Just 3 corporate bond issuances worth nearly 1,200 billion VND in February 2024.

According to data from the Vietnamese Bond Market Association (VBMA) compiled from HNX and SSC, as of the announcement date of information on 01/03/2024, there were 3 private corporate bond issuances worth 1,165 billion VND in February 2024.

Specifically, Hai An Transport and Stevedoring Joint Stock Company (stock code: HAH) successfully issued the HAHH2328001 bond lot worth 500 billion VND, with a term of 5 years. With a fixed interest rate of 6% per year, the lowest in the market in the first 2 months of 2024.

Hanoi Highway Construction and Investment Joint Stock Company (a subsidiary of CII) successfully issued the HNHCH2433001 bond lot worth 550 billion VND, with a term of 117 months (9.5 years). With the initial interest rate of 10.1% per year, the subsequent periods equal the average medium-term lending interest rates of 4 banks Vietcombank, BIDV, Vietinbank, and Agribank.

Lac Hong Tourism and Trading Joint Stock Company successfully issued the LHTCB2427001 bond lot worth 115 billion VND, with a term of 3 years. With a fixed interest rate of 9% per year for the first 4 periods, the subsequent periods equal the average of 12-month savings interest rates in Vietnamese dong by Vietcombank, BIDV, Vietinbank, and Agribank plus 4.3% per year.

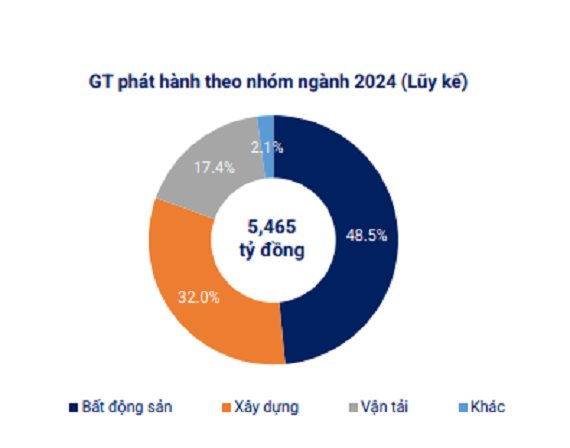

According to data from the Vietnamese Bond Market Association (VBMA) compiled from HNX and SSC, as of the announcement date of information on 01/03/2024, there were 3 private corporate bond issuances worth 1,165 billion VND in February 2024. 2 months in 2024, the real estate business group ranked first, accounting for 48.5% of the total issuance value according to industry group.

In another development, in February, businesses bought back 2,056 billion VND of bonds before maturity, a 68% decrease compared to the same period in 2023. In the remaining 10 months of 2024, it is estimated that there will be about 255,732 billion VND of bonds due, of which the majority is real estate bonds with 98,127 billion VND, equivalent to 38.4%.

Regarding abnormal information disclosure, 7 businesses delayed principal and interest payment in the month, with a total value of about 6,213 billion VND (including interest and remaining debt of bonds) and 24 bond codes extended the time for interest payment, principal payment, or early bond repurchase time.

in the future issuance plan, the Board of Directors of Ban Viet Joint Stock Commercial Bank (UPCoM: BVB) has approved a plan to issue private bonds in 2024 with a total value of up to 5,600 billion VND, expected to be divided into 6 issuance periods. These are non-convertible bonds, without warrants, with collateral, a face value of 100,000 VND/bond, a maximum term of 8 years, and a fixed interest rate of 8% per year.