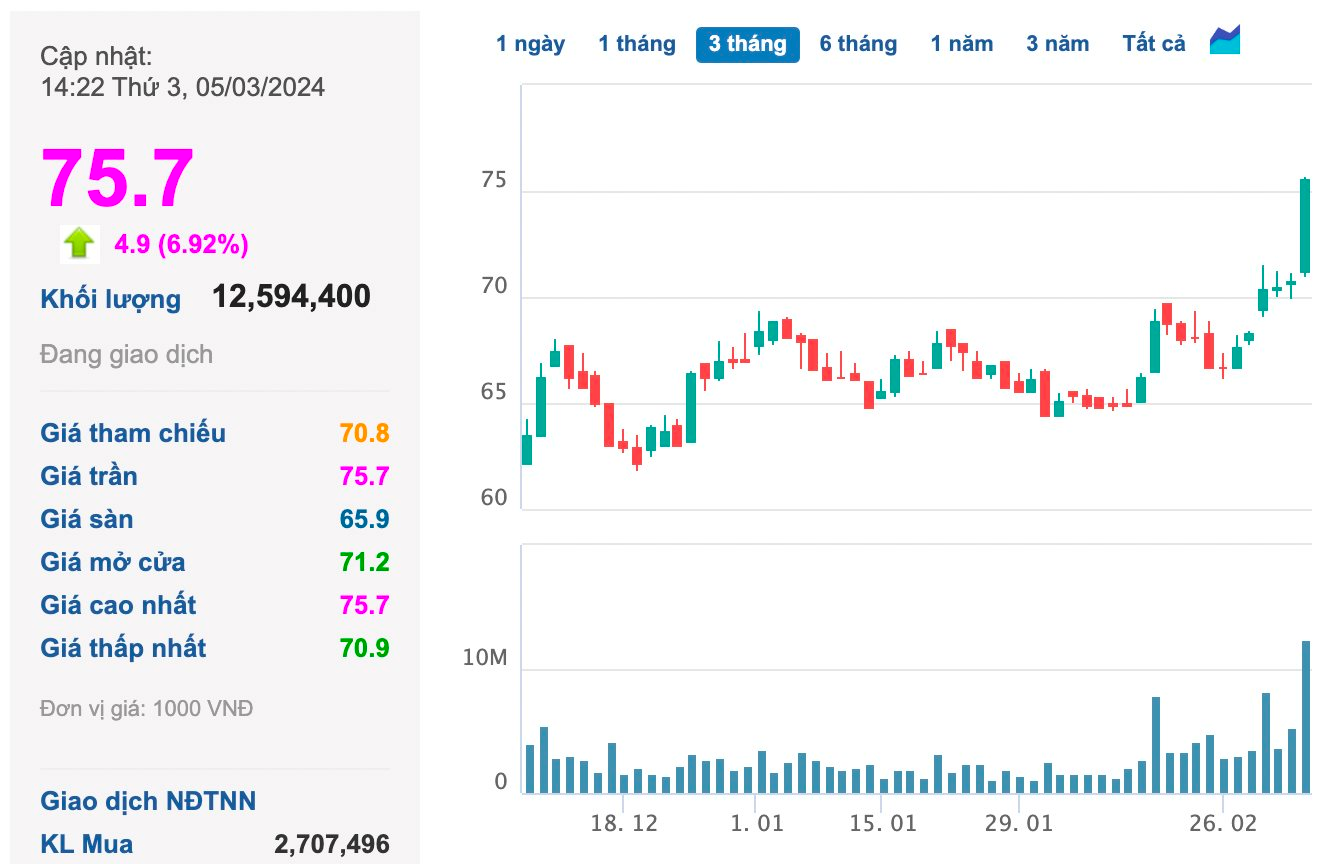

In the trading session on March 5th, Masan Group’s stock MSN unexpectedly “shined” as it soared to the ceiling price of 75,700 dong. The shares of billionaire Nguyen Dang Quang have only started their race from the end of February until now.

Expectations of the retail market’s growth in 2024 is also a common point of many analytical reports, after a year of negative growth due to the economic recession.

2023 was the year Masan recorded its lowest net profit in the past 10 years with 419 billion – a decrease of more than 88% compared to the same period. The growth of consumer business segments could not compensate for the sharp increase in financial costs in the environment of interest rates and exchange rate fluctuations, and the pessimistic business results of non-core areas and affiliated companies.

According to Bao Viet Securities (BVSC), a bright spot of Masan is that financial pressure will decrease significantly from 2024. By the end of the fourth quarter of 2023, MSN’s debt due within the next 12 months was 8,963 billion dong (a decrease of 62%) and accounted for 21.6% of the total long-term debt.

