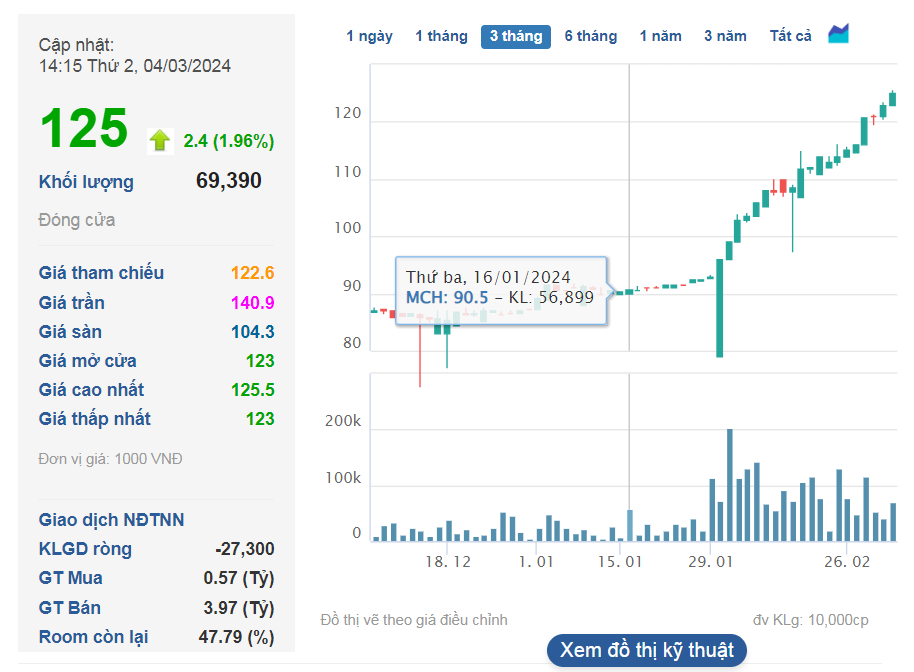

On March 4th, Masan Consumer Holdings (MCH) stock of Masan – Consumer Goods Joint Stock Company increased 2% to 125,000 VND/share. Recently, MCH stock price has skyrocketed. Since late November, MCH stock has increased by about 60%, corresponding to an increase of nearly 34,000 billion VND in market capitalization.

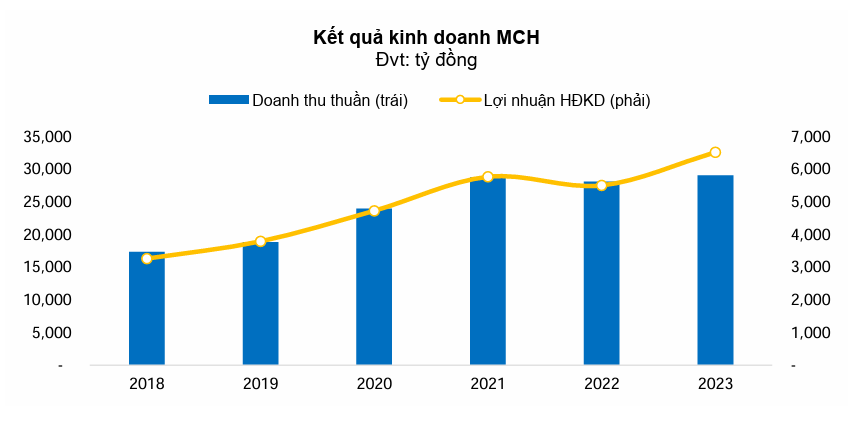

The upward trend of MCH stock is supported by positive business results. According to the analysis report of Bao Viet Securities Company (BVSC), Masan Consumer Holdings continues to be the pillar of Masan’s Consumer Goods division. In 2023, MCH recorded revenues of 29,066 billion VND (an increase of 3.4% compared to the same period) and operating profit of 6,521 billion VND (an increase of 18.5% compared to the same period).

If we exclude the impact of transferring MSN Jinju to Masan MeatLife, MCH’s revenue grew by 9% compared to last year. BVSC considers this figure extremely impressive in the context of tightened spending due to low consumer confidence caused by unfavorable macroeconomic conditions.

