Exactly 6 years ago today, on March 6, 2018, the POW shares of PetroVietnam Power Corporation (PV Power) officially debuted on the impressive UPCoM exchange, soaring nearly 20% in the first trading session with explosive transactions. At that time, the shares matched 15 million units, equivalent to a trading value of 265 billion VND, the largest on the UPCoM exchange.

According to the Hanoi Stock Exchange (HNX), at the time of listing, POW was the 10th stock of state-owned enterprises on the UPCoM exchange. PV Power was also the company with the shortest time from its initial public offering (IPO) registration to listing.

Prior to the 2018 IPO, PV Power attracted nearly 2,000 investors. Over 468 million shares (20% of charter capital) were sold at an average price of 14,938 VND per share, bringing in nearly 6,997 billion VND. The dazzling listing session seemed to mark the beginning of a smooth journey for POW shares on the stock market, but in reality, it was contrary to expectations.

The stock plummeted and quickly lost nearly 40% of its market value just four months after listing. The subsequent transfer to the Ho Chi Minh Stock Exchange (HoSE) did not push POW to new highs, and the effect of the listing at the beginning of 2019 did not last long. The stock hit a historic low in late March 2020, with PV Power’s market capitalization less than half of its listing value.

From there, POW began a resilient climb despite a relatively bumpy road. The stock officially secured loyal shareholders from its “wet feet, dry feet” period to its listing year-end in 2021. POW then reached a new peak in early 2022, with PV Power’s market capitalization reaching a record 47,000 billion VND (~2 billion USD). However, at the present time, this figure is only about half. Compared to the listing six years ago, PV Power’s market capitalization has decreased by more than 20%.

Unfinished state divestment stage

PV Power was established in 2007 with a charter capital of 23,420 billion VND, 100% owned by the Vietnam National Oil and Gas Group (PVN). According to the 2017 equitization plan, PV Power will sell 676.38 million shares (28.82%) to strategic investors, while PVN will remain the largest shareholder holding 51% of charter capital until the end of 2025, after which it may reduce its stake depending on the restructuring of credit related to the Vung Ang 1 Thermal Power Plant.

At the extraordinary shareholders’ meeting in November 2018, PV Power representatives revealed that the company had contacted over 100 major partners and selected a shortlist of 30 units, including financial investment organizations and leading energy conglomerates in Asia. However, due to the short time frame, the process of “marrying off the beautiful girl” has not been completed, as the deadline is too tight (according to Article 38, Decree 126/2017/ND-CP, the deadline is 4 months from the date of approval of the equitization plan).

PV Power has not completed the sale of shares to strategic shareholders, so it will not select strategic shareholders according to the previously approved plan. Instead, all the 28.82% of shares that have not been sold will “enter the capital of PVN held by PV Power,” increasing PVN’s ownership ratio to 79.94% as it is today.

PV Power representatives also stated that the company can sell shares on the stock exchange (according to Decree 32/2018/ND-CP) through two methods: public auction or block auction (similar to the cases of Vinamilk, Sabeco, etc.). The listing on HoSE at the beginning of 2019 was expected to support PV Power in this process. However, after more than 4 years of listing, the state divestment journey at PV Power is still unfinished.

Leading position in the power sector on the stock market

The unclear state divestment story has caused the POW shares to lack truly long-term waves. However, it cannot be denied that PV Power is still the leading electricity company on the stock market in terms of charter capital and market capitalization. The POW shares are also the only electricity stock in the VN30 basket.

In terms of electricity supply capacity, PV Power is currently ranked 2nd among the largest power producers in Vietnam (second only to EVN). The company owns and operates 6 power plants with a total capacity of 4,205 MW, including 3 gas-fired power plants (2,700 MW), 1 coal-fired power plant (1,200 MW), and 2 hydroelectric power plants with a capacity of 305 MW.

In the 2022-2025 period, PV Power will continue to invest in 2 gas-fired power plants, NT3 & NT4, with a total capacity of 1,500 MW. The project has selected an EPC contractor and is in the investment phase. NT3 plant is expected to become commercially operational by the end of 2024, and NT4 plant by the end of 2025. In addition, PV Power will also invest in about 50 MW of renewable energy.

