After a period of bottom fishing, the SAB stock of Saigon Beer – Alcohol – Beverage Corporation (Sabeco) unexpectedly reversed and made a strong recovery from the end of February. This stock even went against the market on March 6th, increasing by 4% with record-high liquidity. After 6 sessions, the value of SAB increased nearly 9%, equivalent to an additional market capitalization of more than VND 64,000 billion.

The strong recovery of SAB shares somewhat alleviated the sadness for Sabeco shareholders after a long period of watching their accounts “evaporate”. Of course, Thaibev is no exception as the Thai tycoon currently holds over 687 million SAB shares (dominant ratio of 53.59%). It is estimated that the investment value in Sabeco of Thaibev increased by about VND 3,400 billion in just over a week.

However, this figure is still not absorbed compared to what the Thai tycoon has “lost”. Since splashing out VND 110,000 billion (~ $5 billion) to hold the controlling stake in the famous capital divestment deal at the end of 2017, this investment in Sabeco by Thaibev has been regularly “in the red”, and the value is now only about VND 42,000 billion (~ $1.7 billion). Including cash dividends of over VND 9,000 billion, Thaibev is still heavily in debt after more than 5 years of investing in Sabeco.

Sharp decline in beer consumption demand

Actually, the “in the red” situation is not a big issue because Thaibev has affirmed that the purpose of investing in Sabeco is to target long-term vision and the ambition to dominate the Vietnamese beer market, thereby laying a technological foundation to target the Southeast Asian market. The thing that really makes the Thai tycoon “headache” is the change in consumer habits that is causing a sharp decline in beer consumption demand.

The move to tighten the penalties for violating regulations on alcohol concentration when participating in traffic over the past time is significantly affecting the beer and alcohol culture. Not only in Vietnam, the reduction in beer and alcohol consumption is also a common trend worldwide. According to Forbes, the increasing idea of restricting beer and alcohol among young people has led to a significant decrease in alcohol consumption demand.

Many forecasts show that the non-alcoholic beverage product portfolio will increase by 25% in the period 2022-2026 when beer and alcohol companies have to shift their business. According to Forbes, Generation Z now drinks 20% less alcohol than Millennials and the increasing number of consumers paying attention to health has led to a sharp decrease in alcohol consumption demand.

