Illustrative image

Oil drops 1% due to concerns about China’s economic growth plan

Oil prices fell nearly 1%, the second consecutive decline due to doubts about China’s economic growth and a weaker USD.

At the close of March 5, Brent crude oil fell $0.76 or 0.9% to $82.04 per barrel, while WTI crude oil fell $0.59 or 0.8% to $78.15 per barrel. Both types of oil have fallen more than $1 per barrel in this trading session.

China, the world’s largest oil consumer, has set a target of about 5% economic growth this year, which puts pressure on oil prices. While this target is similar to last year’s and in line with analysts’ forecasts, the lack of large stimulus plans to boost the country’s struggling economy has disappointed investors.

Providing some support to oil prices, the USD weakened due to a decline in growth in the service sector. This weaker currency makes oil cheaper for investors buying in other currencies.

In a Reuters poll, the latest inventory report for the US is expected to show crude oil inventories increased by about 2.1 million barrels last week, while gasoline and distillate inventories are expected to decrease.

Gold reaches record high

Gold prices rose to a record high, continuing to push above $2,100 per ounce in a rally driven by the expectation of the US cutting interest rates in June and the demand for safe havens due to Middle East conflicts.

Gold spot rose 0.8% to $2,132 per ounce, reaching a record high of $2,141.59 per ounce earlier in the session. Gold futures for April ended up 0.7% at $2,141.9 per ounce. The last time gold prices hit a record high was in December 2023 at $2,135.4 per ounce.

Gold is often used as a safe haven in times of political and financial instability, and has risen more than $300 per ounce since the start of the Israel – Hamas war.

The pre-house hearing of Fed Chair Jerome Powell on Wednesday and Thursday will be closely monitored for clues about the US interest rate hike trajectory. The next major US economic release is the February job report to be released on Friday.

Currently, investors see a 70% likelihood that the Fed will begin cutting interest rates in June.

Copper falls

Copper prices are under pressure amid uncertainty due to the lack of stimulus from China, the world’s largest consumer of the metal, while the market is awaiting data that could shed light on the US monetary policy.

Copper traded 0.6% lower at $8,490 per tonne on the London Metal Exchange.

China set a 5% economic growth target in 2024 as many had expected at the National People’s Congress meeting on March 5, which did not meet some investors’ expectations for stimulus measures.

China has not yet returned to the base metal market after the Lunar New Year holiday in February, but there is optimism about copper prices in the second half of 2024.

Copper prices in recent months have been driven by macroeconomic factors such as the US dollar and its response to US economic data as well as the implications of potential interest rate cuts by the Federal Reserve.

The weakened USD, as new orders for goods fell short of expectations in January, has made commodities priced in this currency cheaper for buyers in other currencies.

Iron ore fluctuates

Iron ore prices fluctuate as investors digest a number of key economic targets set by policymakers at the country’s annual parliamentary meeting in China.

Steel rebar for delivery in May in Shanghai fell 0.51%, hot rolled coil fell 0.41%, wire rod fell 0.8% and stainless steel fell 0.9%.

Japan rubber increases due to supply concerns

Japanese rubber prices rise due to supply concerns while the weak JPY also supports the market.

August rubber contract on the Osaka exchange closed up 1.1 JPY or 0.37% at 299.4 JPY (1.99 USD)/kg.

In Shanghai, rubber for delivery in May fell CNY 70 to 13,780 CNY (1,914.21 USD) per tonne.

Current rubber prices are expected to continue to rise in the coming months due to increasing concerns about supply. The shortage of rubber is currently attributed to the annual leaf-changing season of rubber trees as well as the large-scale transition of planted areas from rubber to other crops such as oil palm and durian, especially in Thailand and Indonesia.

Sugar increases

Raw sugar for May delivery closed higher by 1.2% at 20.87 US cents per pound, having fallen to its lowest level since late January at 20.55 US cents earlier in the session.

Sugar production in the key growing region of central-south Brazil is expected to decrease 4.5% to 40.8 million tonnes in the 2024/25 crop year, BP Bunge Bioenergia said at a Dubai sugar conference.

White sugar for May remained little changed at $594.3 per tonne.

Coffee decreases

Arabica coffee for May delivery closed 1.8% lower at $1.8335 per pound, after reaching a two-week high of $1.8960 in the previous session.

Robusta coffee for May delivery fell 0.4% to $3,180 per tonne, with the price also reaching its highest level since late January at $3,238 per tonne.

Soybeans and corn decrease

Soybean prices on the Chicago exchange closed lower due to pressures from supply in South America.

US export demand is slowing seasonally as Brazil, the world’s largest supplier of soybeans, is harvesting their seasonal crop. Argentina will harvest its next crop.

Soybeans for May delivery closed down 6 US cents at $11.49 per bushel.

Corn prices decrease due to downward pressure from price declines in Europe and fierce competition for global exports from Russia.

Soft red winter wheat for May delivery on the Chicago exchange closed 13 US cents lower at $5.51 per bushel after falling as low as $5.46-1/4 per bushel.

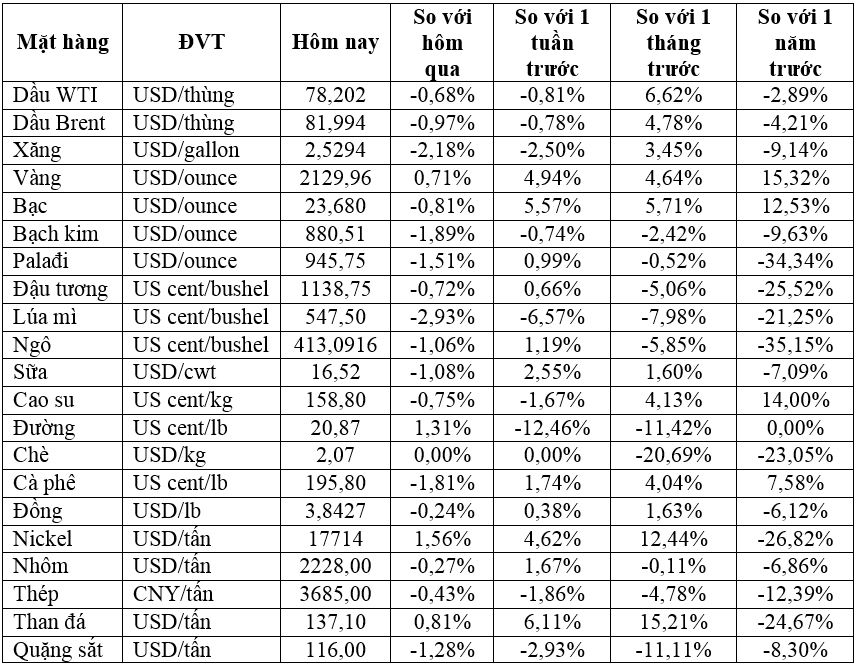

Prices of some key commodities on the morning of March 6