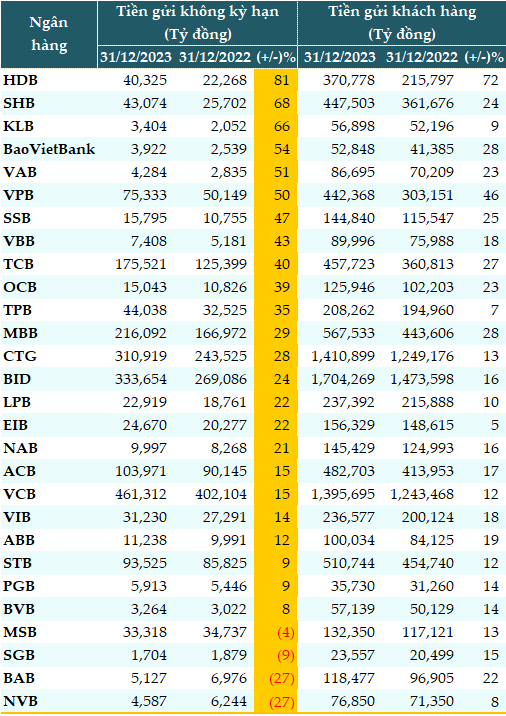

According to VietstockFinance, as of December 31, 2023, total customer deposits at 28 banks reached nearly 9.9 quadrillion VND, an increase of 19% compared to the beginning of the year.

Among them, total non-term deposits (CASA) were over 2.1 quadrillion VND, an increase of 24% compared to the beginning of the year.

24 out of 28 banks experienced CASA growth, with an average growth rate of 33%. HDBank (HDB) had the highest growth rate, reaching 81%, with 40.325 trillion VND. Next was SHB with a 68% increase, attracting 43.074 trillion VND. This was followed by KLB (+66%, 3.404 trillion VND), BaoVietBank (+54%, 3.922 trillion VND), Vietbank (VBB, +51%, 4.287 trillion VND), and VPB (+50%, 75.333 trillion VND).

In absolute numbers, state-owned banks led in terms of non-term deposit volume. Vietcombank (VCB) was at the top of the system with 461.312 trillion VND. Next were BIDV (BID, 333.654 trillion VND) and VietinBank (CTG, 310.919 trillion VND).

MB continued to lead among private banks with 216.092 trillion VND, a 29% increase compared to the beginning of the year. TCB recorded 175.521 trillion VND in non-term deposits, a 40% increase.

|

CASA of banks as of December 31, 2023

Source: VietstockFinance

(Note: CASA in the article refers to non-term deposits)

|

As of the end of 2023, 25 out of 28 banks had a recovery rate of CASA compared to the end of the third quarter, and 18 banks improved compared to the beginning of the year.

TCB regained its leading position in terms of CASA ratio, reaching 38.35%, an increase of over 4 percentage points compared to the beginning of the year.

TCB stated that CASA balance increased for 3 consecutive quarters, reaching a record high of 181.5 trillion VND at the end of the year, a strong increase of 37% compared to the fourth quarter of 2022 and 32% compared to the third quarter. As a result, CASA ratio improved to 40%. The growth rate indicated the transaction capacity of TCB, demonstrated by the growth rate of transaction volume on digital channels (an increase of 41% compared to the same period, reaching 2.2 billion transactions, equivalent to 13% market share of NAPAS transactions) and the monthly application access worldwide – over 50 times per active customer.

MB’s CASA ratio reached 38.08%, a slight increase of 0.4 percentage points compared to the beginning of the year. MB stated that the CASA ratio maintained at 40%, effectively managing operating costs and helping the bank increase competitiveness in the digital banking race.

In the past year, MB’s non-cash payment volume reached 2.6 billion transactions, an increase of 1.5 times compared to 2022. Revenue from MB’s digital platforms reached 24.4%. Chairman of MB’s Board of Directors – Mr. Luu Trung Thai – said: “In the next 4 years, MB aims to have revenue from digital platforms account for 50% of the bank’s total revenue.”

|

CASA ratio as of the end of 2023

Source: VietstockFinance

(Note: CASA ratio in the article is calculated as CASA ratio = Non-term deposits / Customer deposits)

|

Why has CASA grown strongly?

Dr. Dinh Trong Thinh – Economic expert, explained that CASA has grown due to investment in the stock market and the higher risk real estate market. In the past year, the real estate market has frozen, making it difficult to invest further as prices are already high and the market is stagnant. Therefore, if investors want to attract investors, they can only lower prices.

On the other hand, the stock market is fluctuating, and gold has reached its peak and increased significantly, making it difficult for investors to invest.

Therefore, at the end of the year, those who have income, if they want to preserve the value of their assets, can only deposit money in the bank for peace of mind, even though deposit interest rates are currently very low. From there, CASA of banks increases.

Similarly, Dr. Nguyen Huu Huan – Lecturer at the University of Economics Ho Chi Minh City, also assessed that due to low interest rates, people do not have the motivation to save much but keep money in transaction accounts, waiting for opportunities to switch to other channels.

However, there have not been many opportunities in the past year. Although the money is still waiting to be transferred, it is clear that bank deposits have increased to record levels, so CASA has also increased along with bank deposits.

Furthermore, businesses do not have a need for production and business due to weak demand. They also deposit money in the bank.

In general, these behaviors have led to the fact that people save and keep money in the bank more than in previous periods.

Although people may have started to accumulate again now, it is not clear whether the trend of saving or investing has formed. The money is still in the bank, waiting for opportunities to invest in other channels, which will continue to increase bank deposits and CASA.

With these expectations, many banks have set goals to continue to grow CASA in 2024, seeing it as a driver to improve funding costs.

As the bank with the highest CASA growth rate in the system in 2023, HDBank has set a target CASA ratio of at least 16% in 2024, up from 11% in 2023. This will have a very positive impact on the bank’s funding costs in 2024.

At VPBank, the individual customer segment, as the leading segment, made a significant contribution with CASA balance reaching 47 trillion VND at the end of 2023, doubling compared to 2022.

Based on the doubled growth of CASA from the personal customer segment compared to 2022, contributing over half of the total CASA scale, the leaders of VPBank’s retail banking segment set a very ambitious goal to double this figure in 2024.

The CASA growth target has always been set by VPBank in recent years. High CASA is seen as one of the factors that support the bank to reduce funding costs and improve net interest margin (NIM).

Cat Lam