Recently, Pomina Steel (POM) has attracted attention with news of a strategic investor pouring capital to restart the Pomina 3 blast furnace plant. The identity of the new investor has not been disclosed by POM as both parties are still in negotiations. According to Chairman Do Duy Thai, this is a group with a large ecosystem and operates closely with the steel industry.

This can be seen as a “savior” for POM in the context of the general economy and the steel industry in particular having just gone through a difficult year. POM is also not hiding its expectations for the new investor, as the company not only “divests” Pomina 1 and Pomina 3 plants but also voluntarily proposes to merge the remaining assets, which is the Pomina 2 plant, into the new Pomina Phu My project.

In Pomina Phu My, POM will contribute 35% of the capital with all the assets related to Pomina 1 and Pomina 3 plants, while the partner will “take the helm” by pouring 65% of the capital in cash.

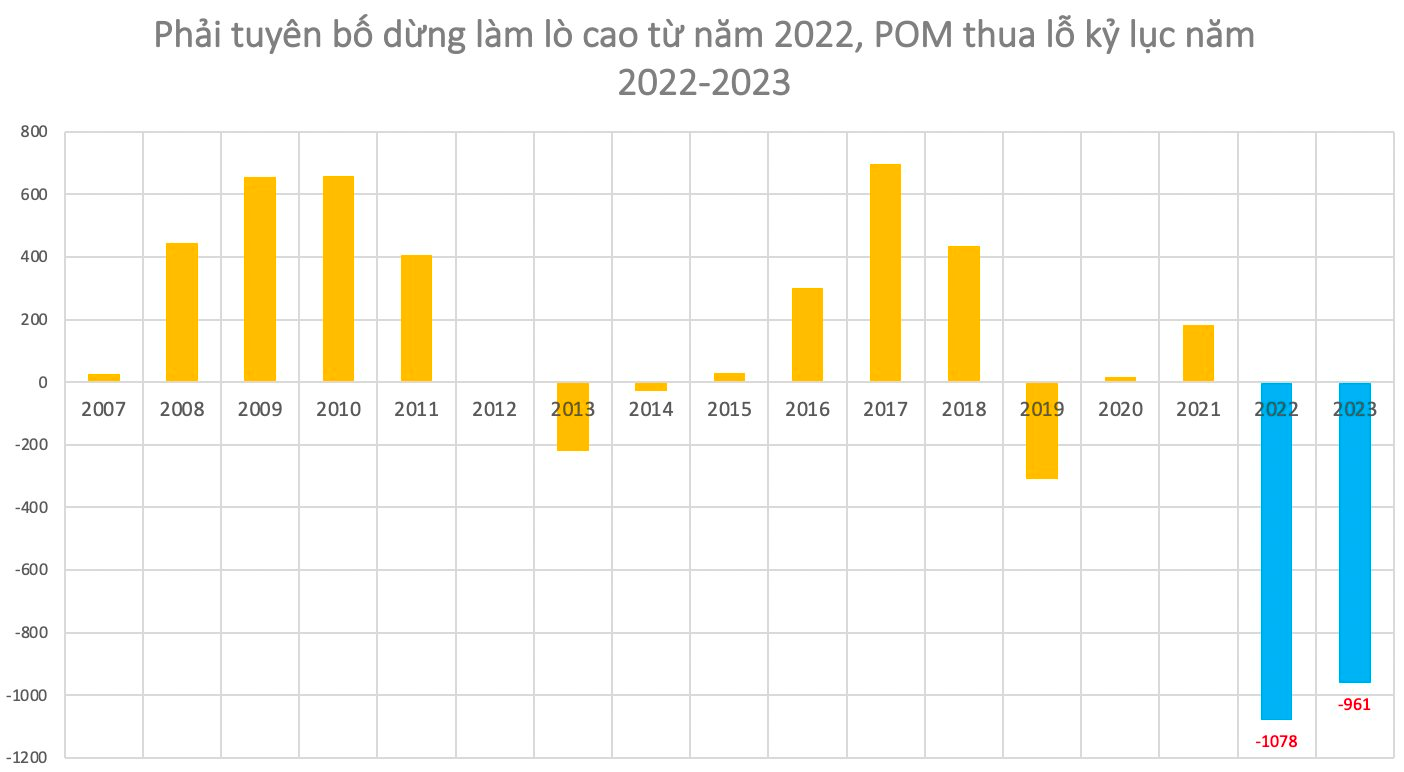

Record losses in 2022-2023

Being called a “savior” may not be an exaggeration, as POM not only resumes the Pomina 3 project “unfinished” due to financial burden but also collects 6,000 billion dongs to pay off debts to suppliers and banks.