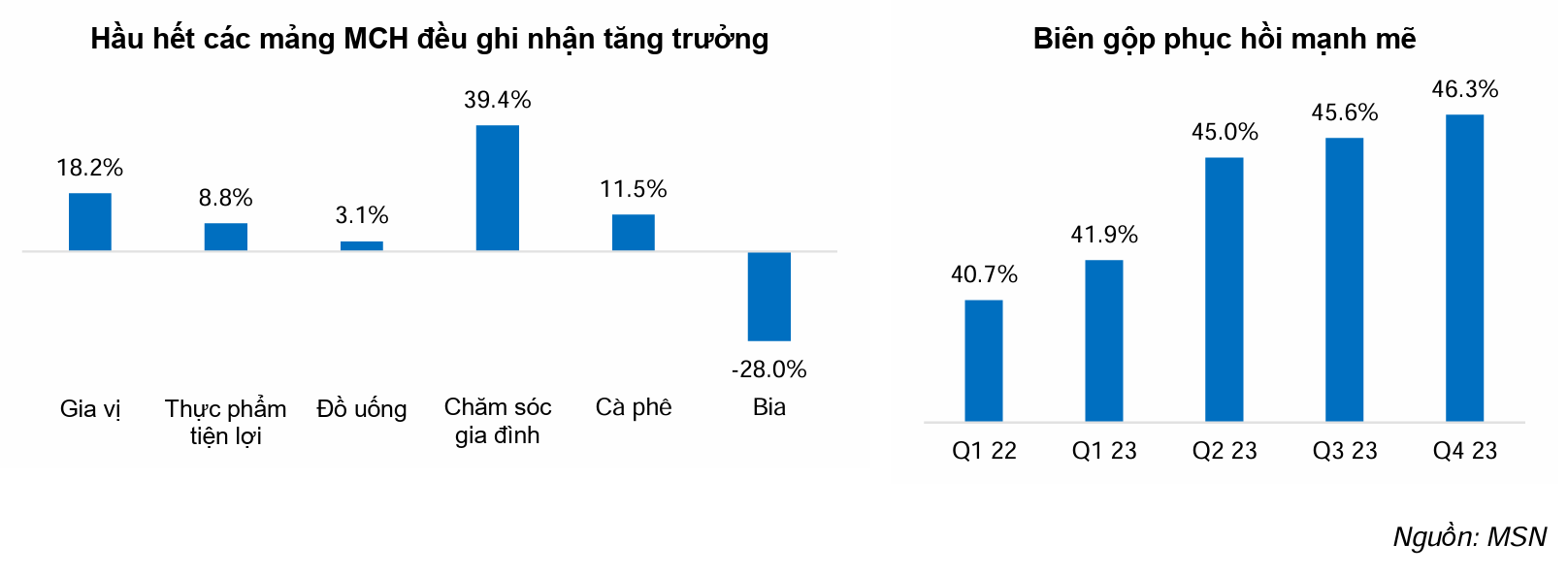

The Spices, Convenience Foods, and Household Care categories benefit from the trend of increased home consumption, while Beverages and Beer recorded slower growth due to reduced spending on eating out and entertainment. Revenue from new products increased by 39% compared to last year, contributing 4.4% to the total revenue in 2023.

Gross profit margin also showed strong improvement, reaching 46.3% in the fourth quarter of 2023, up 440 basis points from the beginning of the year thanks to reduced inputs and changes in product structure.

According to Masan, the outstanding growth of gross profit margin is the result of having high selling prices reinforced by a strong brand, a product portfolio with high profit margins, the ability to ensure low material costs, and an optimized supply-demand plan to improve production conversion costs.

In Masan Consumer’s 2022 annual report, the company stated that MCH applies a strategy focused on investment opportunities that can bring gross profit margins above 30%, creating conditions for the company to build a strong brand and create breakthrough products that bring value to consumers.

MCH’s “Go Global” strategy also achieved encouraging results, with revenues exceeding 1,000 billion VND in 2023. Chin-su brand products are currently being exported to developed markets such as the US, Canada, Australia, Europe, and Japan. In particular, Chin-su chili sauce is one of the best-selling products on the Amazon platform.