The CTCP Hanoi Noi Bai Airport Services Company (Nasco – NAS) recently announced its audited consolidated financial statements for the year 2023.

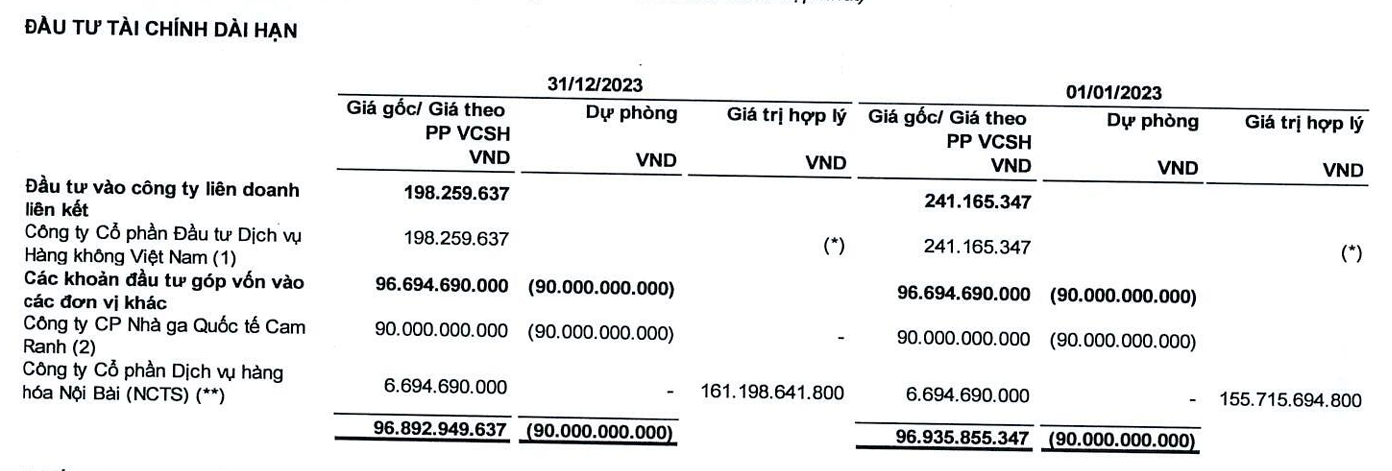

Notably, Nasco currently owns nearly 1.83 million shares of the Noi Bai Cargo Services Joint Stock Company (NCTS – NCT) with a capital investment of just over 7 billion VND. As of December 31, 2023, Nasco’s investment in NCT is valued at approximately 161 billion VND, 23 times its capital investment.

It is known that Nasco has held shares of NCTS for over a decade, initially purchasing 669,469 shares for nearly 7 billion VND.

NCT shares have been traded on the stock exchange since 2015. Maintaining a continuous upward trend in the past 4 years, the stock price of this company has nearly tripled from its price in March 2020, despite the heavy impact of the Covid-19 pandemic on the aviation industry and the market trend of the stock market.

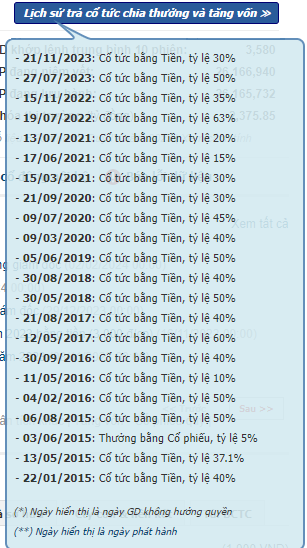

In addition to the profit from the increase in stock price, Nasco also receives a large amount of money from dividends of NCTS. NCTS is known for maintaining a stable cash dividend payout ratio over the years. “Like squeezing a picture”, NCT always allocates hundreds of billions of VND to pay dividends to shareholders each year, such as a 75% ratio in 2020, 83% ratio in 2021, 85% ratio in 2022, and an estimated 75% ratio in 2023 (already paid 30% in the first installment).

Since the last time NCTS distributed dividends in the form of shares, Nasco has received cash dividends at a ratio of about 700%, earning nearly 130 billion VND. On average, more than 14 billion VND per year.

Although it is a “golden egg-laying hen”, Nasco wants to sell 1 million shares of NCT to supplement the capital for its production, business, and investment activities. It is known that Nasco incurred losses in 2020 and 2021. In particular, a loss of nearly 92 billion VND in 2021 has resulted in accumulated losses of more than 71 billion VND.

The Nasco Board of Directors’ Resolution in late December 2021 approved the plan to auction NCT shares. Later, by the end of November 2022, the Board of Directors decided on a price of 87,130 VND/share. If successful, Nasco could receive about 87 billion VND.

On May 17, 2023, Nasco announced that it had received the certificate of registration for the public offering of NCT shares from the State Securities Commission and would auction 1 million NCT shares to the public. However, the auction session could not be held as the registration and deposit deadline had expired and no investors had registered to participate in buying shares.

In the audited financial statements for the year 2023, Nasco stated that the company would continue to sell 1 million NCT shares in 2024.

Regarding the business results of NCTS, during the Covid period until now, NCTS’ business activities have not been heavily affected and have maintained a revenue of about 700 billion VND and a post-tax profit of over 200 billion VND. In 2023, NCTS recorded net revenue of nearly 702 billion VND and post-tax profit of 216 billion VND, a decrease of nearly 5% and 9% respectively compared to the same period.