In 2023, POM achieved a revenue of 3,280 billion – down 75% and suffered a loss after tax of 960 billion. This is the heaviest loss among steel companies in the past year.

As of December 31, 2023, POM has accumulated losses of nearly 1,271 billion dongs, equivalent to 45.4% of the equity. The company’s total assets reached 10,404 billion, while total liabilities exceeded 8,809.5 billion dongs.

Record losses – the high price of investing “right person, wrong time”

Regarding Pomina, it used to be the leading steel company in Vietnam, making substantial investments with the most advanced technology in the industry; at the same time, it was a unit that dared to compete with Chinese steel in 2009-2010 with its quality.

In 2009, POM put into operation the largest steel refining project in Vietnam at that time, with a capacity of 1 million tons/year, which is owned by Pomina Steel Joint Stock Company (POM) and built in Ba Ria – Vung Tau. It is noteworthy that POM made a major investment in a large project in the context of the global economic crisis and the beginning of severe difficulties in the Vietnamese economy. The company’s leadership was confident that with low raw material prices and its current position, POM could take advantage of growth opportunities as the market recovered.

At that time, Chairman Thai did not hesitate to express his view of competing with Chinese steel on the basis of quality, so he fiercely invested in factories with European technology, even though if investing in Chinese technology, the financial costs would be only 1/3. However, with European technology, Pomina was able to utilize emissions at temperatures of 300-400 degrees Celsius in the furnace to dry scrap before being melted. As a result, electricity consumption for the steel refining process was reduced by 30%, and production costs were reduced by more than 10 USD/ton. The process of producing steel from raw materials directly loaded from the refining factory helped to reduce 30% of the heat treatment costs in the process of producing finished steel.

However, when plant number 3 began operating in the fourth quarter of 2012, POM’s revenue dropped sharply from 12,000 billion dongs (in 2011) to 9,900 billion and a loss of 219 billion in 2013. In 2012, POM also only had a profit of 5 billion – a very small number compared to the profits of 500-600 billion in previous years.

Being born in difficult conditions, Pomina’s steel plant could not reach its maximum capacity, and even the system’s capacity in 2013 only reached 47.8% and POM had to bear high depreciation and loan costs when borrowing over 1,000 billion for the project. Pomina’s consolidated financial statements showed that the interest expense in 2012 and 2013 was 273 billion dongs and 234 billion dongs, respectively, significantly eroding gross profit, not to mention other costs.

According to the steel industry cycle and support from Vietnamese authorities, POM’s profit rebounded strongly in the three years of 2016 – 2018, reaching 302 billion, 700 billion, and 434 billion dongs, respectively.

However, Pomina 3 plant once again invested at the wrong time.

In 2019, POM implemented the blast furnace project and completed production in February 2021. In the 2021 annual report, the company stated that the Pomina 3 plant had transitioned from the EAF furnace (electric arc furnace) to the blast furnace, increasing net revenue by 42.6% and after-tax profit by 1.5 times compared to the previous year.

POM also declared itself as the only company in Vietnam to operate a combined steel refining system with a blast furnace and a Consteel electric furnace from Europe to produce refined steel from ore, clean impurities, high quality, and stable for construction of super projects.

However, with the decline in the steel market since the beginning of 2022, POM had to announce a halt in blast furnace production from September 23, 2022, and terminate labor contracts with some employees due to difficulties in business.

Until the end of 2013, POM still held the largest market share in the construction steel market, but now it has been “dropped” to others.

In summary, POM is a case of “investing in the right person, wrong time”, leading to the failure of a once shining name and the consequence of having to sell more than half of its assets today. In addition, many experts have also stated that another reason for the decline at POM is the family governance factor.