Illustration

|

According to data from the Ministry of Agriculture and Rural Development, by the end of 2023, Vietnam had exported about 8.29 million tons of rice, earning 4.78 billion USD, up 16.7% in volume and 38.4% in value compared to 2022. This is a record high figure in over 30 years of participating in rice exports.

In 2023, many countries increased their rice imports from Vietnam. Among them, the Philippines was the largest rice importing market with over 3.1 million tons, followed by Indonesia with 1.15 million tons, China with 908 thousand tons, Ghana with 576 thousand tons, etc.

The high demand from the international market has pushed up the average export price of rice from Vietnam, reaching its highest level of 663 USD/ton in early December 2023, surpassing its competitors to become the world leader.

Despite the impressive export numbers, many rice export businesses experienced thin profit margins or even heavy losses.

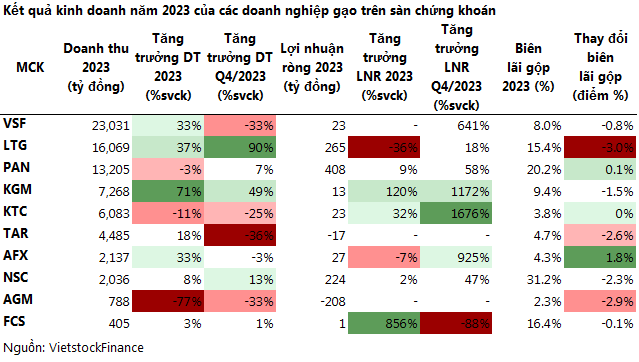

According to statistics from VietstockFinance, out of 10 listed rice businesses that have announced their business results in 2023, 5 businesses increased their profits, 2 businesses decreased their profits, 2 businesses suffered losses, and 1 business went from loss to profit. The total revenue reached over 75.505 trillion VND, an increase of 16% compared to the previous year, but net profit was only about 760 billion VND, a decrease of 14%.

Leading in revenue growth in 2023 is Kien Giang Import-Export Company (Kigimex, UPCoM: KGM) with nearly 7.3 trillion VND, an increase of 71% compared to the previous year, and the highest level since being listed in 2016. This result helped the company achieve a net profit of 12.5 billion VND, 2.2 times higher than before.

In terms of absolute numbers, Southern Food Corporation (Vinafood 2, UPCoM: VSF) topped the group, with revenue of over 23 trillion VND, an increase of 33%, and after-tax profit doubled to 63 billion VND – a record high. Net profit was about 23 billion VND, while the company had a loss of 9 billion VND in the previous year.

Notably, in 2023, Vinafood 2 sold over 1.5 million tons of rice, exceeding nearly 70% of the annual plan, an increase of 31% compared to the same period (of which, exports reached nearly 1.3 million tons).

In reality, since its equitization in 2018, despite achieving annual revenue of over 16 trillion VND, Vinafood 2 has continued to suffer losses or very thin profits, due to the low profit margin characteristic of the rice export industry. As of the end of 2023, the accumulated losses of the company were 2.778 trillion VND, the result of four consecutive years of loss from 2018 to 2021.

The profit leader in the past year belongs to The Pan Group (HOSE: PAN), reaching a record 408 billion VND, an increase of 9% compared to the previous year, and accounting for 54% of the group’s total profit. The packaged rice segment significantly contributed to the overall profit of the company, with the gross profit margin of this segment increasing from 9% to over 15%.

Sharing the joy of record profits, Foodcosa (UPCoM: FCS) saw its net profit increase to 1 billion VND, 10 times higher than the previous year. After six consecutive years of losses from 2016 to 2021, the company still had accumulated losses of 193 billion VND at the end of 2023.

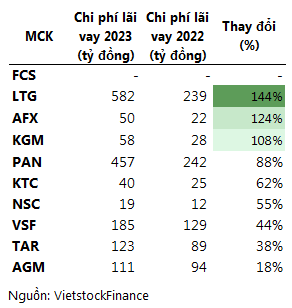

Lending costs weigh heavily on businesses.

Looking from the outside, although rice industry businesses are in favorable business conditions, the increase in borrowing during the peak period of bank interest rates has made borrowing costs become a burden, eroding profits.

In 2023, the short-term loans of Loc Troi Group (UPCoM: LTG) increased by 66% to 6.227 trillion VND, while long-term loans accounted for an insignificant proportion. The company incurred interest expenses of up to 582 billion VND, 2.4 times higher than the previous year.

Notably, the borrowing costs are not the only burden on Loc Troi. At the end of 2023, the value of difficult-to-collect debts exceeded 1 trillion VND (3 times higher), and a provision of 564 billion VND had to be set aside. This pushed the company’s management costs to increase from nearly 400 billion VND to nearly 720 billion VND.

These two factors have led to a decrease in Loc Troi’s net profit in 2023 to 256 billion VND, a 36% decrease compared to the previous year, while revenue reached a record level of over 16 trillion VND.

In terms of revenue structure, the rice segment contributed more than 11 trillion VND, an increase of 75% and accounting for 68%. However, the gross profit margin of this segment is very thin, contributing little to the company’s overall profit. The plant protection business segment had a gross profit margin of 57%, even though its revenue only accounted for 38% of the rice segment’s revenue. This is still the segment that has brought the main source of profit to Loc Troi up to now.

In the same situation, An Giang Export-Import (UPCoM: AFX) had to pay 50 billion VND in interest expenses, 2.3 times higher than the previous year, accounting for 54% of the company’s gross profit. Finally, the net profit for the year decreased by 7%, reaching 27 billion VND.