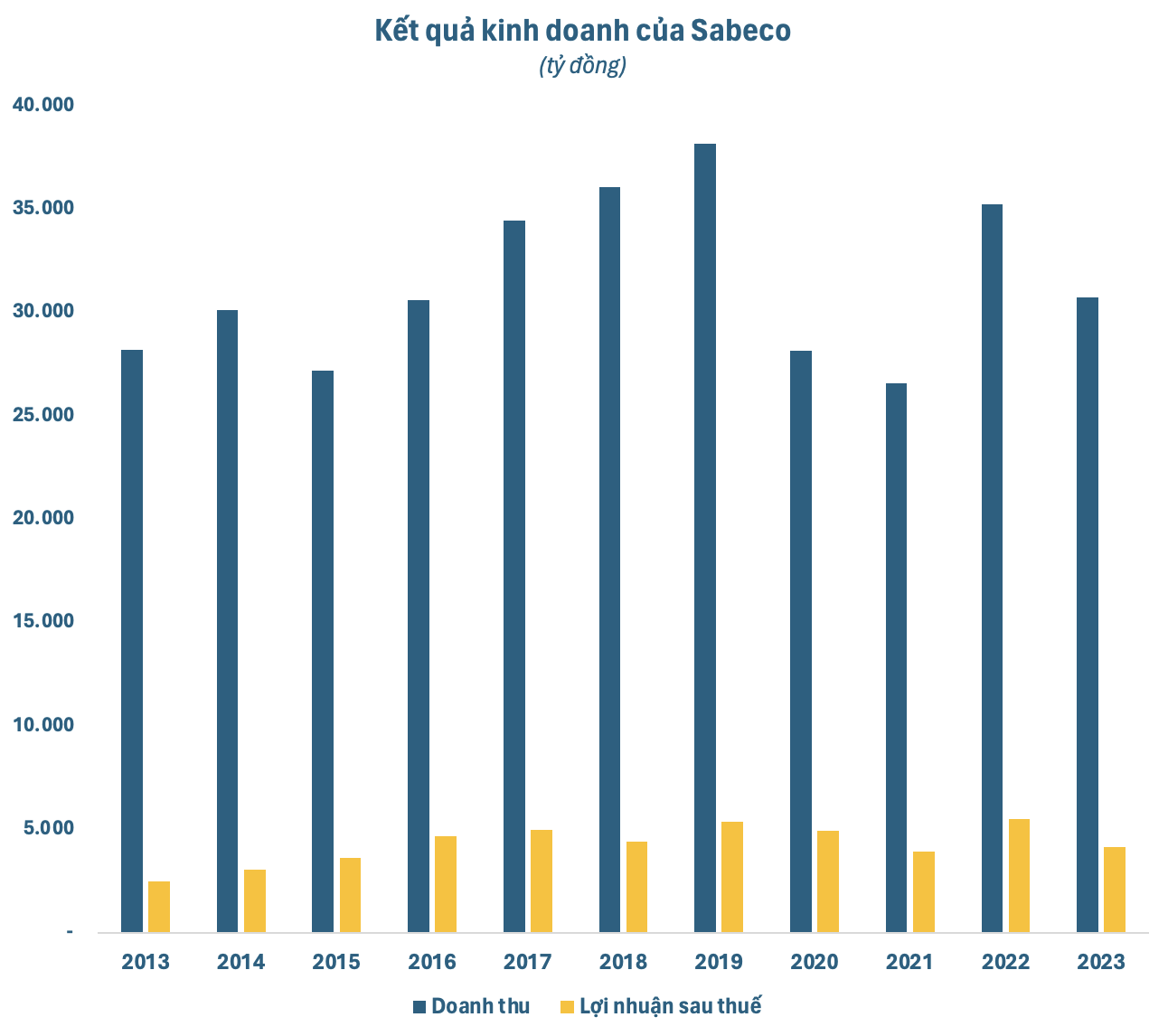

The decreased demand directly affects the sales of beer companies, and Sabeco is no exception. In 2023, Sabeco’s revenue reached over VND 30,700 billion, a decrease of nearly 13% compared to the previous year. This number is only higher than the Covid period (2020-2021), calculated from when Thaibev took over at the end of 2017.

Earnings also declined in line with sales. In 2023, Sabeco’s net profit was over VND 4,100 billion, a decrease of 25% compared to the previous year. According to the explanation, apart from tightening Decree 100, the company is also affected by fierce competition, reduced consumer demand due to the domestic economic recession. Input costs and management costs have also increased, while the profit share in joint ventures and associates is lower.

Adapting to changing user habits

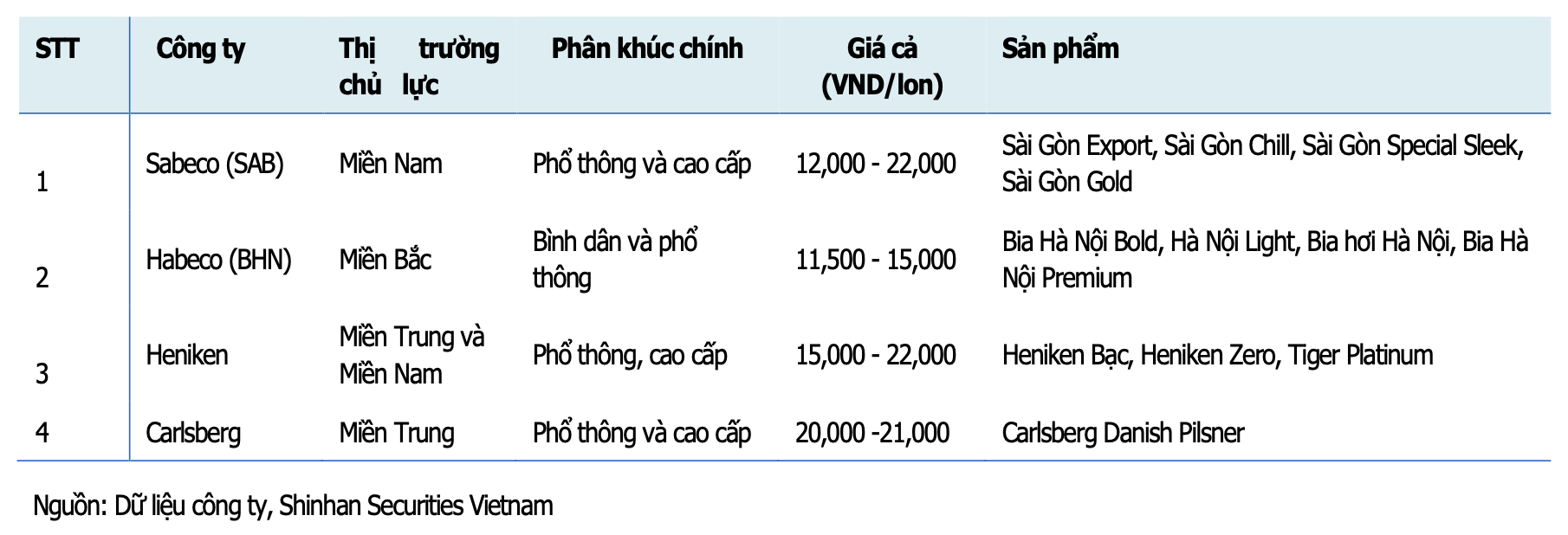

As one of the two leading beer production companies in Vietnam, Sabeco’s market share began to narrow from 2019 before the “expansion” of Heineken when continuously launching new product lines such as Heineken Silver, 0% alcohol Heineken. However, Sabeco still has the advantage of Vietnamese brand such as 333 Beer, Saigon Chill Beer. In addition, research and development and the launch of premium product lines also contribute to helping the company maintain its position and market share.

A ShinhanSec report indicated that with the increase in income, consumers tend to shift from the popular segment to the standard segment and from the standard segment to the premium segment. According to Euromonitor, premium beer is forecasted to grow by 12.7% in the 2021-2026 period, higher than the average industry growth of 4%.

ShinhanSec expects that beer consumption will improve in 2024 thanks to the return of major football tournaments (the Asian Cup, Euro 2024, Copa America) and the adaptation and transformation of habits from on-trade to off-trade when Decree 100/2019/ND-CP on alcohol concentration violations is more strictly enforced.

According to ShinhanSec’s forecast, Sabeco’s net revenue in 2024 will increase slightly by 6.3% compared to the previous year because the transformation of consumption habits from on-trade to off-trade may take more time. However, the gross profit margin is expected to improve to 34.6% from 33.4% thanks to the reduction in raw material prices.