Illustration

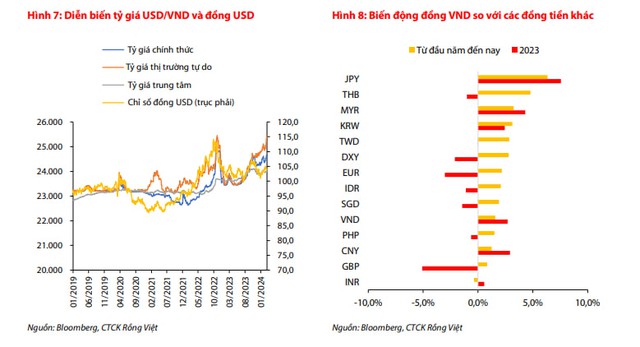

In a new macro report published, Rong Viet Securities (VDSC) stated that the pressure of the Dong’s depreciation continued into February 2024. Specifically, the Dong continued to depreciate by an additional 0.91% in February, higher than the 0.6% depreciation in the first month of the year. So far this year, the Dong has depreciated by about 1.6% in the interbank market and 2.7% in the free market.

Specifically, the selling exchange rate at Vietcombank recorded on March 4, 2024, was 24,870 dong/USD, 450 dong/USD higher than the end of 2023, and the selling exchange rate in the free market was 25,430 dong/USD, 660 dong/USD higher than the end of the previous year.

In this development, the USD index slowed down in February 2024, currently trading at 103.9, corresponding to a 0.6% increase compared to the end of January 2024 and a 2.5% increase compared to the beginning of the year. Similarly to the movement of the USD index, other currencies in the Asia-Pacific region continued to depreciate against the USD in February, but with lower volatility than the first month of the year.

“Compared to other currencies that have experienced depreciation in the first two months of this year, the depreciation of the Dong is higher than that of the Chinese yuan but reasonable compared to other currencies in the region,” VDSC commented.

According to the analysis group, there are 3 domestic factors that have influenced the exchange rate recently.

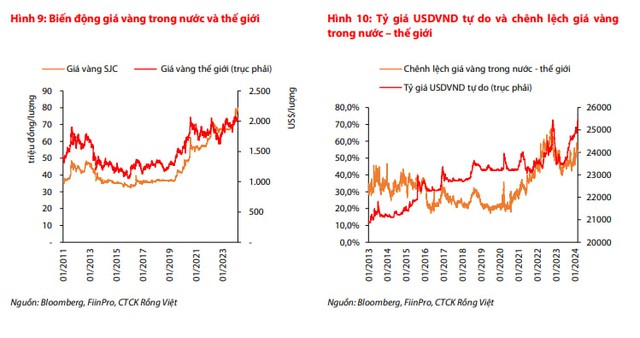

First, the global gold price has been recovering since the second half of February 2024, driving the increase in domestic gold prices. Although the global gold price has decreased by 0.5% compared to the beginning of the year, SJC gold prices have increased by 5.0% due to the characteristics of the domestic gold market. As a rule of thumb, the larger the difference between domestic and global gold prices, the stronger the pressure on USD/VND exchange rate, especially in the free market.

Secondly, trade data for the first two months of 2024 shows that although the overall trade surplus expanded compared to 2Q2023 ($4.0 billion in 2Q2024, +16.6% compared to the same period), the domestic trade deficit also tended to increase sharply. Specifically, the domestic block imported $19.6 billion in 2Q2024, recording a trade deficit of $3.9 billion, an increase of approximately 30.0% compared to the same period.

“The increasing import demand of the domestic block has also led to the depreciation of the Dong in the official market,” VDSC said.

Third, the positive gap in the USD-VND interest rate has increased in recent days, implying that the impact of carry trade activities on the Dong’s exchange rate has not yet ended. In addition, the decrease in dong deposit interest rates to a low level is also a factor that increases the attractiveness of other assets such as foreign currencies and gold.

In the opposite direction, the only counter-acting factor that VDSC has observed supporting the Dong is the positive FDI capital disbursement activities in 2Q2024 ($2.8 billion, up 9.8% compared to the same period). Currently, the analysis group is not overly concerned about the pressure of the Dong’s depreciation as the USD/VND exchange rate is still fluctuating within an allowable range. However, the State Bank of Vietnam may need to utilize tools such as foreign exchange reserves or implement new solutions to manage the gold market to limit the depreciation of the Dong in March 2024.