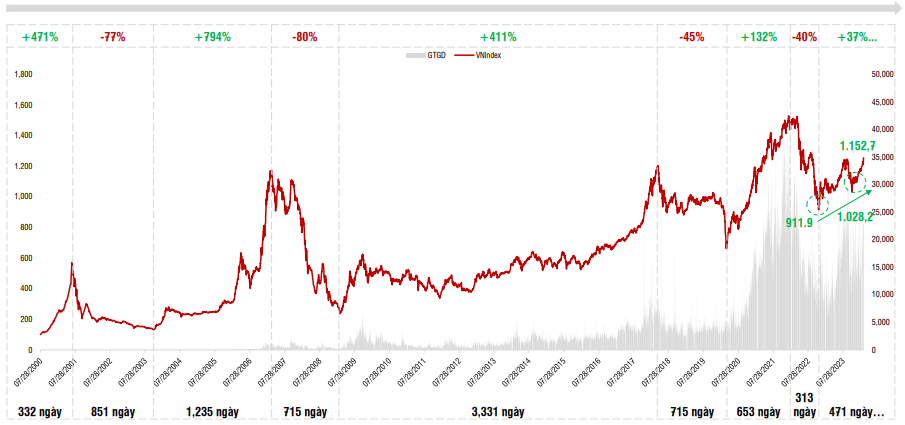

First, when considering past data, the analytical team noted that the long-term recovery of VN-Index from the November 2022 bottom is not the strongest after previous deep correction cycles.

|

The market in the long-term recovery cycle from November 2022

Source: SSI Research

|

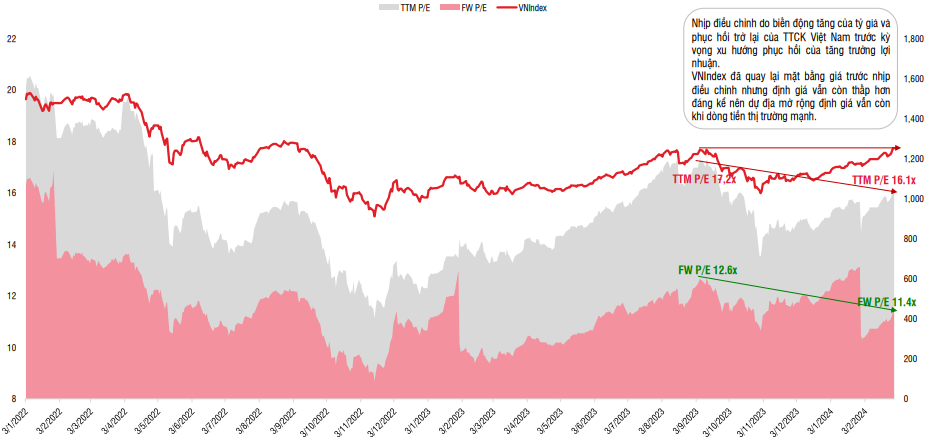

Secondly, VN-Index has returned to the pre-correction level in October 2023, but the price based on the trailing twelve months P/E ratio and the price based on estimated earnings for the next year are still considerably lower than the short-term peak set on September 8, 2023. Therefore, there is still room for valuation expansion in the context of a strong market cash flow.

|

There is still room for valuation expansion

Source: SSI Research

|

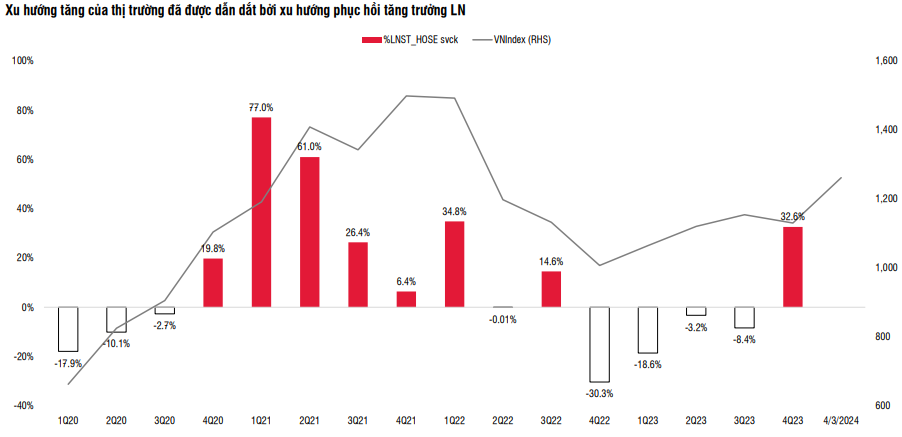

Thirdly, analysts also observed that the trading sentiment in the market has been positive in the past 2 months, with the scores returning to pre-adjustment levels along with increasing liquidity and spreading to more sectors. However, this is a “crowd psychology” signal that needs to be cautious as it leads to pushing up margin trading and creating hidden stock supply.

Source: SSI Research

|

Based on these analyses, SSI Research believes that the potential for a deep correction in the market is relatively low and the market still has the potential to rise.

In addition, with the signs of recovery in the growth drivers of the economy in the first 2 months of the year (production, trade, investment), low interest rates, continued profit recovery in the first quarter of 2024, and the more specific changes in the operation of the KRX trading system, these are the factors that support the analyst team’s evaluation that the market may only undergo short and early correction phases but the upward trend will slow down and there will be more frequent volatile risks.

The recommended strategy by the analysis team is to “sell high-buy low” for short-term trades and focus more on profit preservation.

The potential risks that could lead to a more severe market correction than expected are the increasing exchange rate volatility and interventions by the SBV, the possibility of an increase in deposit interest rates, high margin trading debts, and escalating political tensions.

Two scenarios for March

Based on technical signals, SSI Research believes that the market may follow 2 scenarios in March.

In the positive scenario, if there is a short-term correction, VN-Index will be supported at the range of 1,220-1,225 points and gradually recover towards 1,280 points. If this level is surpassed, the next target is expected to be 1,300 points.

In the cautious scenario, in the case of unfavorable information leading to a strong supply, the next support level at 1,200 points will help VN-Index gradually recover and aim for the medium-term target of 1,280 points.

In terms of risk management, if VN-Index loses the support level of 1,160 points, investors need to adjust their portfolios to a safe state and wait for the market to rebalance.