According to the Vietnam Rubber Association, tire exports have been Vietnam’s main rubber export product for many years. In 2022, the estimated value of tire exports is over $2.2 billion, a 23% increase compared to 2021, accounting for 52.5% of the total value of rubber product exports.

Although Vietnam has a large tire export value, it still needs to import many types of tires that cannot be produced domestically. In the Vietnamese automobile tire manufacturing industry, FDI companies hold a large proportion, with well-known names such as Bridgestone (Japan), Kumho Tire (South Korea), Michelin (France)…

Among them, Kumho Tire is known as the first foreign company to set up a tire manufacturing plant in Vietnam with an initial investment of $126 million in 2006. The factory went into operation in early 2008. The factory currently has a production capacity of 3.15 million tires per year and its products are distributed in 160 countries worldwide. Kumho Vietnam accounts for 40% of Vietnam’s total automotive tire exports.

Kumho Tire is a member of Kumho Asiana – the 7th largest conglomerate in Korea with nearly 40 subsidiary companies, which has been operating in Vietnam since 1993. Currently, the Group has 7 member companies operating in Vietnam.

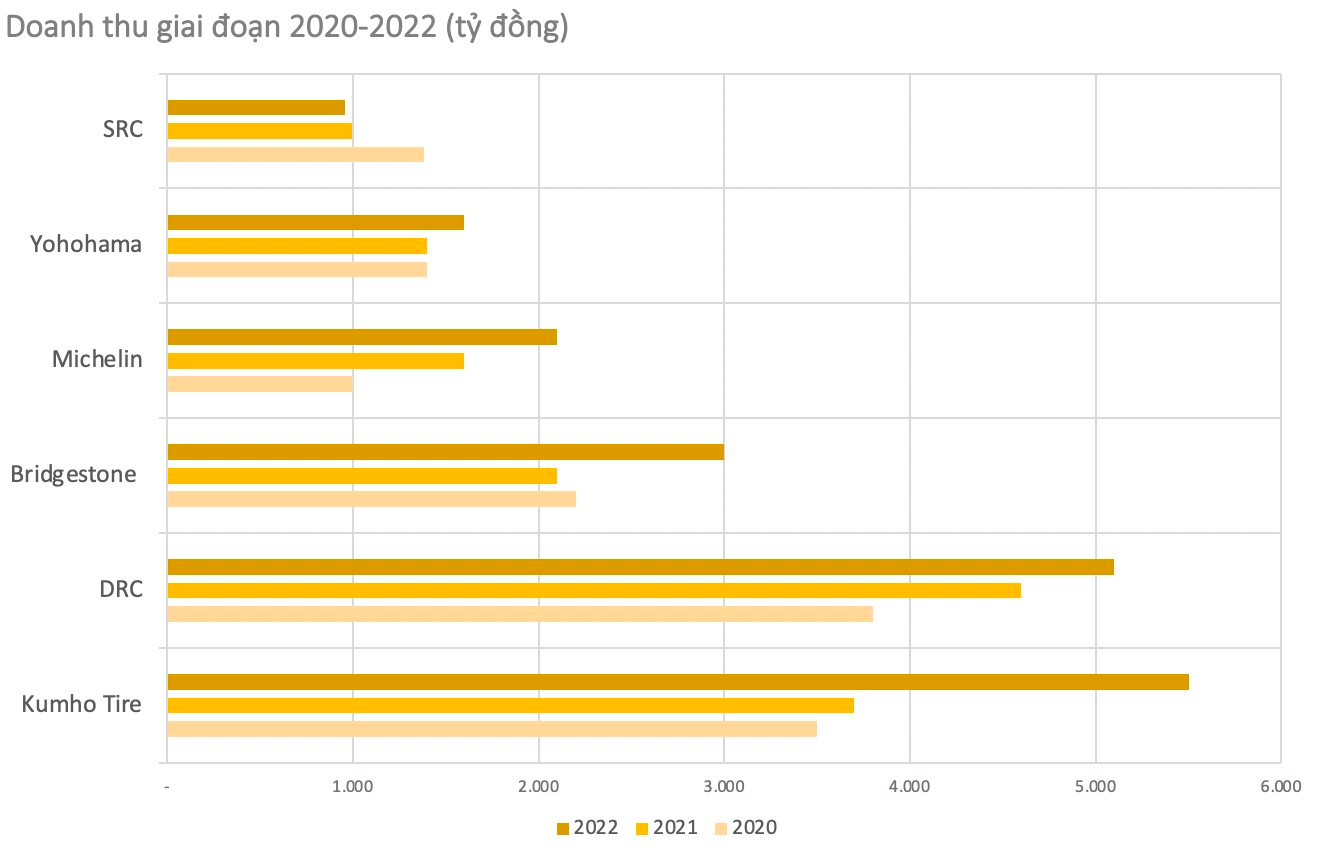

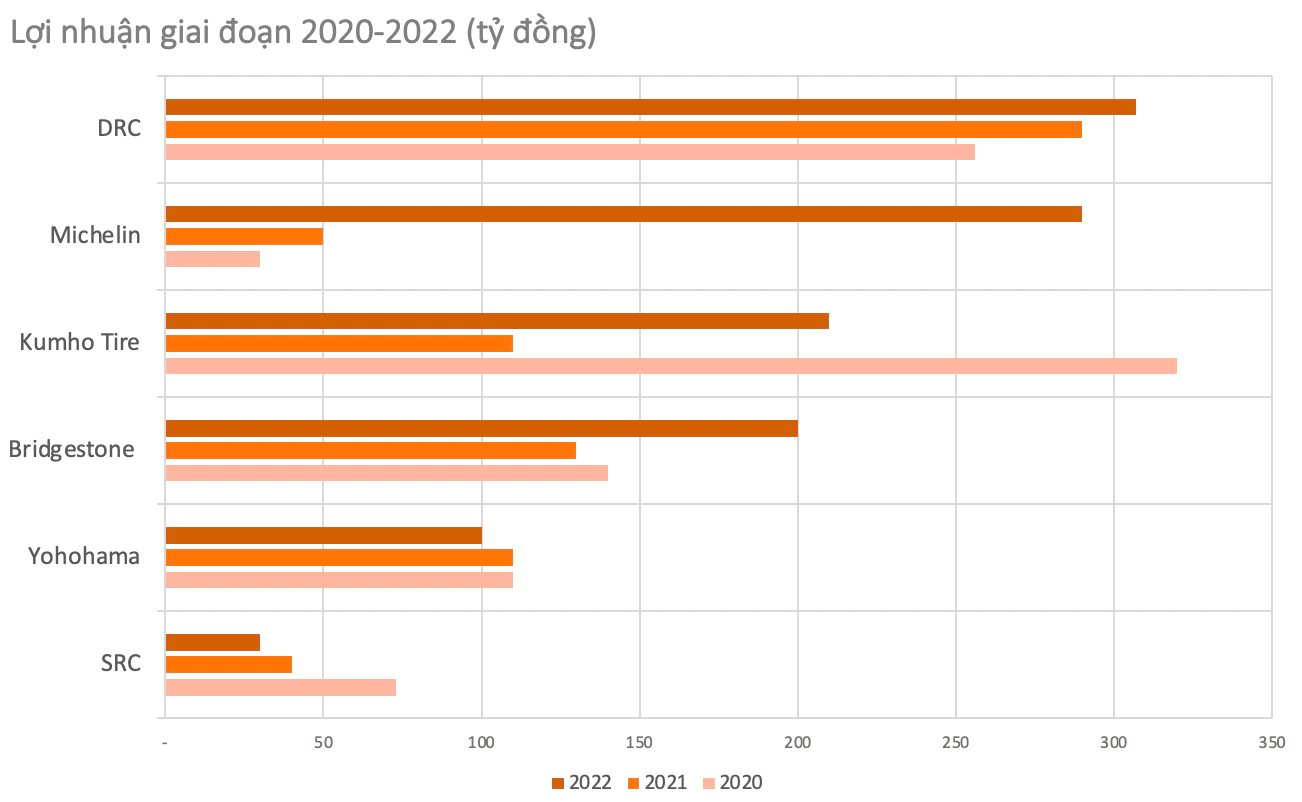

