Recently, Hai Phat Investment Corporation (HOSE: HPX) announced that it has resolved the issue of the stock being suspended from trading and requested the resumption of trading for HPX shares.

Specifically, on September 10, 2023, HPX released its interim financial statements for the year 2023. One day later, the company published its consolidated interim financial statements for the year 2023.

In addition, Hai Phat Investment Corporation proactively prepared its financial statements for the year 2023 and received full approval from the auditing firm CPA VIETNAM. The audited financial statements for the year 2023 were then released on March 7, 2024.

Prior to this, the Ho Chi Minh City Stock Exchange (HOSE) decided to transfer HPX shares from restricted trading to suspended trading starting from September 18, 2023. The reason was that the company did not timely disclose its interim financial statements for the year 2023 as required.

Hai Phat explained that the company operates in the real estate sector, which has been heavily impacted by the COVID pandemic and the recent slowdown in the real estate market. The suspension of HPX shares has caused significant difficulties in accessing capital from financial institutions, implementing projects, dealing with pressure from shareholders and investors, managing debt restructuring, and valuing collateral assets for credit loans and bond issuance. It has also had a significant impact on the morale of hundreds of employees.

After the suspension of HPX shares, the company conducted a review and evaluation to learn from its mistakes and avoid violations of its obligations to disclose information in the future. The company has also diligently complied with legal regulations regarding the disclosure of information by listed public companies.

Therefore, HPX requests the State Securities Commission, the Ho Chi Minh City Stock Exchange, and HOSE to consider and approve the resumption of trading for HPX shares.

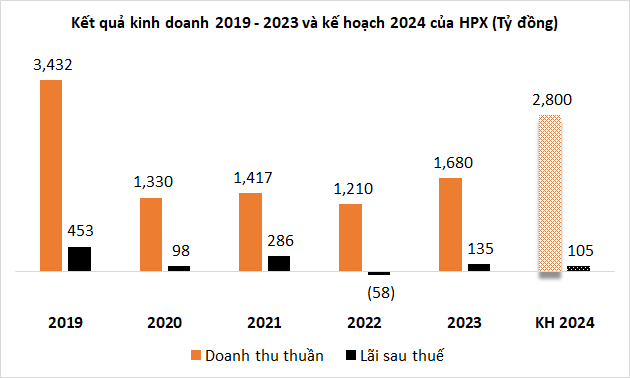

Highest revenue plan in the past 5 years in 2024

On March 4, the Board of Directors of Hai Phat approved the business plan for 2024, with a consolidated revenue target of 2,800 billion VND, a 67% increase compared to the previous year and the highest level in the past 5 years (since 2020). However, the expected net profit after tax is projected to decrease by 22% to 105 billion VND. The parent company’s dividend ratio is expected to be 5%.

Regarding the main tasks in 2024, HPX stated that it will focus on balancing cash flow, arranging capital for project implementation, managing resources to pay taxes, principal, and interest to bondholders, extending credit packages, etc. Additionally, the company will timely issue and disclose financial statements, restructure the ownership ratios in subsidiary and affiliated companies.

Regarding investment and project implementation, HPX provided the following update: the Bac Giang project will be completed and handed over in June 2024, the second phase of the Cao Bang project will commence construction in June 2024, and there are also projects in Lao Cai and Hoa Binh islands.

In 2023, HPX recorded net revenue of over 1,680 billion VND, a 39% increase compared to the previous year. The net profit was more than 127 billion VND, while in 2022, there was a loss of over 60 billion VND. HPX exceeded its minimum net profit target of 120 billion VND set for 2023.

Source: VietstockFinance

|