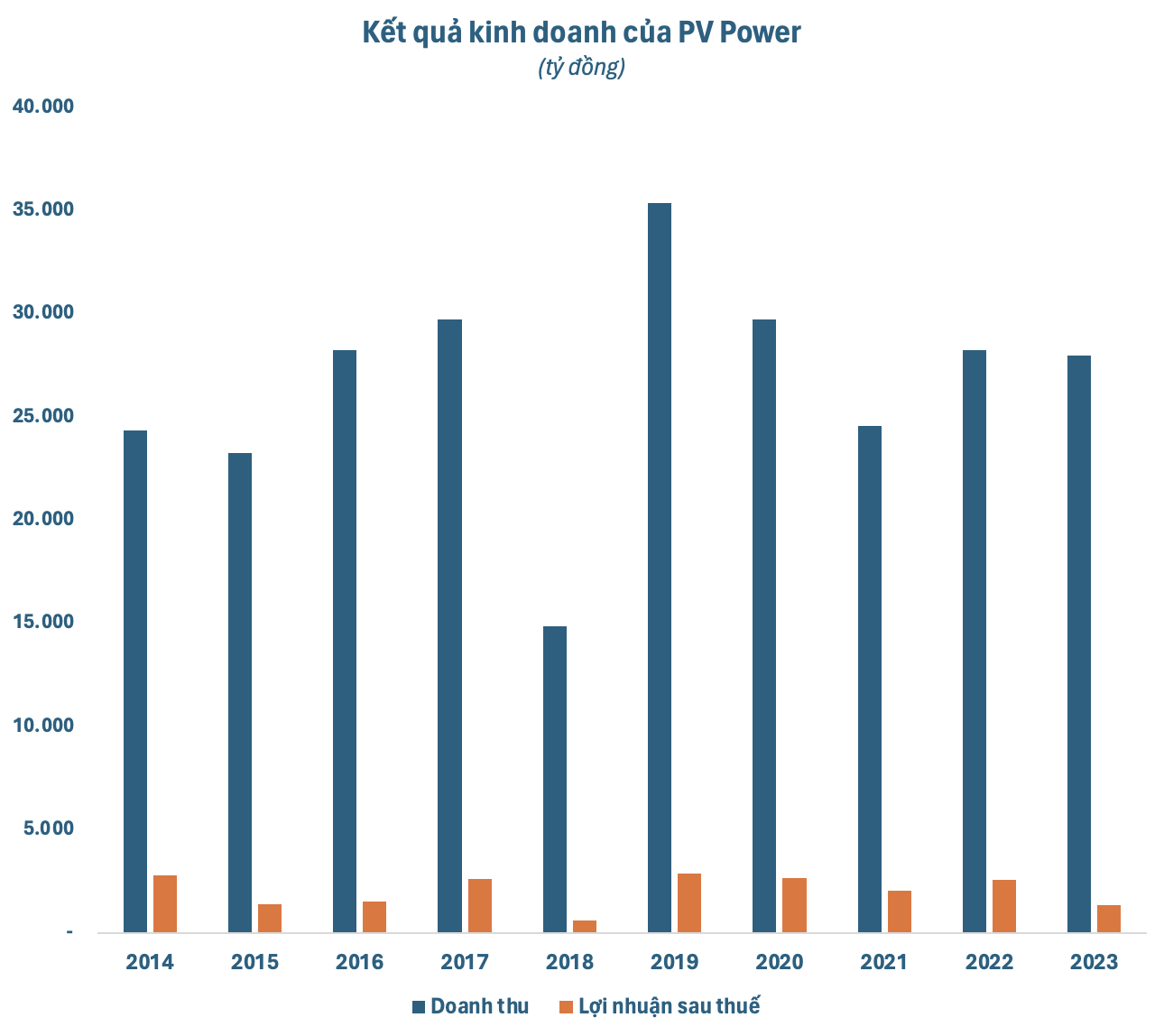

Despite its immense scale, PV Power’s business results in recent years have not shown much breakthrough and have not truly met expectations. In 2023, the company recorded a slight decrease in revenue to below 28,000 billion VND, and after-tax profit even “vanished” by 48% to only 1,329 billion VND, the lowest in 5 years.

However, the situation is expected to be more optimistic in 2024. According to BSC, PV Power’s gross profit margin will improve, and extraordinary costs will decrease thanks to the completed renovations of Vung Ang 1, Ca Mau 2, and Nhon Trach 2 power plants in 2023. In addition, the electricity output of Vung Ang 1 is projected to increase by 49% compared to the previous year due to the declining coal prices.

On the other hand, the construction progress of projects NT3 and NT4 (long-term growth driver for PV Power), according to BSC’s assessment, is currently lagging behind the plan. As of the end of January 2024, the overall progress of the EPC package is estimated at 65.6% (9.5% behind schedule). According to the plan, NT3 will receive gas for testing on April 1, 2024. However, with the current situation, the project may experience a delay of 3-6 months.

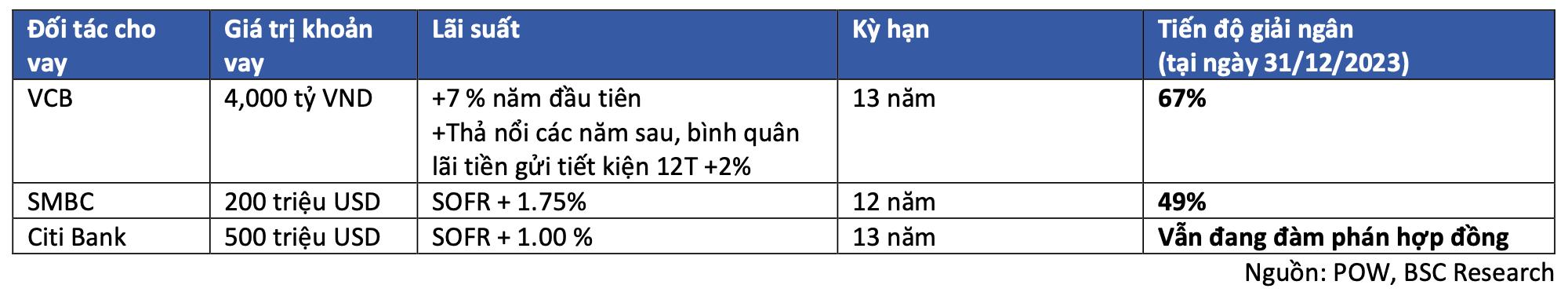

Regarding capital arrangement for the project, the disbursed loans, PV Power is still working with Citi Bank for a loan of 500 million USD. The exchange rate loss costs will not be capitalized into the project but will be recorded in the business results. However, the PPA contract is still pending. The parties are still negotiating other terms, with LNG price being the most difficult issue.