The most visible in the investment channels is the heat from the gold market in recent days when the SJC gold price has surpassed the milestone of 82 million dong per ounce – the highest in history. Not only that, the price of gold rings also surpassed the milestone of 69 million dong per ounce.

Although most experts had previously forecast that the domestic gold price would increase along with the world gold price and this situation would only occur in the short term, it seems that the heat of the gold market is increasing.

|

Chart of SJC gold price from the beginning of 2024 to now

Source: Giavangvietnam

|

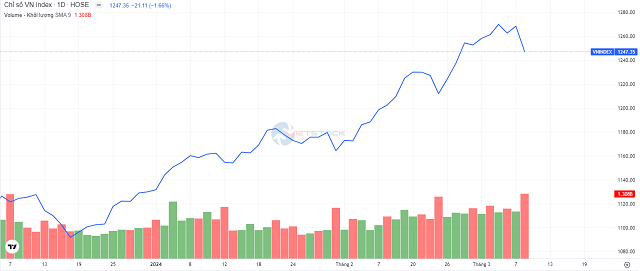

The stock market is also recovering with good liquidity since after the Lunar New Year. The VN-Index closed on 08/03/2024 at 1,247.35 points, an increase of over 10% compared to the beginning of the year. The liquidity from the beginning of the year until now is considered positive, with some sessions reaching 1.5 billion USD and an average of over 20 thousand trillion since the Lunar New Year. The biggest contributor to the market’s upward trend is support from the banking stock group.

|

VN-Index from the beginning of 2024 to now

Source: VietstockFinance

|

Although not a mainstream channel in Vietnam, the world’s largest digital currency – Bitcoin – has increased by 60% compared to the beginning of 2024. After breaking the 70,000 USD threshold (08/03), the price of Bitcoin fell to around 68,000 USD.

In addition to the recovering and heating channels, there are still no clear signs of recovery from the real estate or bond markets. However, despite the deposit interest rate hitting bottom, the amount of savings deposits in banks still set a record of 13.5 million trillion dong in 2023, showing that the deposit channel is still attractive.

In the face of the recovery and new heights of some investment channels, experts assess that the stock market is still a channel that has the potential to attract large investment flows in the future.

Promising stock market

Mr. Phan Dung Khanh – Director of Investment Advisory Maybank Investment Bank believes that funds will still focus on the stock market. Recently, the stock market has recovered but funds are still weak because funds are still mostly in the deposit channel. Although the stock market is recovering, it is still far from its historical peak, so it promises to have more support for this channel.

Regarding the gold channel, Mr. Khanh believes that, although it is continuously making new highs, there is still money flowing into this channel, but at present the price of gold is quite high and the return on investment is not much. The expert evaluates the gold channel as less attractive than the stock market.

However, Mr. Khanh also points out another potential channel, which is real estate. This channel will attract long-term funds because at present it is the only channel that is “bottoming out” while other channels are going up and even creating new highs.

Mr. Tran Truong Manh Hieu – Head of Analysis Department of KIS Vietnam Securities Company also evaluates that the best investment channel for the majority of investors at the moment is stocks, while other channels can be allocated but with a small proportion.

The stock market has good liquidity with many positive support signals for long-term growth trends, and large funds will definitely flow into this channel.

However, other investment channels are also recovering like virtual currency, but this is not a mainstream investment channel in Vietnam. Money can flow into this channel, but not large funds, mainly individual investors.

The real estate market is still not recovering and in fact, money that wants to “catch the bottom” of the real estate market has entered about 1.5-2 years ago.

The gold market has recently increased but if calculated in the last 6 months, it only increased by about 10%. Because the price of gold is overheating, the trading volume may be large, but the return on investment is not much. However, it should be noted that when investing in gold, there is a price difference between buying and selling, so smart money will not choose to invest in channels like this. Only a part of the people buy for storage or for marriage purposes… That is why large funds will not flow into the gold channel but mainly individual small investors.

Mr. Hieu added that gold has recently surged due to the currency exchange rate being maintained at a high level. However, if as forecasted, in the second quarter of 2024, the US Federal Reserve (Fed) reverses its monetary policy by reducing interest rates, the exchange rate will decrease and also have a strong impact on the gold market. In the coming period, when FDI capital continues to be disbursed, the exchange rate decreases, and the gold market will also decrease.

Gold and stocks attract money

Dr. Nguyen Tri Hieu – Banking and Financial Expert believes that there will be a shift in investment capital from banks to other channels. At present, there are 2 channels that have the most potential to attract capital, which are gold and stocks.

The domestic gold price has recently exceeded the milestone of 82 million dong per ounce and is likely to continue to rise until the Government is also considering solutions to amend the Decree on gold. Therefore, a part of investors is likely to continue to pour money into this channel.

In the past few days, the stock market has increased significantly, however, Mr. Hieu believes that it is still not really stable. In particular, the Vietnamese stock market has many individual investors, and the investment decisions of this group usually have more emotional factors than analysis.

In addition, major cases such as Vantinphat Group are “hindering” the bond market. Although there are still many obstacles in the short term, Mr. Hieu still hopes that the bond market will be better this year. The immediate issue is to regain the trust of investors. Secondly, investors need to equip themselves with investment skills, and in terms of credit rating, it will be used more this year.

Regarding the real estate market, Mr. Hieu agrees with other experts that it can only recover in the second half of 2024. The problem in the first half of the year is still a lack of capital, market risks, and a lack of products suitable for people’s wallets.

Another channel that Mr. Hieu noted is the foreign exchange market, he predicts that it will continue to increase this year. “I think there is a possibility that the VND can maintain its value against the USD, because when the Fed reverses its monetary policy, the USD will depreciate. The VND/USD exchange rate may increase by about 3%,” Mr. Hieu added.

With bank deposits, although the deposit interest rate is currently decreasing, in the second half of 2024, when the economy is operating more efficiently, the loan demand may increase, so banks have to increase the deposit interest rate to attract capital and the loan interest rate may increase again.