 billion VND, a decrease of 5,900 billion VND. Bank loans were 9,400 billion VND.

In conclusion, despite reporting billions of VND in profit in the fourth quarter, Novaland still face many difficulties and outstanding issues, especially the “burden” of bond liabilities of 38,262 billion VND – a consequence of the past “intoxication”.

It is known that Novaland has announced the final list of shareholders to attend the Annual General Meeting of Shareholders in 2024. The last registration date is on March 25 and the scheduled date for the meeting is on April 25. The company will announce the specific details in the invitation letter.