Currently, SCIC holds over 491.4 million shares of MBB, accounting for a 9.42% ownership stake in the Bank. After completing the transaction, SCIC will increase its ownership to over 521 million shares, equivalent to 9.86% of MBB’s charter capital.

SCIC said the transaction is expected to be carried out from March 8th to April 6th.

In late January this year, MBB’s Board of Directors approved a plan to privately sell 73 million shares to two investors, Viettel Group and SCIC.

| MBB stock price performance from the beginning of 2023 to the session on March 6th, 2024. |

The expected selling price is 15,959 dong per share, nearly 35% lower than MBB’s closing price on March 6th, which was 24,400 dong per share.

Specifically, Viettel has the right to purchase 43 million MBB shares and SCIC has the right to purchase 30 million MBB shares. The transfer restriction period is 5 years from the completion of the private sale.

The proceeds of the 73 trillion dong sale will be added to MBB’s investment capital and business capital in a safe, effective and beneficial manner for shareholders. The private sale plan will be implemented from the first quarter of 2024, with registration and reporting procedures to be carried out from January 2024.

After exercising their purchase rights, Viettel will increase its holdings from 965 million shares to 1.01 billion shares, equivalent to an increase in ownership stake from 18.514% to 19.072%, remaining the largest shareholder of MBB.

Meanwhile, SCIC will hold 521 million shares, increasing its ownership stake from 9.425% to 9.862% and becoming the second largest shareholder of MBB.

The private sale for domestic investors does not affect the maximum foreign ownership stake of the Bank, which remains at 23.2351% of charter capital.

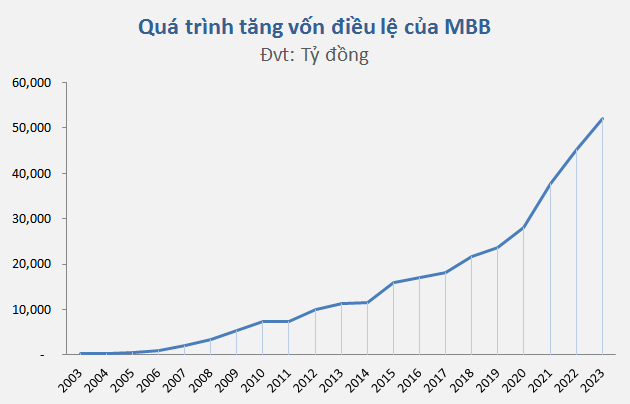

After completing the private sale, MBB’s charter capital will increase by 730 billion dong, from 52.141 trillion dong to 52.871 trillion dong, ranking 5th in the industry, only after VPBank, BIDV, Vietcombank and VietinBank but higher than Agribank.

According to the previously approved plan at the 2023 General Shareholders’ Meeting, MBB plans to increase its charter capital from 45.34 trillion dong to 53.683 trillion dong by issuing 680 million shares as dividend payment, equivalent to a 15% ratio; issuing ESOP shares and privately placing a total of 135 million shares (divided into two batches of 65 million shares and 70 million shares), for two investors, Viettel and SCIC.

Source: VietstockFinance

|

In 2023, MBB completed its plan to increase its charter capital through the issuance of shares to pay dividends, from 45.34 trillion to 52.141 trillion dong.

Khang Di