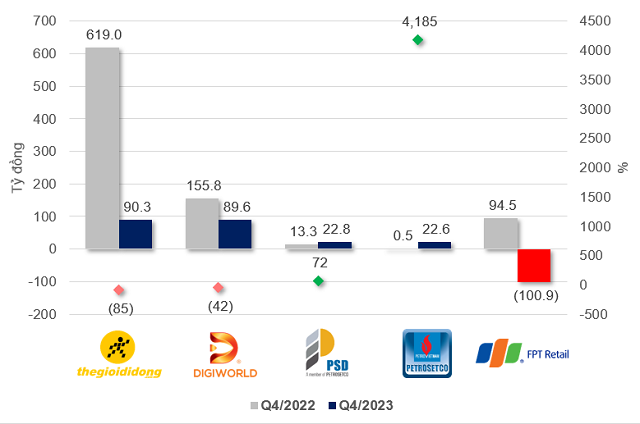

According to data from VietstockFinance, 5 companies on the stock exchange, associated with the telephone and electronics products, all experienced a decrease in profit in 2023, especially with MWG and FRT having the lowest profits since listing, FRT even incurred losses. The remaining 3 names also had low profits.

For the fourth quarter of 2023, the group of companies with parent-subsidiary relationships such as PET and PSD went against the trend, with an increase in net income, but not from core operations.

|

Net income of phone and electronics businesses in the fourth quarter of 2023

Source: VietstockFinance

|

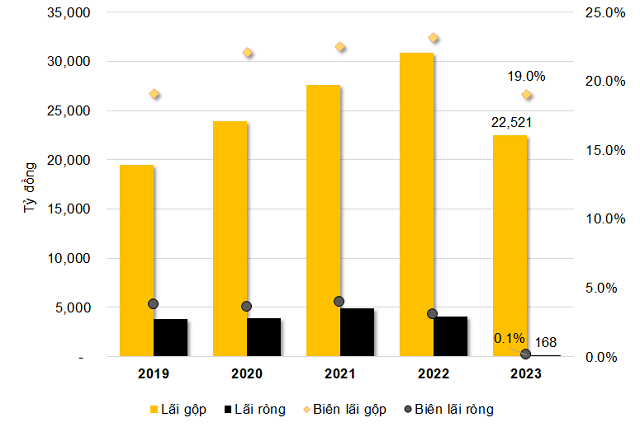

“Big players” in retail and their sad records

The Gioi Di Dong (HOSE: MWG) ended 2023 with more than 118 trillion dong in revenue. The main contributions were still the revenue from The Gioi Di Dong (Mobile World) chain including Topzone, and Dien May Xanh (Dien May Xanh), with more than 28 trillion dong and 55 trillion dong respectively, decreased by 18% and 20%. According to MWG, most industries have declined, except for air conditioners.

After a difficult period, the event of this retail giant closing nearly 200 ineffective The Gioi Di Dong (Mobile World) and Dien May Xanh (Dien May Xanh) stores in the fourth quarter seemed inevitable.

Bach Hoa Xanh (BHX) saw its revenue increase by 17%, reaching nearly 32 trillion dong. In addition, financial activities brought in a profit of nearly 611 billion dong, instead of a loss of nearly 70 billion dong in the same period.

With countless difficulties, MWG ended 2023 with a net profit of nearly 168 billion dong, down 96%. Since its listing in 2014, this is the lowest net profit of MWG.

