Comparison between Penang and Shenzhen

The majority of experts agree that foreign direct investment (FDI) can boost the economy by bringing in important technologies, expanding local production, and creating more jobs. Therefore, it is not surprising that attracting FDI has long been a top priority for both developed and developing economies. This is reflected in the generous incentives in the US Inflation Reduction Act. However, when it comes to promoting growth and economic development, FDI has mixed results.

To understand why, we need to look at the contrasting outcomes of Penang, Malaysia, and Shenzhen, China. Thanks to its strategic location, low labor costs, and tax incentives, Penang was one of the first Asian cities to attract investment from multinational companies through its established free trade zones in 1972. Later, Shenzhen also started attracting FDI, establishing special economic zones in 1980 and quickly becoming a manufacturing hub with millions of laborers.

The city of Shenzhen, China

Source: BBC

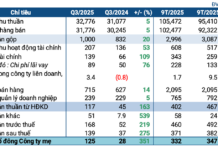

However, when it comes to transforming FDI into income growth and technological upgrading, Shenzhen has been much more successful than Penang. As the chart shows, in 2017, Shenzhen’s per capita GDP stood at $39,245 USD in purchasing power parity (72% of the US), compared to only $27,569 USD (about 50% of the US) for Penang. While Penang has been slow in development due to its reliance on low-value-added manufacturing sectors, Shenzhen has focused on high-tech development. The number of US patents registered for inventors in Shenzhen increased from 0 in the 1990s to around 2,500 in 2017, while Penang only reached 100.

Per Capita GDP (PPP, USD)

Source: Project Syndicate

This difference could be attributed to the scale of the national economy: surely, China’s vast market and labor force, along with massive state investments and dynamic cities, have contributed to Shenzhen’s development.

Success lies in nurturing local enterprises

The real explanation for Shenzhen’s success lies in company ownership. After the initial dominance of FDI, Shenzhen gradually came to be dominated by innovative local enterprises such as BYD, DJI, and Tencent. In 2005, the top two patent-filing companies in Shenzhen were both Taiwan-based – namely, Foxconn (also known as Hon Hai Precision Industry Co.). By 2015, Chinese-owned companies filled the entire top 10, with ZTE and Huawei in the lead. Today, Shenzhen is one of the most developed cities in China and seems to have surpassed Hong Kong.

The Chinese government places a high priority on promoting local enterprises and has implemented industry and innovation support policies, including research initiatives, public-private partnerships, and venture capital. The government has even created publicly funded R&D corporations, facilitating technology transfer to local manufacturers. Without these policies, Huawei might not exist. Initially, Huawei imported electronic components from Hong Kong. Eventually, the company transformed into a high-tech manufacturer based on internal R&D instead of forming joint ventures with multinational corporations.

Nurturing dynamic local enterprises has never been a policy priority in Penang. As a result, the economy is still dominated by US multinational corporations – mainly engaged in low-value-added activities in Malaysia while maintaining high-value-added and R&D activities domestically. US giants like Intel and Motorola account for 50-70% of the top patents in Penang, while the proportion of Malaysian companies has declined from 20% in the 2000s to 0% since the mid-2010s.

What FDI has achieved in Penang is the development of the labor force. In 1989, the Malaysian government established the Penang Skills Development Center to ensure that workers had the skills demanded by multinational companies. Well-trained labor, along with a strong supply chain, explains why the country remains an attractive destination for many multinational companies, even as local wages have risen. In other words, Penang still has a lot of potential. However, it lacks innovation, which hampers the city’s development.

These contrasting development stories hold an important lesson for both developed and developing countries. Attracting FDI is important, but to fully capitalize on it, supportive interventions are required to facilitate knowledge transfer and long-term innovation. If the US hopes to lead industries in the future, it might consider creating public-private R&D programs similar to Shenzhen.

About the author Keun Lee

Keun Lee is a former Vice Chairman of Korea’s National Economic Advisory Council to the President and former President of the International Schumpeter Society, a professor of economics at Seoul National University, recipient of the 2014 Schumpeter Prize, and author of the book China’s Technological Leapfrogging and Economic Catch-up: A Schumpeterian Perspective (Oxford University Press, 2022).

Source: Seoul National University

This article reflects the opinions of author Keun Lee