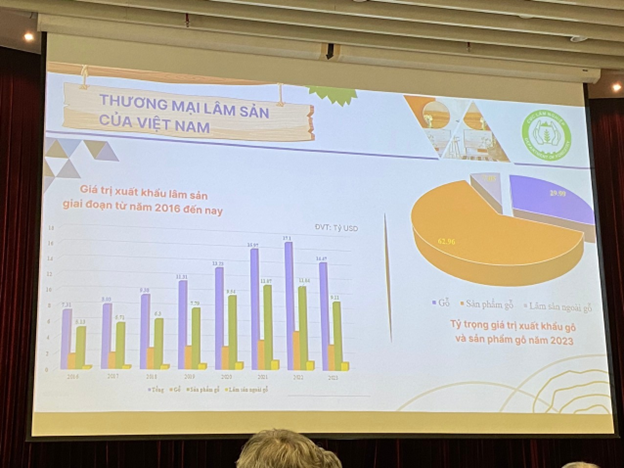

Looking back, Mr. Liem assessed that 2023 is a challenging period for the Vietnamese wood industry. The value of wood exports has decreased by more than 15% in 2023 after continuous growth since 2016. In Binh Duong, the wood export capital of Vietnam and accounting for 45% of the country’s total wood exports, wood exports decreased by 25% in 2023.

What caused the decline?

The sharp decline in 2023 is attributed to several factors. Firstly, consumers tightened their spending to combat inflation, and wood is not considered an essential product. In addition, competition in the market is increasing, with the risk of trade fraud and counterfeit products. A major challenge also comes from trading partners’ increasing demands for sustainable sourcing, green production, and emissions reduction.

Meanwhile, the Vietnamese wood industry relies heavily on foreign markets. In 2023, purchasing power from major markets such as the US (accounting for 53% of Vietnam’s wood exports), China, Japan, South Korea, and the EU all declined significantly. Vietnamese businesses also faced difficulties in claiming VAT refunds.

Positive signs from exports, but customers remain cautious

However, there have been positive signs returning in the early months of 2024, with strong export growth in the first two months. In January, wood exports reached $1.5 billion, while February saw about $1 billion.

“This is good news for wood exports. Stockpiles in other countries will decrease, and customer demand will gradually increase,” said Mr. Liem.

However, he noted that this year’s context is very different from previous periods. “In the past, wholesalers could buy a lot and sell slowly, but with high inflation and interest rates, they now don’t place large orders. They are cautious, ordering on a weekly, monthly, or quarterly basis,” he added.

While there have been positive signals from wood exports in 2024, Mr. Liem remains cautious due to the world’s volatile situation. He predicts that wood export turnover in 2024 may reach the same level as the previous year.

At the same event, Ms. Giovanna Castellina, Director of the International Furniture Research and Market Reports Division at CSIL, shared that the global market still faces many uncertainties, but Vietnam’s wood industry has the quality to overcome current challenges. She also forecasted that the Vietnamese wood industry will stabilize in 2024 and return to growth in 2025.

From left to right: Mr. Ngo Sy Hoai – Vice Chairman of VIFOREST, Mr. Nguyen Liem – Chairman of Lam Viet JSC, Ms. Giovanna Castellina – CSIL representative, and Mr. Zilahi Imre – Chairman of the International Alliance for Interior Furnishing Publications.

|

Wood businesses in Vietnam need to do what to overcome difficulties?

At the event, Mr. Nguyen Tan Hung, Head of the Processing and Timber Market Division under the Vietnam Forestry Administration, also pointed out the current situation of the Vietnamese wood industry.

He believes that Vietnam has many advantages with cheap labor, abundant raw materials, and numerous free trade agreements with many countries and regions, but there are still many challenges.

“Most businesses mainly process orders and designs from foreign distributors. Although wood exports have grown continuously since 2016, the added value is still low, relying on cheap labor and raw materials. Most small-scale businesses do not have the capacity to build their own brands. Product distribution channels often have to go through third parties. Moreover, small and medium-sized enterprises have limited resistance,” shared Mr. Hung.

According to Giovana, the export system of Vietnam’s furniture industry is unbalanced as it mainly focuses on a few trading partners such as the US. “It will be very risky when one market has too much dominance. If the partner weakens, the entire industry will be affected,” she stated.

She believes that Vietnam needs to diversify its customer base to minimize risks and increase the sustainability of the industry. Additionally, businesses also need to improve their designs to attract more customers worldwide.

Meanwhile, Mr. Liem suggests that Vietnamese wood businesses need to further enhance their quality. He pointed out that in Binh Duong, the wood export capital of Vietnam (accounting for 45% of the country’s wood exports), wood exports decreased by 25% in 2023, with Vietnamese businesses experiencing a 40% or more decline, compared to FDI businesses which only decreased by 20%.

“This is because FDI businesses have supply chains abroad and they produce wood products for the middle-income segment and above, a group that is less affected compared to the low-income group,” he explained. “In the context of economic downturn and inflation, low-income consumers will reduce spending the most. The evidence is that the amount of exports for Home Depot or cheap buyers decreased rapidly, but high-end goods decreased less. Therefore, we need to improve the quality even more,” he concluded.