Leading the Vietnamese automotive tire production market, Kumho Tire is currently leading in sales with more than 5,000 billion VND in 2022, an increase of 60% compared to 2021, according to Vietdata’s data. Kumho Tire’s profit this year also increased sharply by 70% to 200 billion VND, but still lost to a Vietnamese domestic company – Cao su Da Nang (stock code DRC). In 2022, DRC earned more than 307 billion in net profit, a slight increase compared to last year. In terms of revenue, this Vietnamese company is also ranked Top 2 with more than 5,100 billion VND.

DRC has developed for over 47 years since its beginnings as a tire retreading plant for the US military. DRC is currently Vietnam’s largest manufacturer of truck and bus tires, as well as the leading manufacturer of specialty and industrial tires in Southeast Asia. In Vietnam, DRC has a scale of 2,000 level 1 and level 2 agents in 63 provinces and cities, partnering with major businesses such as Truong Hai Auto, Hyundai, and Xuan Kien Auto…

Another domestic company in the billion-dollar revenue club is Cao su Sao Vang (stock code SRC), the company was established in 1960 in Hanoi and is one of the top three companies in tire tread manufacturing in Vietnam. Currently, SRC dominates the Northern market, while CSM is famous in the South and DRC focuses on the Central region. SRC manufactures and supplies various commercial truck tires, including light truck, medium truck, and heavy truck tires. SRC’s products can include radial tires, track tires, and regular tires, with various sizes and designs.

In contrast to the above units, SRC’s business has declined in the 2020-2022 period. In 2022, SRC’s net revenue continued to decrease to 960 billion, and its profit also decreased from 40 billion to 30 billion VND.