NTP: Tracking with a target price of 49,700 VND/share

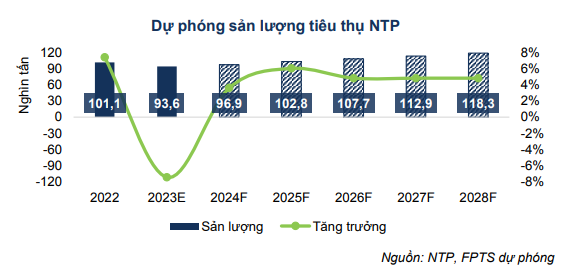

According to FPT Securities (FPTS), the estimated 2024 consumption of NTP Plastic Company Limited (HNX: NTP) will increase by 3.6% compared to the low base in 2023, reaching 96,900 tons with the expectation that the construction and non-residential building segment will improve by 7.2% (according to BMI).

FPTS believes that the demand for plastic pipes will improve from Q2/2024 after the Tet holiday, and the growth will be more visible in the second half of 2024. However, it should be noted that the demand for plastic pipes is forecasted to not fully recover as the prospects for the residential construction segment are still impeded by difficulties from the civilian real estate customer group.

FPTS forecasts the 2024 gross profit margin of NTP to reach 28.7%, a decrease of 1.4 percentage points compared to the same period due to the recovery in plastic resin prices by ~3% from the bottom level of 2023. Assuming that NTP will maintain the same selling price as in 2023 based on the expectation that the negative consumption of plastic pipes will decrease and the input plastic resin prices will not fluctuate significantly.

Overall, the 2024 net revenue of NTP is projected to increase by 1.4% compared to the same period to nearly 5,248 billion VND; However, the after-tax profit is only about 543 billion VND, a decrease of 3% compared to the peak level in 2023. In the period of 2024-2028, FPTS forecasts the revenue of NTP to achieve an annual compound growth rate of 5.1%, mainly due to the growth in consumption volume.

FPTS believes that the optimistic profit prospects of NTP have already partially reflected in the stock price, therefore, it recommends tracking NTP with a target price of 49,700 VND/share.

Read more here

Buy SMC shares at a reasonable value of 14,000 VND/share

BIDV Securities Company (BSC) expects the real estate market to recover from the second half of 2024, and commercial steel companies such as SMC Investment Corporation (HOSE: SMC) will also recover from the general trend of the industry, SMC production is expected to increase by 12% compared to the same period in 2024.

In 2024, with the changing policies of the Chinese and domestic real estate market, BSC expects purchasing power to return. Accordingly, the steel prices will increase from the end of Q2 to the second half of 2024, and commercial steel companies such as SMC will improve gross profit margins.

BSC forecasts that the gross profit margin of SMC will recover from the bottom level of 0.5% in 2022 to around 1.7% in 2024 and 4% in 2025 – equivalent to the period of stable steel price fluctuation (2018-2019).

In general, BSC believes that the business results of SMC will gradually turn from loss to profit in 2024-2025. Specifically, BSC predicts that the business results of SMC will return to profit in 2024 due to assets sale (estimated total value after-tax is about 256 billion VND), mainly from selling more than 13 million shares of NKG of Nam Kim Steel Corporation.

In addition, SMC also registered to sell 2 land lots, SMC Tan Tao 2 and SMC Binh Duong with selling prices of 126 billion VND and 49 billion VND respectively. Based on the book value at the time of purchase, BSC estimates that SMC will recognize a pre-tax profit of 92 billion VND from the sale of real estate.

According to BSC, besides 50% of bad debts which were provisioned in 2023, SMC still has 710 billion VND of unprovided bad debts. Under the Circular 48/2019/TTBTC, The Company will have to provision 252 billion VND in the second half of 2025 and 457 billion VND in the second half of 2026.

In normal period, BSC estimates that SMC can maintain a profit of 250 billion VND. Therefore, the remaining unprovided bad debts (710 billion VND) will be offset in part by accumulated profits left in the period of 2024-2026.

In summary, BSC believes that the book value per share of SMC will be maintained at the range of 10,203-11,970 VND/share in the period of 2024-2026. In the worst case, if SMC has to fully provision the reserve, the book value per share is 10,203 VND/share, equivalent to P/B of 1.1x.

In 2024, SMC is forecasted to achieve net revenue of 16,213 billion VND, an increase of 18% compared to the same period, and a net profit of 28 billion VND, while in the previous year, it recorded a loss of 879 billion VND, equivalent to an EPS of 383 VND/share.

Finally, BSC recommends accumulating SMC shares and suggests buying these shares at a reasonable value of 14,000 VND/share in 2024 (equivalent to a 19% increase compared to the ceiling price on March 7, 2024).

Read more here

Buy DPM shares with a target price of 41,800 VND/share

KB Vietnam Securities Company (KBSV) recommends buying shares of PetroVietnam Fertilizer and Chemicals Corporation (DPM) with a target price of 41,800 VND/share.

In contrast to the business results, the main highlight in DPM‘s financial picture in 2023 is the balance sheet. DPM has fully repaid its short-term and long-term borrowings, thereby helping reduce the burden of future interest expenses.

KBSV believes that with a debt-free structure, combined with cash on hand of 6,627 billion VND and a minimal investment requirement, DPM will be able to pay sustainable dividends of about 2,000-2,500 VND/share, equivalent to a dividend yield of about 6-7%.

In terms of future prospects, KBSV expects El Nino to peak in Q1/2024, then weaken and transition to neutral and La Nina phases in the rest of the year.

The source disputes between power and nitrogen gas businesses will be less serious than in 2023. Thereby, the input natural gas cost for DPM is forecasted to decrease slightly by about 3% compared to the same period in 2024.

In addition, the prices of rice, wheat, and corn in 2023 are still high compared to the 10-year average. The supply of these products is in a tight state, countries will have the motivation to increase agricultural output, thereby boosting consumption demand and supporting urea prices.

Overall, in 2024, KBSV projects that DPM‘s revenue will reach 14,209 billion VND, an increase of 5% compared to the previous year mainly from the increase in urea prices. The gross profit margin is expected to recover (but still lower than the 5-year median of 22.3%) thanks to the higher selling prices and slightly lower input gas prices. The expected after-tax profit is 1,304 billion VND, an increase of over 140%.

Read more here

—