Approximately 50% of the trading volume on the HoSE exchange today focused on the midcap group, while the VN30 accounted for just over 37%. Out of the 62 stocks with liquidity over 100 billion VND on the entire exchange, 33 are midcap stocks. The VNMidcap index ended the session up 1.06%, while the VN30 increased by 0.43% and the VN-Index rose by 0.45%.

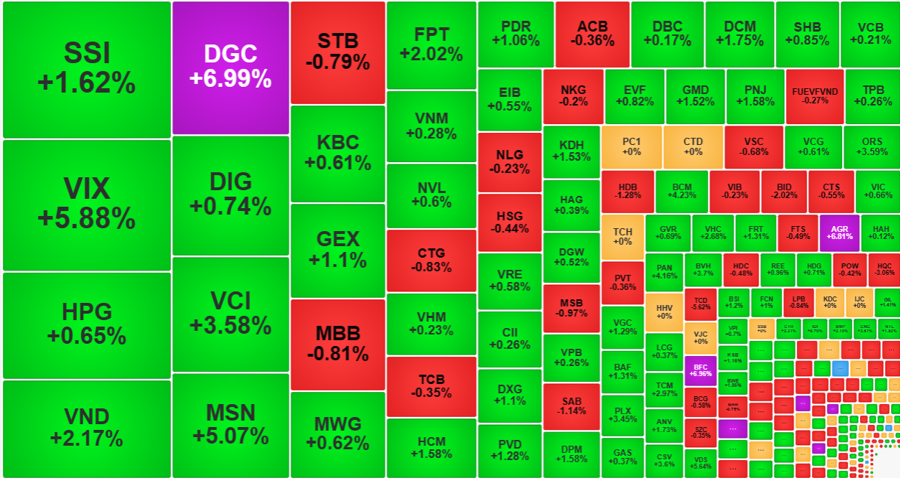

Despite good price performance and abundant liquidity, midcap stocks still haven’t made much headway into the leading group. Among the top 10 stocks driving the VN-Index today, only DGC from the midcap group contributed, with a surge of 6.99%.

MSN continues to be the strongest pillar of the index, similar to the trading session on March 5. MSN increased by 5.07% today with a liquidity of 683.9 billion VND and 8.72 million shares, which is significantly lower than in previous sessions. However, looking at it positively, today is the T+2 session following the record-breaking day of 13 million shares and 959.2 billion VND in liquidity arriving to accounts. MSN has managed to overcome selling pressure quite well, despite profit margins exceeding 14%.

The VN30-Index closed the session up 0.43%, with 18 gainers and 10 losers. The blue-chips in this basket were relatively stagnant, with only 6 significant gainers: MSN up 5.07%, BCM up 4.23%, BVH up 3.7%, PLX up 3.45%, FPT up 2.02%, and SSI up 1.62%. It can be seen right in the VN30 basket that the midcap stocks also stand out: MSN, the largest in this group, is only ranked 14th in terms of market capitalization on the HoSE exchange, while BCM is ranked 18th.

The leading pillar group of the VN-Index also saw many green stocks, but the gains were too modest: VCB up 0.21%, VHM up 0.23%, GAS up 0.37%, HPG up 0.65%, VIC up 0.66%, VPB up 0.26%, and VNM up 0.28%. This is why the index couldn’t surge, despite the lively and strong trading conditions in the afternoon. Additionally, another reason is that the 2nd largest pillar of the market, BID, decreased sharply by 2.02%, and the 3rd largest pillar, CTG, declined by 0.83%.

Although the leading indexes are sluggish, the stocks still show strong inflows. The afternoon session naturally saw higher liquidity than the morning session since orders were processed smoothly: the total matching value of the two exchanges reached 13.12 trillion VND, close to the morning’s trading session. The HoSE exchange reached 11.785 trillion VND.

The capital flow tends to choose stocks with medium market capitalization. Among the top 10 highest-traded stocks today, 4 are in the VN30 group, and the rest belong to the midcap group. Securities stocks continue to attract impressive capital inflows, with SSI and VIX recording over a trillion VND in trading volume: SSI traded 1,280.1 billion VND, up 1.62%, and VIX traded 1,226.6 billion VND, up 5.88%. VND and VCI, both securities group stocks, were also among the top 10 most traded stocks, reaching 916.3 billion VND and 751.2 billion VND, respectively. In general, securities stocks had a much stronger price performance in the afternoon session, with 2 stocks, APS and TVS, hitting the ceiling price after strong gains, along with 12 other stocks rising by over 5%.

The midcap group showed outstanding growth in this session, with the representative index increasing by 1.06% and a breadth of 43 gainers and 19 losers. The overall market today showed a tug of war, with 253 gainers and 219 losers. The midcap group includes many securities stocks such as VIX, VND, VCI, HCM, as well as many hot stocks in other industries. DGC, GEX, PDR, DCM, DXG, PVD, GMD, PNJ… are strong gainers with high liquidity.

In general, the liquidity of both exchanges increased slightly by 4% compared to the previous day, reaching 26.315 trillion VND. However, since the orders processed yesterday were not smooth, the liquidity in this session actually decreased. Nevertheless, from the Lunar New Year to now, the trading volume has been extremely impressive, with an average of 24.164 trillion VND/day in the past 14 sessions.