On the morning of March 8th, MarketVector Indexes will announce the portfolio of the MarketVector Vietnam Local Index – the benchmark index of the VNM ETF ($550 million scale) in the 1st quarter 2024 review,

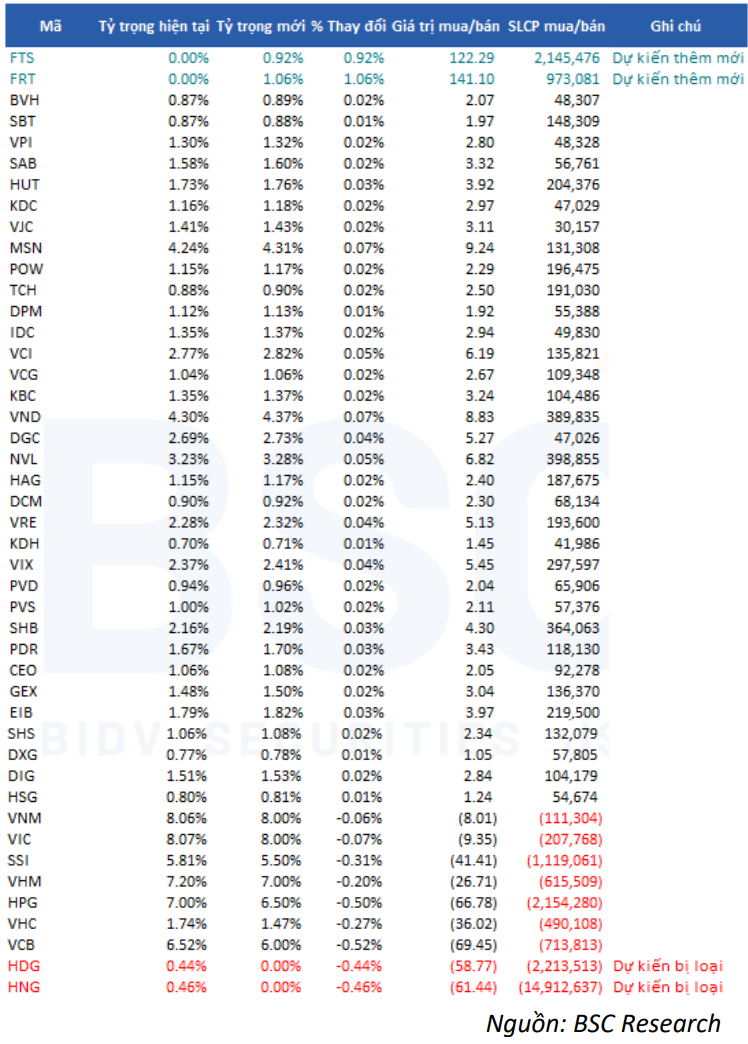

Based on data as of February 29th, BIDV Securities (BSC) has provided the forecasted stock component portfolio and the quantity of stocks bought/sold for the ETFs referenced by the MarketVector Vietnam Local Index.

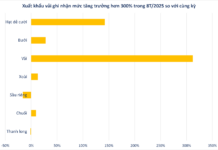

Specifically, two stocks, FPT Securities (FTS) and FPT Retail (FRT), are predicted by BSC to be added due to being in the top 85% of accumulated free-float market capitalization among qualified stocks.

In contrast, BSC believes that HDG stock of Hado Group and HNG stock of HAGL Agrico may be excluded as they fall outside the top 98% of accumulated free-float market capitalization.

Under this assumption, the VNM ETF may purchase 2.1 million FTS stocks and 973 thousand FRT stocks to add to its portfolio. Also on the buying side, the VNM ETF is expected to buy NVL (399 thousand stocks), VNM (390 thousand stocks), SHB (364 thousand stocks), EIB (220 thousand stocks),…

On the selling side, over 14.9 million HNG stocks and 2.2 million HDG stocks may be sold to be removed from the portfolio. Similarly, 2.2 million HPG stocks, 1.1 million SSI stocks, 714 thousand VCB stocks,… may also be sold to reduce their weight in the portfolio.

Beforehand on March 1st, FTSE Russell announced the inclusion of Electricity Financial Joint Stock Company (EVF) into the FTSE Vietnam Index basket without excluding any stocks. The number of stocks in the FTSE Vietnam Index increased to 27 stocks.

According to the schedule, the new portfolios of both the FTSE Vietnam Index and the MarketVector Vietnam Local Index will take effect after the closing of the trading session on Friday (March 15th) and officially start trading on the following Monday (March 18th).