The market liquidity has increased significantly compared to the previous trading session, with the trading volume of VN-Index reaching over 1.308 billion shares, equivalent to a value of nearly 32 trillion VND; HNX-Index reaching nearly 129 million shares, equivalent to a value of over 2.4 trillion VND.

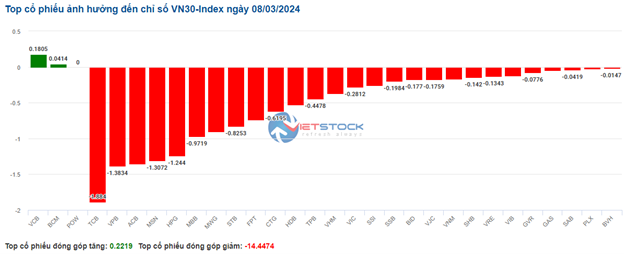

VN-Index opened the afternoon session not too negatively as buying pressure appeared right from the beginning of the session, narrowing the decline of the index. However, towards the end of the session, selling pressure dominated again, causing VN-Index to decline sharply and close near the lowest level of the day. In terms of impact, BID, CTG, and TCB were the most negatively affected stocks, taking away more than 6 points from the index. On the contrary, NAB, HVN, and DCM were the stocks with the most positive impact on VN-Index, contributing to a 0.6 point increase.

Source: Vietstock Finance

|

HNX-Index also had a similar trend, in which the index was negatively affected by stocks such as TAR (-4.71%), CEO (-2.69%), TVC (-2.3%), TIG (-2.29%),…

Source: Vietstock Finance

|

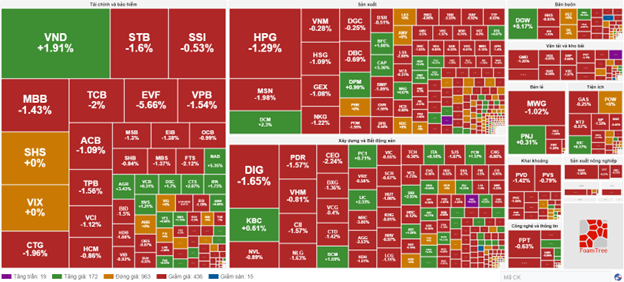

The banking sector had the biggest decline in the market with -2.34%, mainly from stocks like VCB (-0.73%), BID (-4.13%), and CTG (-3.63%). It was followed by the food and beverage sector and the retail sector, which saw declines of 1.96% and 1.85% respectively. On the other hand, the rubber product sector was the strongest performer with a 3.98% increase, mainly driven by stocks like DRC (+5.7%), CSM (+1.55%), and SRC (+0.68%).

In terms of foreign trading, foreign investors continued to be net sellers with a net selling value of nearly 688 billion VND on HOSE, focused on stocks like VNM (118.59 billion VND), VPB (101.42 billion VND), KBC (79.63 billion VND), and VND (68.15 billion VND). On HNX, foreign investors were net buyers with a net buying value of over 49 billion VND, focusing on stocks like IDC (27.04 billion VND), SHS (21.85 billion VND), and DTD (5.3 billion VND).

Source: Vietstock Finance

|

Morning session: Blue-chip stocks plummet, dragging VN-Index down

VN-Index, after gaining points from the start of the morning session, experienced a downturn and reversed its negative trend. At the same time, the continuous net selling from foreign investors indicated a pessimistic situation. By the end of the morning session, VN-Index decreased by 11.11 points, equivalent to 0.88%. HNX decreased by 0.39 points, equivalent to 0.16%.

The trading volume of VN-Index recorded in the morning session reached over 687 million units, with a value of over 16.5 trillion VND. HNX-Index recorded a trading volume of over 75 million units, with a trading value of nearly 1.4 trillion VND.

Most large-cap sectors are mostly in the red, notably the retail, banking, mining, construction materials, and food and beverage sectors, which are not showing much positive movement.

The retail sector was the most negatively affected by the end of the morning session, with all stocks covered in red. Key stocks in the sector such as MWG decreased by 2.45%, PNJ decreased by 0.1%, and FRT decreased by 1.36%,…

Alongside retail, the banking sector is also pessimistic. Most declines came from stocks like BID, CTG, VPB, TCB, MBB, ACB, HDB, ACB, STB, SHB, LPB which all recorded quite negative declines in the morning session.

The continuous net selling from foreign investors contributed to the negative sentiment of VN-Index in the morning session. Among them, VNM was the most heavily sold stock, occupying a significant proportion compared to other stocks below such as MWG, KBC, MSN, CTG, and VHM. Following these stocks, FTS, SAB, BCM, CTD were also net sold, but at a lower level.

10:30 AM: VN-Index plunges with dominant sellers

Selling pressure has increased more than at the start of the session, pushing the main indexes below the reference level. By 10:30 AM, VN-Index decreased by more than 10 points, trading around 1,258 points. HNX-Index decreased by 0.71 points, trading around 236 points.

Most stocks in the VN30 basket are facing strong selling pressure. Specifically, TCB, VPB, ACB, and MSN have taken away 1.88, 1.38, 1.35, and 1.31 points from the index respectively. On the contrary, VCB and BCM are the two rare stocks still maintaining a green color, but with insignificant increases.

Source: Vietstock Finance

|

The banking sector recorded a sharp decline in the market. In particular, BID decreased by 1.69%, CTG decreased by 1.96%, VPB decreased by 1.54%, and TCB decreased by 2.11%,…

Following that, the seafood processing sector also turned red with VHC down 1.57%, ASM down 1.76%, IDI down 0.79%, and FMC down 0.1%,…

Compared to the start of the session, the sellers have become more dominant. The number of declining stocks is 451 (15 stocks hit the floor) and the number of advancing stocks is 191 (19 stocks hit the ceiling).

Source: Vietstock Finance

|

Opening: Market fluctuates around the reference level

At the start of March 8, by 9:30 AM, VN-Index fluctuated around the reference level, around 1,270.16 points. HNX-Index had a slight increase, at 238.53 points.

The securities sector continued to lead the market with expectations of the KRX system coming into operation. Specifically, VND had the most impressive increase, up 2.34%, SHS up 1.07%, and VIX up 1.26%.

The real estate and industrial zone real estate sectors also showed good recovery with prominent stocks like BCM up 1.66%, KBC up 0.76%, and IJC up 3.67%,

Alongside these sectors, large-cap stocks are showing differentiation. In the upward direction, notable stocks include SSI up 0.65%, PNJ up 0.83%, and KDC up 5.04%. On the contrary, stocks that constrained the market’s upward trend like MSN down 0.62%, MWG down 0.31%, and HPG down 0.32%.

Lý Hỏa