Source: MB Securities

|

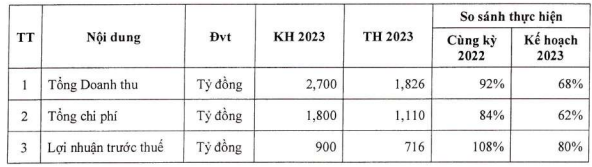

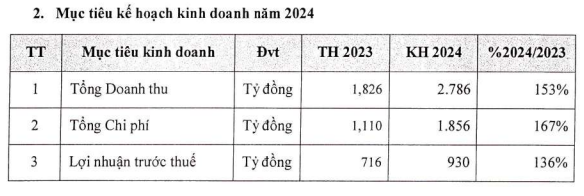

A 36% growth in profit is equivalent to last year’s target. In 2023, MBS aims for a pre-tax profit of 900 billion VND and total revenue of 2,700 billion VND. As a result, the company achieved 68% of its revenue plan and 80% of its pre-tax profit plan.

|

Business performance and implementation of the 2023 plan

Source: MB Securities

|

According to MBS, in 2023, the value of stock market transactions decreased compared to the previous year, causing securities brokerage revenue to decrease accordingly. In addition, interest income from loans also decreased, resulting in a revenue of 1,826 billion VND, a decrease of 8%. However, pre-tax profit reached 716 billion VND, an increase of 8%.

In the document, the company’s management board also forecasted the opportunities and challenges of the securities market in 2024.

On the positive side, listed companies’ profits are expected to increase by 12-16% and solutions to upgrade the securities market will be strongly implemented in 2024, with an expected daily liquidity of 20,000 billion VND.

On the challenging side, the global securities market in general and Vietnam in particular will face difficulties due to central banks maintaining tight monetary policies. In the domestic market, corporate bond market is forecasted to remain sluggish in the first 6 months, and the competition among companies to increase their capital (in terms of technology, preferential policies, and charter capital) requires flexibility, caution, and creativity in business activities.

In addition, the management board also proposed to the General Meeting of Shareholders to approve the bonus plan for employees with a 20% share of the profit plan exceeded after tax, and authorize the Board of Directors to decide on the implementation plan.

|

The Annual General Meeting of Shareholders 2024 of MB Securities will be held on March 28th at the Grand Mercure Hanoi Hotel, 9 Cat Linh, Quoc Tu Giam, Dong Da, Hanoi. |