|

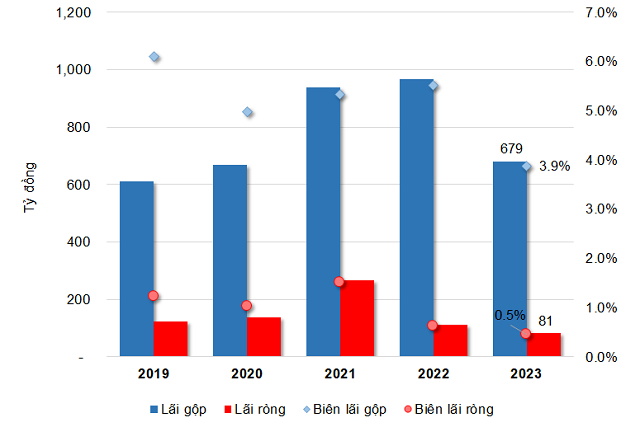

Business results of MWG in recent years

Source: VietstockFinance

|

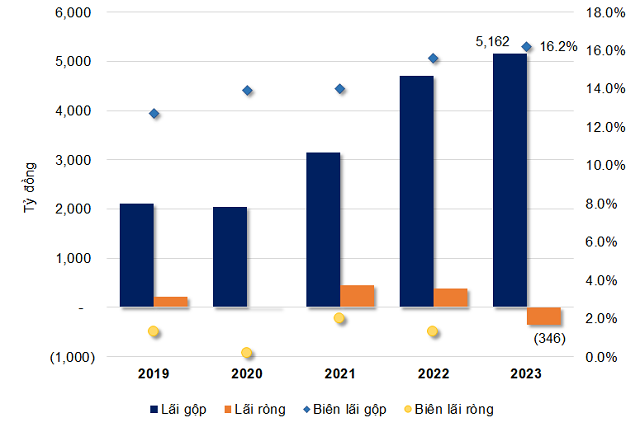

FPT Retail (HOSE: FRT) recorded losses in all four quarters of 2023, despite achieving new milestones in revenue.

In 2023, FPT Retail brought in nearly 32 trillion dong in revenue, a 6% increase, with the main driving force coming from the Long Chau chain, which increased by 66%, accounting for 50% of the revenue structure, while FPT Shop declined by 22%, with 31 fewer stores, some of which were converted to Long Chau chain.

After deducting expenses, FRT incurred a net loss of 346 billion dong, marking the first year of losses since its listing.

|

Business results of FRT in recent years

Source: VietstockFinance

|

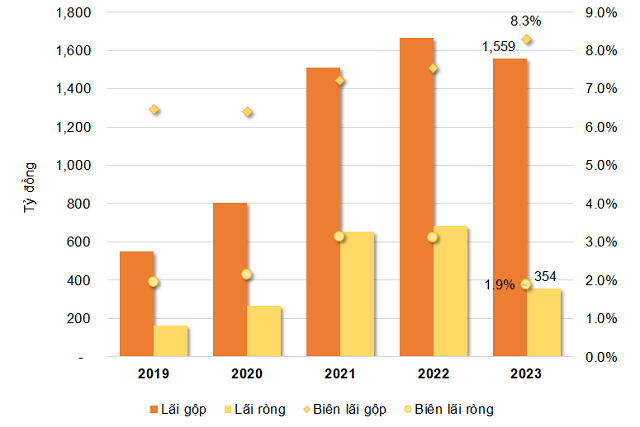

Wholesale businesses also struggle

Not only did retail businesses face difficulties in a challenging market, but wholesale businesses also have been affected to some extent.

For Digiworld (HOSE: DGW), in 2023, revenue reached nearly 19 trillion dong, a 15% decrease; net profit was over 354 billion dong, down 48%.

The two main activities, which accounted for 74% of revenue, were the sale of phones and laptops, and tablets, which decreased by 25% and 16% respectively. Other segments including office equipment and consumer electronics and appliances grew, but their impact on overall results was insignificant.

Moreover, selling expenses increased by 31%, reaching 944 billion dong, mainly due to increased costs in advertising, promotions, and customer support.

|

Net profit of DGW decreased by 48% in 2023

Source: VietstockFinance

|

As for Petrosetco (HOSE: PET), although it had a profit of nearly 23 billion dong in the final quarter of the year, instead of a loss of over 24 billion dong in the same period, after accumulating difficulties in the first 9 months of the year, PET still couldn’t end 2023 with growth.

The fourth quarter of 2023 showed that PET benefited from no longer having investment losses in securities as in the previous period, along with reducing sales and business management costs, while core operations still faced many difficulties, with both revenue and gross profit decreasing. PET explained that the difficult economic situation led to a decline in demand for electronic products.

|

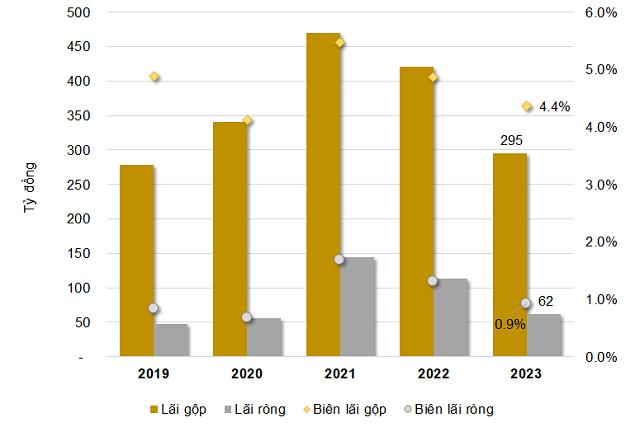

Business results of PET decreased due to a decline in demand for electronic products

Source: VietstockFinance

|

PET faced difficulties, and Petrosetco Distribution Services (HNX: PSD) – a subsidiary directly owned by PET with 77% of capital – also reflected a similar situation. The revenue in the fourth quarter of 2023 decreased by 18%, and the gross profit decreased by 35%. They had to reduce expenses to save the growth of net profit.

