Selling pressure continued to rise this afternoon, blocking all attempts to bottom out and recover. The market slightly edged up in the first half of the afternoon session, then plunged. VN-Index closed at the lowest point of the session, losing 21.11 points, equivalent to -1.66%, the biggest daily drop since November 23, 2023. The number of declining stocks in the index was nearly 5 times higher than the number of gaining stocks.

Today’s strong decline completely broke the sideways trend of VN-Index over the past 6 sessions. All leading stocks/stock groups that have been leading the market above the peak for the past 2 weeks turned around and declined. VN30-Index dropped by 2.06%, confirming the pressure from banking stocks.

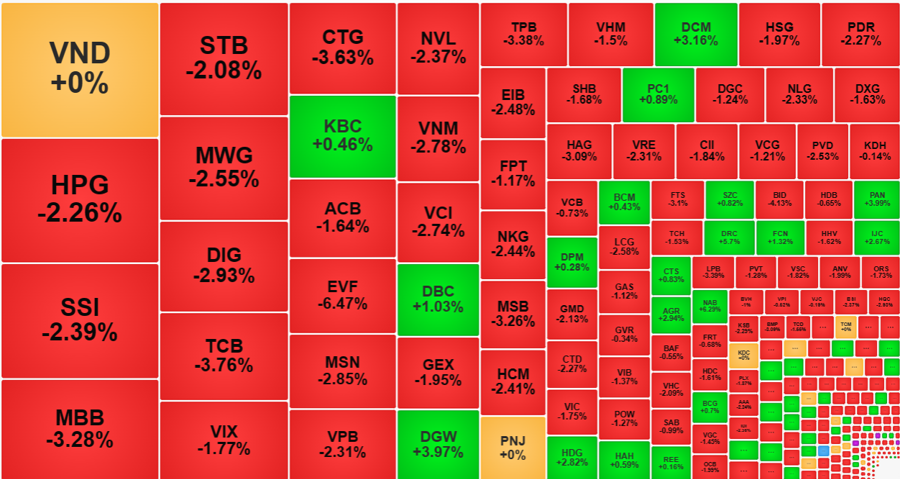

The blue-chip basket only had BCM increasing by 0.43%, while the rest of the 29 stocks decreased, with 5 stocks decreasing by over 3% and all of them were banks: BID decreased by 4.13%, TCB decreased by 3.76%, CTG decreased by 3.63%, TPB decreased by 3.38%, MBB decreased by 3.28%. The whole banking group only had NAB increasing by 2.42% and besides the blue-chips, there were still LPB and MSB with over 3% decrease.

Among the top 10 largest capitalized stocks in VN-Index, besides the significant decrease in the banking sector, VHM also decreased by 1.5%, GAS by 1.12%, HPG by 2.26%, VNM by 2.78%.

Liquidity on both exchanges in the afternoon session was about 11% lower than in the morning session, but still reached VND 15,985 billion. The decrease in trading value is partly due to the significant decrease in stock prices compared to the morning session. The breadth of VN-Index was only 89 gainers/408 decliners, with 160 stocks decreasing by over 1%. The liquidity of this deepest declining group accounted for nearly 74% of the total trading value on HoSE, confirming extremely strong selling pressure.

The large scale of trading today is a noteworthy point. Just the matched orders on the two exchanges reached nearly VND 34 trillion, the highest since August 2023. Taking into account all 3 exchanges, the total trading volume reached nearly VND 36 trillion, including agreements. On one hand, this record liquidity shows that there is a large amount of money waiting at deep price levels, on the other hand, it shows that there is also a very high demand to exit. Of course, with the result of narrow breadth and deep decrease, the sellers must be proactive in selling off.

Not only domestic investors, foreign investors also aggressively sold off this afternoon: The total value sold separately in the afternoon session on HoSE was up to VND 1,431.2 billion and the net sell was VND 456.8 billion. This group had a net sell of VND 208.9 billion in the morning session. Thus, foreign investors set the largest net sell level in the past 9 sessions.

A series of stocks with large sell-offs are VNM – VND 126.5 billion, VPB – VND 106.1 billion, KBC – VND 80.2 billion, VND – VND 67.8 billion, SSI – VND 64.9 billion, CTG – VND 52.1 billion, SAB – VND 40.2 billion, MWG – VND 37.8 billion. On the buying side, there are KDH + VND 71 billion, DGW + VND 63.8 billion, DGC + VND 36.3 billion, DRC + VND 31.6 billion.

In the context of a blazing market, the contrary group is more noteworthy. Out of the 89 stocks that stayed green today, there are many stocks that investors were not swept into the selling wave. The liquidity of many stocks is not small, showing strong support. Typical examples include DRC with a 5.7% increase in trading volume of VND 137.2 billion; PAN increased by 3.99% with VND 139.1 billion; DGW increased by 3.97% with VND 436.4 billion; DCM increased by 3.16% with VND 398.5 billion; AGR increased by 2.94% with VND 114.2 billion; HDG increased by 2.82% with VND 173.5 billion; IJC increased by 2.67% with VND 125.7 billion; FCN increased by 1.32% with VND 131.1 billion; DBC increased by 1.03% with VND 445.6 billion.

The sharp decline today along with record liquidity shows that the market is experiencing a simultaneous capital withdrawal because stocks have gone through a very long upswing. Continuous weeks of large liquidity show that the market is attracting attention, investors are disbursing large amounts of money. However, when individual investors are highly excited, large investors have the opportunity to sell off a large volume.