Receiving even more disappointing results, Angimex (HOSE: AGM) and Trung An High-Tech Agriculture (HNX: TAR) incurred losses of 208 billion VND and 18 billion VND, respectively, in 2023.

This is also the first loss for Trung An since its equitization in 2016. For Angimex, the rice business in An Giang has increased the total accumulated losses to over 153 billion VND at the end of 2023.

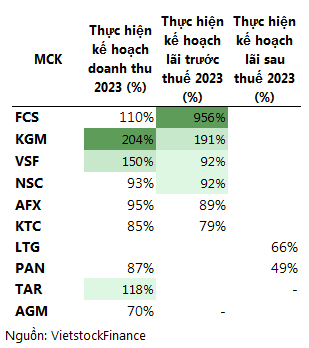

This also means that the two companies were unable to achieve their full-year profit targets set for 2023. On the other hand, FCS and KGM are the two rice industry businesses that have announced profits far exceeding their full-year profit targets. LTG and PAN were disappointing as they failed to achieve 75% of their profit targets for 2023.

Rice stocks “rising”.

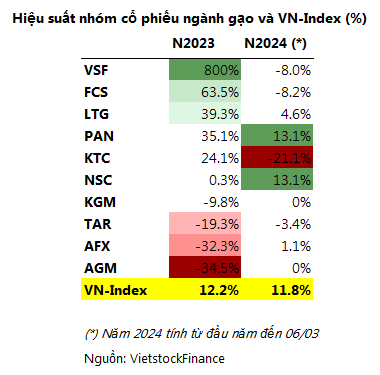

Rice stock group stocks are often affected by cycles, specifically the continuously rising rice prices in 2023 have attracted the attention of investors. Throughout the year, rice stocks such as VSF, FCS, LTG, PAN, and NSC all experienced strong increases, with higher growth rates than the average increase of 12% of the VN-Index.

VSF stocks had the highest price increase (+800%). From late July 2023, this stock reached the daily trading ceiling for 11 sessions, helping the stock price increase from around 8,000 VND/share to 37,400 VND/share; liquidity also improved to tens of thousands of shares/day, compared to just a few thousand shares as usual.

Following the rise in rice prices, AGM stocks also attracted attention in the market in late July with 12 consecutive trading sessions at the ceiling (+122%, to 13,500 VND/share). However, after the increase, this stock plummeted with many sessions at the floor price when it received a decision to suspend trading from mid-September 2023. Overall, AGM’s market capitalization decreased by 35%.

Entering 2024, rice stock performance seems to have declined. From the beginning of the year until March 6, PAN and NSC were the two stocks with the same increase of 13% – higher than the average increase of 12% of the VN-Index. Meanwhile, some stocks like KTC (-21%), VSF, or FCS (-8%) proved to be sluggish from the beginning of the year.

Will 2024 continue to be “bright”?

According to the Ministry of Agriculture and Rural Development, in 2024, global rice production may reach a record high of nearly 520 million tons, and consumption may reach nearly 525 million tons. Global rice inventories are decreasing, with only about 160 million tons remaining.

The increased consumption demand exceeds production capacity, while the end-year inventories continue to decrease. This indicates that the overall picture of the global rice industry in 2024 is forecasted to continue to be “bright” for countries with export advantages like Vietnam.

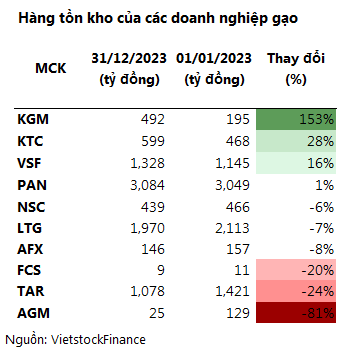

In this context, businesses that have accumulated a large inventory will directly benefit. However, at the end of 2023, the inventories of most businesses have decreased, and they will need to buy more to fulfill export contracts.

Leading in inventory growth is KGM with 492 billion VND, an increase of 153% compared to the beginning of the year. Meanwhile, inventories of Angimex and Trung An decreased sharply by 81% and 24% to 25 billion VND and over 1 trillion VND, respectively.

Loc Troi’s inventories decreased by 7% to nearly 2 trillion VND; however, provisions increased more than 10 times, from 4 billion VND to 47 billion VND. The decrease in inventories is due to raw materials and purchased goods sharply decreasing, while finished products increase strongly from 841 billion VND to 1.222 trillion VND.

In practice, at the beginning of 2024, many positive news has come to Vietnam’s rice industry as many contracts and memorandums of understanding on rice exports have been signed. First, 7 Vietnamese businesses won 10 out of 17 tenders to supply over 300 thousand tons of rice to Indonesia.

According to information from the Ministry of Agriculture and Rural Development, in 2024, South Korea may organize 9 bidding sessions to import rice from several countries around the world. Vietnam is allocated a total quota of 55,112 tons by this country.

In addition, Vietnam has signed a memorandum of understanding to sell 1.5 – 2 million tons of rice per year to the Philippines for 5 years. Moreover, some rice export businesses in Vietnam also shared that they have received many orders from Philippine partners since the beginning of the year.

According to the general evaluation of Do Ha Na – Chairman of the Board of Directors of Intimex Group, looking at the overall supply, demand, and inventory situation, the rice market in 2024 is still favorable for sellers. However, the rice market is always closely linked to weather and geopolitical factors, making it very difficult to make accurate forecasts.