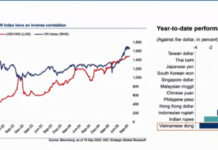

The market struggled in today’s session, but the indices maintained a recovery state. As of the closing of the March 7th session, the VN-Index increased by 5.73 points to 1,268. The money flow was sustained with trading liquidity on HOSE surpassing 23,500 billion VND.

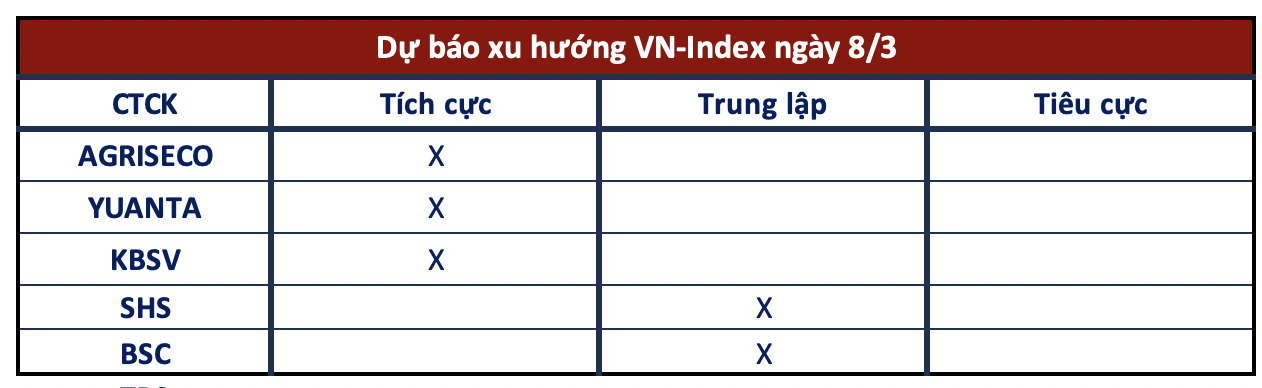

Market outlook for the coming sessions according to brokerage firms suggests that the market may continue to increase, but investors need to closely observe the buying power at the 1,270 level.

Money flow shifting to midcap and penny stocks

Agriseco Securities

On the technical chart, buying pressure in the afternoon session helped the VN-Index regain its bullish momentum after yesterday’s correction. With the market’s upward trend still intact, the VN-Index may continue to target the short-term level around 1,280 points. The correction pressure will gradually become clearer during the uptrend, while the support force around the 1,240-1,250 zone is expected to be a reliable cushion for the index in the coming sessions.

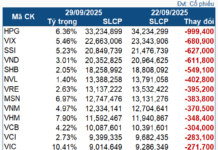

In addition, after a period of increase for large-cap stocks, there are signs of a gradual shift in money flow to penny and midcap stocks. Investors should avoid chasing stocks in optimistic rallies, only increasing trading weight for stocks near accumulation stages or during corrections around mentioned support levels. Priority should be given to some sectors that are attracting good cash flow like securities, real estate, and chemicals.

Market continues the upward trend

Yuanta Securities

The market may continue its uptrend in the next session. At the same time, if the VN-Index can surpass the 1,270 level, the short-term uptrend may become clearer and the VN-Index could aim for the 1,334 level in the coming sessions. In addition, the psychological indicator continues to increase, showing that investors are still positive and new buying opportunities will continue to increase.

The banking stock group shows signs of slowing down, but the money flow is now shifting to other large-cap groups such as food production and securities. Meanwhile, the short-term risk for midcap stocks remains low, indicating that the market still has growth potential in the short term.

KBSV Securities

Buying force has returned with relatively positive effects on most small- to medium-cap stocks, showing the optimism of investors and the activation of money flow, continuing to demonstrate strong buying readiness to rejoin the market after the correction period. Although the recovery range is relatively narrow and the correction pressure still exists, the index is still expected to maintain its upward trend in the short term or soon return in case of a correction with the support zone around 1,240 (+-5) being reached. Investors are advised to avoid chasing in hot upturns, only accelerate disbursement for the leading positions currently held when the index or target stocks approach the support zone.

Observing the 1,270 threshold

SHS Securities

The market may continue its uptrend in the next session. At the same time, if the VN-Index can surpass the 1,270 level, the short-term uptrend may become clearer and the VN-Index could aim for the 1,334 level in the coming sessions. In addition, the psychological indicator continues to increase, showing that investors are still positive and new buying opportunities will continue to increase.

BSC Securities

The selling pressure at the 1,270 threshold prevented the VN-Index from breaking through for 3 consecutive sessions. The VN-Index is likely to remain volatile within the current range before moving on to the 1,280 – 1,300 range.