At the end of 2023, MSN also announced that it had completed full payment of its maturing debt obligations in 2023. In 2024, the total bond maturity calculated by analysts falls to 6,000 billion dong, with improved cash flow and a large amount of USD 250 million from the recent deal with Bain Capital, indicating that liquidity issues will no longer be a concern in the future for this company.

According to VietCap’s viewpoint in the latest analytical report, MSN owns many consumer business segments from food and beverage production to a nationwide retail network, each segment has a significant synergy with each other.

In the past 3 years, the company’s leadership has positioned MSN more clearly as a consumer company, increasing ownership rights and investment in business activities related to the consumer segment as well as divesting from non-core food and animal feed business.

Especially, the company is currently targeting to reduce its ownership ratio in another non-core business activity, Masan High-Tech Materials (MHT). VietCap considers this activity as a factor strongly supporting the enterprise value of MSN.

According to the update from the General Statistics Office (GSO), the total retail sales of goods and consumer services in January 2024 is estimated at 524.1 trillion dong, an increase of 1.6% compared to the previous month and an increase of 8.1% compared to the same period last year if excluding the factor of a 5.8% increase in prices.

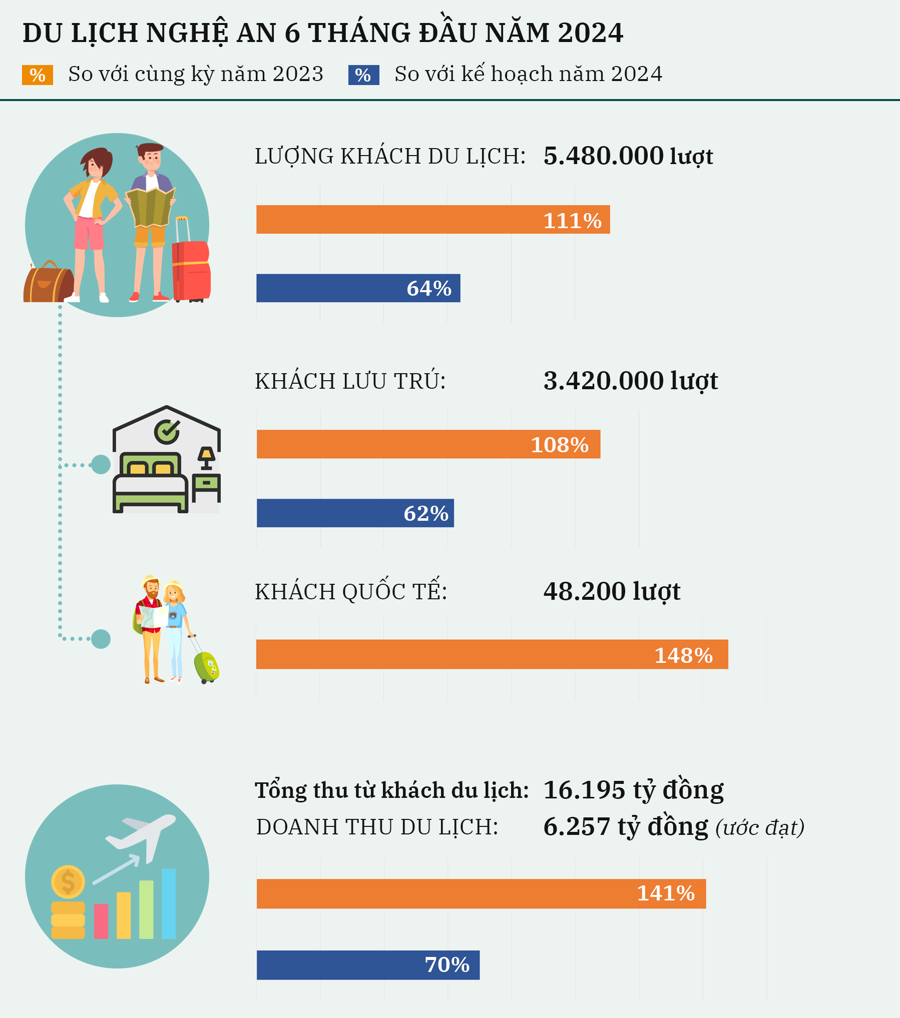

In addition, thanks to promotion policies and promotion of international tourism to Vietnam, in January 2024, the number of international tourists reached more than 1.5 million, an increase of 10.3% compared to the previous month and an increase of 73.6% compared to the same period last year.

Also on February 1st, the latest report of the Purchasing Managers’ Index™ (PMI®) by S&P Global was released with signs of growth returning at the beginning of 2024 for Vietnamese manufacturers, improving demand helping the number of new orders and production volume to increase again.

Furthermore, the enterprises themselves also focus on investing in a stimulus strategy, which is one of the growth drivers in the future.