South A Bank dialogue held in the afternoon of March 05, 2024

|

Listing will help NAB diversify shareholder structure

At the beginning of the dialogue, Mr. Võ Hoàng Hải – Deputy General Director of NAB shared that the listing story will help the Bank achieve the goal of diversifying the shareholder structure.

Sharing the reasons why it is only now being listed on the HOSE floor, Mr. Võ Hoàng Hải said that there are currently many favorable market factors. The process of transferring from the UPCoM floor to HOSE is a long and carefully prepared process, requiring close supervision from the State Bank of Vietnam (SBV).

In addition, the Bank not only meets the soft criteria for implementing projects, consulting on ESG, Basel… but also meets the criteria for effective operation and strict information transparency of the State Securities Commission and HOSE, because the process of transferring from UPCoM floor to HOSE is a carefully prepared process with close supervision from SBV and relevant agencies. The Bank must be prepared with standards for information disclosure, transparency, ready to become a new bank on the HOSE floor.

Answering investors’ questions about the biggest competitive advantage of NAB compared to its competitors when listed on the HOSE floor, Mr. Hà Huy Cường – Deputy General Director of NAB shared that green banking and digital banking are the pillars that NAB prioritizes to pursue and devote all efforts to, making these two pillars become competitive edges. This is the current competitive advantage of NAB and in the future.

3 pillars NAB is aiming to build a green bank. First is to build green capital by collaborating with international institutions. Second is green credit. In the 2024 strategy, the risk appetite portfolio for green development has the highest growth rate. Third is green operation. The Bank will standardize products and services, create benchmark products, and optimize carbon emissions.

Projected profit of 4,000 billion VND for 2024 and 5,000 billion VND for 2025

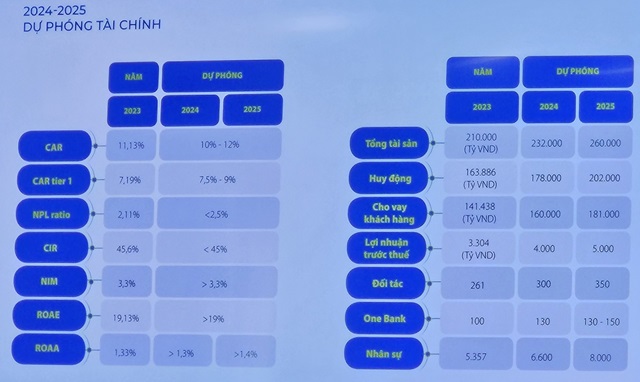

Forecasting for the period 2024-2025, the Capital Adequacy Ratio (CAR) of NAB fluctuates around 10-12%, the bad debt ratio is controlled below 2.5%, the NIM ratio is above 3.3%. The ROA and ROE ratios are expected to be above 1.4% and at least 20%, respectively.

NAB sets a target of 232,000 billion VND for total assets in 2024 (260,000 billion VND in 2025), 178,000 billion VND for mobilization (202,000 billion VND in 2025), and 181,000 billion VND for customer loans. Pre-tax profit in 2024 is projected at 4,000 billion VND and 5,000 billion VND in 2025.

|

Financial projection of NAB for the 2024-2025 period

|

Maintaining a 20% dividend, increasing capital to over 16,000 billion VND by 2025

Mr. Võ Hoàng Hải shared that in favorable conditions, the credit growth orientation of NAB is 17%, focusing on agriculture, forestry, and seafood with the USD interest rate of 3-3.3%/year and about 6-7%/year for VND loans.

NAB is trying to develop a preferential interest rate package of up to 6% for enterprise customers in the 5 priority sectors according to the SBV’s orientation to create momentum for economic growth. At the same time, NAB aims to reduce funding costs. Although CASA of NAB does not account for a large proportion, in 2023, NAB had a good CASA growth rate. Based on that, a better cost of capital will build a better credit target.

Currently, the Bank’s strategy is to increase short-term funding, nearly 1/3 of NAB‘s funding portfolio has been shifted to under 6 months, helping to reduce the input interest rate. However, the interest rate reduction will change according to the economic cycle and real estate liquidity in the coming time. When liquidity and the market improve, interest rates will not be as low as they are now.

NAB also aims to maintain a minimum dividend of 20% based on profits.

Regarding the capital increase plan, NAB aims to increase capital to 13,000 billion VND from undistributed profits. It is expected that by the end of 2024, charter capital will reach about 13,000 billion VND and the target for 2025, charter capital will reach about 16,200 billion VND.

|

On 08/03/2024, over 1 billion shares of NAB will be listed on the Ho Chi Minh Stock Exchange (HOSE) with a reference price of 15,900 VND/share. Fluctuation range +/- 20%, the stock price of NAB in the first trading session will fluctuate around 12,720-19,080 VND/share. Prior to that, on February 29, NAB shares were officially delisted from the UPCoM floor, the closing price on February 28 was 16,500 VND/share. |