However, their results for the whole year still declined by 45% in profit after being affected by several previous quarters.

|

Business results of PSD are similar to PET

Source: VietstockFinance

|

Missing the target

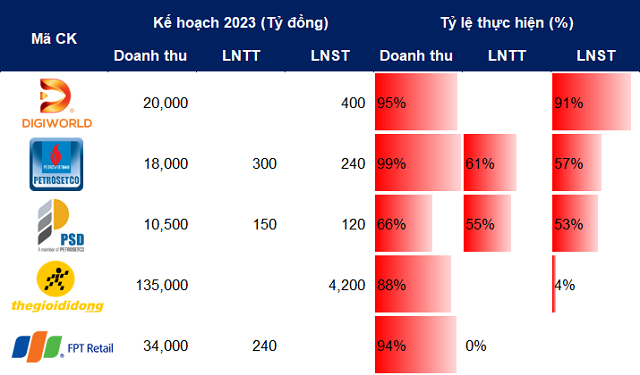

With unfavorable results, all 5 companies in the telephone and electronics business did not achieve their plans in 2023.

MWG achieved 88% of the revenue target but only reached 4% of the profit. The loss made FRT suffer a year under the profit target, despite completing 94% of the revenue target.

In the wholesale group, DGW, rare as it may be, approached their plan, achieving 95% of revenue and 91% of profit. But it should be noted that DGW set a very cautious target with profits equal to only half of the previous year’s results.

PET was about 1% below the revenue target, but the net profit was only a little over half, as PET’s plan for 2023 was relatively ambitious, higher than the results of the previous year. Meanwhile, PSD, a subsidiary of PET, completed only 66% of the revenue target and 53% of the profit target.

|

The performance of phone and electronic businesses in achieving their targets in 2023

Source: VietstockFinance

|

What prospects for 2024?

After a year of obstacles, phone and electronics businesses enter the new year with a very low starting point, while being expected to achieve better results.

According to SSI Research’s perspective, presented in the report “Prospects for the Retail Industry in 2024,” the revenue of phone and electronics retail businesses will recover by 5% from the low level of 2023; however, the growth rate will gradually decrease in the second half of 2024.

SSI Research also assesses that macroeconomic conditions may still be difficult in 2024, particularly inflation. However, some difficulties will be reduced compared to 2023, such as low-interest rates, and better export prospects, supporting a slow recovery in non-essential consumer goods.

Profit margins are expected to increase in 2024 after a period of decline due to inventory reduction by phone and electronics retailers, leading to price wars.

The reduction of inventory for phone and electronics products has already started from the fourth quarter of 2022 and was most intense for iPhone 14 products. Due to the delay in the launch of iPhone 14 (the first quarter of 2023 instead of the expected fourth quarter of 2022), consumers canceled their orders, and retailers had to heavily discount to clear inventory before Apple launched new products, resulting in intense price competition in the second quarter of 2023. The discount for iPhone 14 was up to 25%. Meanwhile, the discount for iPhone 15 was from 4 to 6% in the third quarter of 2023. Thus, the price competition subsided in the third quarter of 2023. However, phone and electronics retailers may have to maintain competitive pricing strategies and profit margins in 2024, which may not return to the level of 2022.

For the BHX chain owned by MWG and the Long Chau chain of FRT, although they are not phone and electronics products, they are gradually showing their important contributions to these two retail giants. SSI Research predicts that Long Chau will maintain a positive pace of new store openings, while BHX will reach a break-even point in the first half of 2024, providing conditions for new openings from the second half of 2024.

In terms of revenue, the BHX chain is expected to increase by 20% compared to the same period, break even in the first half of 2024. Meanwhile, Long Chau is projected to increase by 22%.

According to SSI Research, retail businesses are forecasted to experience a brighter outlook in 2024 than in 2023, with recovering revenues and profit margins. However, challenges such as inflation and economic fluctuations remain, requiring businesses to adapt and look for new growth opportunities.